Understanding the Basics 🌍

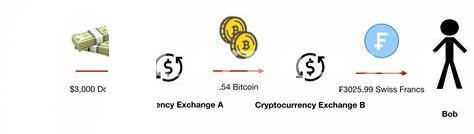

Understanding the Basics: Bitcoin, a digital currency, operates on a decentralized platform without the need for traditional financial intermediaries. Transactions are recorded on a public ledger known as the blockchain, ensuring transparency and security. Users store their Bitcoin in digital wallets, each with a unique address for sending or receiving funds. The value of Bitcoin can fluctuate based on market demand. Understanding this foundational concept is crucial for engaging in international transactions and harnessing the benefits of efficiency and cost-effectiveness that Bitcoin offers in the realm of international money transfers.

Benefits of Using Bitcoin 💰

Using Bitcoin for sending money abroad offers a range of advantages. Transferring funds with Bitcoin is typically faster and more cost-effective compared to traditional methods. The decentralized nature of Bitcoin means that transactions can be conducted without the need for intermediaries, reducing fees and processing times. Additionally, Bitcoin transactions are secure and transparent, providing greater reliability and peace of mind for both senders and recipients. The ability to send money directly, without the need for banks or other financial institutions, empowers individuals to take control of their financial transactions and avoid unnecessary delays or complications. This can be especially beneficial for individuals in regions with limited access to traditional banking services, enabling greater financial inclusion and access to global markets.

Risks and Considerations ⚠️

Bitcoin offers a convenient way to send money abroad, but it’s essential to be aware of potential risks and considerations. Fluctuating exchange rates can impact the value of your transfer, and the volatile nature of cryptocurrencies could lead to unexpected changes in the amount received. Additionally, regulatory issues and security concerns are important factors to consider when choosing to use Bitcoin for international money transfers. By understanding these risks and taking necessary precautions, you can make informed decisions and maximize the benefits of using Bitcoin for sending money globally.

Choosing the Right Service Provider 🛡️

When choosing the right service provider for sending money abroad with Bitcoin, it is crucial to conduct thorough research and consider factors such as fees, exchange rates, security measures, and customer reviews. Look for providers that offer competitive rates, transparent pricing, and reliable customer support. Additionally, ensure that the service provider is compliant with regulations and has a strong track record in handling international transactions. By selecting a reputable and trustworthy service provider, you can minimize the risks associated with transferring money through Bitcoin and maximize the efficiency of your cross-border transactions. For more information on using Bitcoin for international remittances in São Tomé and Príncipe, check out this informative article by WikiCrypto News using Bitcoin for international remittances in Sao Tome and Principe.

Tips for Secure Transactions 🔒

– Suggestions for increasing security during bitcoin transactions include carefully verifying the recipient’s address, utilizing two-factor authentication whenever possible, and regularly updating your wallet software. Additionally, consider using hardware wallets for storing larger amounts of bitcoin and avoiding public Wi-Fi networks when conducting transactions. Keep track of your transactions and periodically review your security measures to adapt to any new threats or vulnerabilities that may emerge in the ever-evolving realm of digital currency. By staying vigilant and proactive, you can enhance the security of your bitcoin transactions and minimize the risks associated with sending money abroad using this innovative technology.

Future Outlook and Potential Challenges 🚀

As the world of international money transfers continues to evolve, there is a sense of optimism surrounding the future of using Bitcoin for cross-border transactions. The potential for increased efficiency and cost-effectiveness is evident, offering a promising outlook for individuals looking to send money abroad securely. However, challenges such as regulatory hurdles and market volatility remain key considerations in navigating the landscape of global remittances.

For those considering utilizing Bitcoin for international remittances, it is crucial to stay informed and adapt to the changing dynamics of this emerging financial ecosystem. By exploring innovative solutions and staying abreast of the evolving technology, users can harness the benefits of cryptocurrencies while navigating potential challenges with resilience. Embracing the future of digital currency in global money transfers presents both opportunities and obstacles, shaping the way we transact across borders.

Using Bitcoin for international remittances in Slovakia