Regulatory Environment 🌐

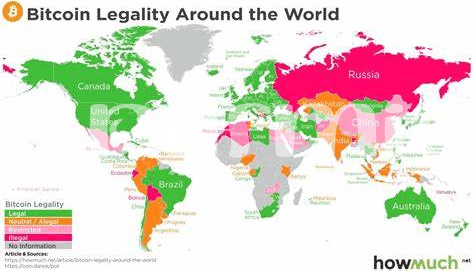

The legal landscape surrounding Bitcoin investments in the Dominican Republic is undergoing significant developments, with regulatory authorities actively shaping policies to accommodate the growing interest in cryptocurrency. This dynamic environment seeks to strike a balance between fostering innovation and protecting investors from potential risks. The evolving regulatory framework aims to provide clarity and guidance for market participants, establishing a foundation for a more secure and transparent investment ecosystem. As the cryptocurrency market continues to expand globally, policymakers in the Dominican Republic are increasingly focused on creating a conducive environment for digital asset investments while ensuring compliance with relevant laws and regulations.

Investor Protections 🛡️

When it comes to safeguarding investments in the realm of Bitcoin, it is crucial for individuals in the Dominican Republic to be aware of the legal protections in place. These protections serve as a shield, offering assurances and recourse for investors navigating the volatile landscape of cryptocurrencies. Understanding the regulatory frameworks and mechanisms designed to uphold investor interests is paramount in making informed decisions and mitigating risks. By familiarizing themselves with these safeguards, investors can confidently engage in the world of Bitcoin with a greater sense of security and assurance.

Legal Obligations 📝

Cryptocurrency investors in the Dominican Republic are subject to certain legal obligations that aim to ensure transparency and compliance within the rapidly evolving digital asset landscape. By adhering to regulatory requirements and reporting obligations, investors play a vital role in supporting the integrity of the market. These legal obligations not only serve to safeguard investors’ interests but also contribute to the overall stability of the cryptocurrency ecosystem. Furthermore, by fulfilling their legal duties, investors can help foster trust and credibility in the burgeoning cryptocurrency sector, paving the way for sustained growth and innovation.

Enforcement Mechanisms ⚖️

In upholding the legal framework surrounding Bitcoin investments, the Dominican Republic is equipped with robust enforcement mechanisms designed to safeguard investors and maintain market integrity. The enforcement mechanisms act as a deterrent against fraud and misconduct, ensuring that individuals and entities engaging in Bitcoin transactions adhere to the established regulations. By actively enforcing these measures, authorities can mitigate risks and uphold the credibility of the cryptocurrency market within the country. This proactive approach underscores the commitment to creating a secure environment for investors and promoting responsible participation in the burgeoning digital asset landscape. For those interested in further insights on cryptocurrency regulation, Wikicrypto News explores the future of Bitcoin regulation in Cyprus – is Bitcoin legal in Dominica?.

Reporting Requirements 📊

Reporting requirements in the Dominican Republic play a crucial role in ensuring transparency and accountability within the realm of Bitcoin investments. Investors are obligated to provide detailed reports on their transactions, holdings, and any potential capital gains derived from their cryptocurrency activities. These requirements not only serve to safeguard the interests of investors but also contribute to the overall integrity of the financial system. By adhering to these reporting obligations, investors help maintain a level playing field and facilitate regulatory oversight in this rapidly evolving digital landscape. Compliance with reporting requirements fosters trust and confidence in the burgeoning Bitcoin market, laying the groundwork for sustained growth and legitimacy in the future.

Future Outlook 🚀

When looking ahead to the future outlook of Bitcoin investments in the Dominican Republic, the potential for growth and innovation is evident. As the regulatory environment continues to evolve, investors can anticipate a more robust framework that supports and protects their interests. With a focus on enhancing investor protections, strengthening legal obligations, and improving enforcement mechanisms, the landscape for Bitcoin in the country is set to become more secure and transparent. Moreover, the growing interest and adoption of cryptocurrencies globally hint at a promising future for Bitcoin investors in the Dominican Republic.

(““)