Understanding Bitcoin Basics 🌐

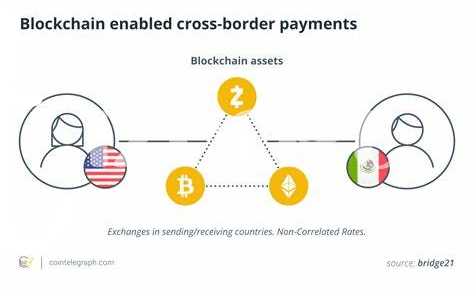

Bitcoin operates on a decentralized network, bypassing traditional financial institutions to facilitate peer-to-peer transactions. Its underlying technology, blockchain, ensures transparency and security by recording all transactions on a public ledger. Users store their Bitcoin in digital wallets and can send funds globally at a fraction of the cost compared to traditional methods. This digital currency is divisible, allowing for microtransactions, and transactions can be conducted anonymously. Understanding Bitcoin basics involves grasping its decentralized nature, the role of miners in validating transactions, and the concept of public and private keys for security. As a digital currency, Bitcoin is borderless, enabling seamless cross-border transactions without the need for intermediaries. Its value can fluctuate, influenced by market demand and supply dynamics. Embracing Bitcoin entails understanding its core principles and potential for transforming international money transfers while acknowledging the risks associated with its volatile nature.

Navigating Global Regulations 📜

Navigating global regulations when it comes to Bitcoin for international money transfers can sometimes feel like traversing a complex maze. With varying laws and guidelines in different countries, understanding the legal landscape is crucial. However, armed with the right knowledge and resources, individuals can successfully navigate these regulations to harness the full potential of Bitcoin for cross-border transactions. By staying informed about the legal frameworks in place and keeping up-to-date with any changes, individuals can ensure compliance and smooth transactions. Additionally, seeking guidance from experts or utilizing resources such as compliance guides specific to different regions can offer invaluable insights into the nuances of global regulations. This proactive approach can empower individuals to make informed decisions and operate within the legal boundaries, ultimately paving the way for seamless and secure Bitcoin transfers across borders.

Benefits of Bitcoin for Remittances 💸

Bitcoin offers a revolutionary alternative for international money transfers, providing faster and more cost-effective solutions compared to traditional methods. Its decentralized nature eliminates the need for intermediaries, reducing fees and processing times significantly. The transparency of transactions on the blockchain ensures secure and traceable remittances, giving peace of mind to both senders and recipients. Additionally, Bitcoin’s usability across borders bypasses the limitations of fiat currencies and restrictive banking systems, making it accessible to individuals in remote regions where traditional banking services are scarce. This accessibility empowers unbanked populations to participate in the global economy, fostering financial inclusion and economic growth. The ability to send funds instantly, securely, and affordably through Bitcoin presents a game-changing advantage for individuals and businesses alike, ushering in a new era of streamlined cross-border transactions.

Risks and Challenges to Consider ⚠️

When considering the landscape of Bitcoin for international money transfers in Guinea, it is crucial to take into account the various risks and challenges that may arise. One of the primary concerns is the volatility of the cryptocurrency market, which can lead to significant fluctuations in value. Additionally, security breaches and hacking attempts pose a threat to the safety of transactions conducted using Bitcoin. It is essential for individuals and businesses engaging in Bitcoin transfers to implement robust security measures to safeguard their funds and personal information.

Furthermore, navigating the regulatory environment surrounding Bitcoin can be complex, as different countries have varying laws and policies regarding cryptocurrency usage. This uncertainty can create obstacles for those looking to use Bitcoin for remittances, requiring careful consideration and compliance with legal requirements to ensure smooth and secure transactions. Understanding these risks and challenges is key to effectively utilizing Bitcoin for international money transfers in Guinea.

Legal Considerations for Businesses 🏦

When venturing into the realm of utilizing Bitcoin for international money transfers, businesses must carefully navigate the legal landscape to ensure compliance with regulations in Guinea and beyond. Understanding the specific laws and requirements related to cryptocurrency transactions, as well as keeping abreast of any updates or changes, is imperative for businesses looking to leverage Bitcoin for their financial activities. It is essential for companies to conduct thorough due diligence and seek legal guidance to mitigate potential risks and maintain transparency in their operations. Moreover, establishing robust internal compliance protocols and procedures can help businesses build trust with their customers and partners, demonstrating a commitment to operating ethically within the evolving regulatory framework. By proactively addressing legal considerations and staying abreast of industry developments, businesses can position themselves for success in harnessing the benefits of Bitcoin for international money transfers.

Conclusion: a Path to Seamless Transfers 🚀

In the realm of cross-border money transfers, navigating the legal landscape can be complex. However, by embracing the potential of Bitcoin, businesses and individuals in Guinea can pave the way for seamless and efficient transactions. With its decentralized nature and global accessibility, Bitcoin offers a path towards borderless remittances that bypass traditional banking systems. By understanding and adhering to the legal frameworks governing Bitcoin cross-border money transfers in Guinea, businesses can leverage this innovative technology to simplify international transactions and provide more cost-effective solutions for their customers.

For more insights on the legal considerations surrounding Bitcoin cross-border money transfers in Guinea, refer to the official guidelines outlined in the Bitcoin cross-border money transfer laws in Ghana. By staying informed and compliant, businesses can harness the power of Bitcoin to revolutionize the landscape of international money transfers in Guinea.