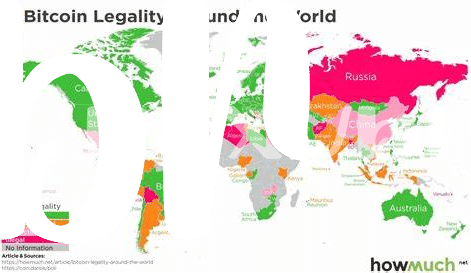

Current Legal Landscape 🌍

The legal landscape surrounding Bitcoin in Russia is ever-evolving, presenting challenges and opportunities for users and businesses alike. With regulatory frameworks continuously adapting to the presence of cryptocurrencies, it’s crucial to stay informed about the latest developments to navigate this complex terrain effectively. Understanding the current legal environment is the first step towards ensuring compliance and mitigating risks associated with Bitcoin usage. By keeping abreast of legal updates and seeking reputable legal counsel, individuals and enterprises can proactively address any uncertainties and operate within the boundaries of the law.

Registration and Reporting Obligations 📝

When it comes to using Bitcoin in Russia, understanding the registration and reporting obligations is crucial. Individuals and companies engaging in Bitcoin transactions must comply with the legal requirements set forth by the government. This includes registering with the appropriate authorities and reporting any Bitcoin transactions as mandated by law. Failure to adhere to these obligations can result in potential legal repercussions, making it essential to stay informed and compliant in this aspect.

Ensuring compliance with registration and reporting obligations not only helps individuals and businesses avoid legal pitfalls but also fosters a more transparent and secure environment for Bitcoin usage in Russia. By proactively fulfilling these requirements, stakeholders can navigate the regulatory landscape with confidence and contribute to the responsible and lawful utilization of Bitcoin within the country.

Tax Implications for Bitcoin Transactions 💰

Bitcoin transactions in Russia come with tax implications that individuals and businesses need to consider. Understanding how these tax rules apply can help you avoid potential legal issues and ensure compliance with the law. Whether you’re buying, selling, or exchanging Bitcoin, being aware of the tax implications will enable you to make informed decisions and manage your financial responsibilities effectively. Consulting with a tax professional or legal advisor can provide further guidance on the specific tax laws related to cryptocurrency transactions in Russia. By staying informed and taking the necessary steps to comply with tax regulations, you can navigate the legal landscape surrounding Bitcoin usage with confidence.

Anti-money Laundering Regulations 🔒

Understanding and complying with anti-money laundering regulations is crucial when dealing with Bitcoin transactions. These regulations are in place to prevent illicit activities such as money laundering and terrorist financing. By following these guidelines, businesses can help ensure the integrity of the financial system and protect themselves from legal risks. It is important to stay informed about the latest developments in anti-money laundering measures and to implement robust procedures to detect and prevent suspicious transactions. By taking proactive steps to comply with these regulations, businesses can demonstrate their commitment to operating responsibly in the cryptocurrency space. For more information on the legal consequences of bitcoin transactions in Saint Lucia, you can refer to the legal consequences of bitcoin transactions in Saint Lucia article.

Cryptocurrency Exchange Policies 🔄

Cryptocurrency exchanges in Russia must adhere to strict regulatory policies to operate legally. These policies encompass requirements for licensing, compliance with anti-money laundering (AML) laws, and implementing robust security measures to protect user funds. The regulatory framework aims to enhance transparency and accountability within the cryptocurrency ecosystem, fostering trust among users and authorities. By adhering to exchange policies, platforms can contribute to a more secure and stable environment for trading cryptocurrencies in Russia.

To ensure compliance and avoid potential legal pitfalls, cryptocurrency exchanges must continuously monitor regulatory updates and adapt their policies accordingly. Implementing effective Know Your Customer (KYC) procedures, conducting regular audits, and collaborating with law enforcement agencies are essential steps towards maintaining regulatory compliance and safeguarding against illicit activities within the cryptocurrency space.

Tips for Compliance and Risk Mitigation 🛡

Effective compliance and risk mitigation in the realm of Bitcoin usage in Russia involves staying informed about regulatory changes, conducting regular audits, and implementing robust security measures. It’s crucial to keep detailed records of transactions, maintain transparency with authorities, and engage in ongoing training for all involved parties. Seeking legal counsel and utilizing reputable compliance tools can help navigate the complexities of the evolving legal landscape. For further insights on legal consequences of Bitcoin transactions in Qatar, check out the legal consequences of bitcoin transactions in Portugal.