Introduction to Fraudulent Bitcoin Activities 🕵️

Bitcoin has revolutionized the financial landscape, offering a decentralized digital currency that transcends borders. However, alongside its potential for innovation and growth, fraudulent activities have emerged within the realm of Bitcoin. These illicit schemes pose significant threats to unsuspecting individuals and organizations, undermining trust and integrity in the digital currency space. Understanding the intricacies of fraudulent Bitcoin activities is essential for safeguarding against potential risks and ensuring the responsible and secure utilization of this groundbreaking technology.

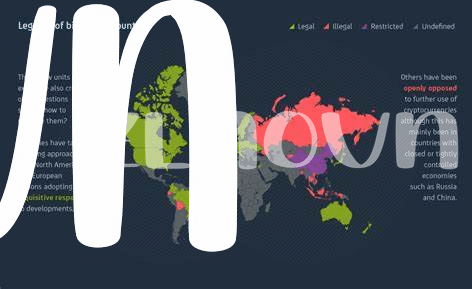

Legal Frameworks and Regulations in Malawi ⚖️

The legal landscape surrounding cryptocurrency in Malawi encompasses a complex web of regulations aimed at addressing the challenges posed by fraudulent activities. These regulations, influenced by international standards and local considerations, seek to provide a framework for mitigating risks and protecting investors. From licensing requirements to anti-money laundering provisions, authorities in Malawi are taking steps to ensure that the burgeoning cryptocurrency market operates within the bounds of the law. As stakeholders navigate this evolving terrain, understanding the legal implications of engaging in Bitcoin transactions becomes paramount, highlighting the need for ongoing dialogue and cooperation between regulators and industry participants.

Challenges in Detecting and Prosecuting Bitcoin Fraud 🕵️♂️

Challenges arise in the realm of Bitcoin fraud detection and prosecution due to the decentralized and pseudonymous nature of cryptocurrency transactions. The lack of a central authority or regulatory body overseeing Bitcoin transactions makes it challenging for law enforcement agencies to track and identify fraudulent activities. Additionally, the complex technical mechanisms behind Bitcoin transactions require specialized knowledge and resources for effective investigation. Without clear legal frameworks specifically addressing cryptocurrency fraud, prosecuting offenders becomes a convoluted process that often lags behind the evolving tactics of fraudulent actors. Overcoming these obstacles necessitates close collaboration between regulatory bodies, law enforcement agencies, and cryptocurrency experts to develop innovative strategies for detecting and prosecuting Bitcoin fraud effectively.

Impact of Fraudulent Bitcoin Activities on Society 💸

The widespread impact of fraudulent Bitcoin activities on society extends beyond financial losses, affecting trust and confidence in digital transactions. In Malawi, where financial literacy may vary, individuals and businesses are vulnerable to scams and Ponzi schemes disguised as legitimate Bitcoin investments. The rise in such fraudulent activities not only leads to economic repercussions but also erodes the credibility of decentralized currencies among the population. Moreover, the lack of regulatory oversight in this emerging digital landscape raises concerns about consumer protection and financial stability. Addressing these challenges requires a collaborative effort between authorities, financial institutions, and the public to promote awareness and establish safeguards against fraudulent schemes in the evolving crypto space.Legal consequences of bitcoin transactions in Malaysia

Case Studies of Bitcoin Fraud in Malawi 🔍

In recent years, Malawi has witnessed a rise in Bitcoin-related fraudulent activities, causing significant concerns among both authorities and the public. These cases often involve individuals or groups exploiting the decentralized nature of cryptocurrencies to engage in illicit schemes, taking advantage of unsuspecting victims. The lack of clear regulations in this domain has made it challenging to address and combat such fraudulent practices effectively.

Several high-profile incidents have shed light on the severity of Bitcoin fraud in Malawi. For example, a Ponzi scheme promising quick returns through cryptocurrency investments defrauded many individuals of their hard-earned savings. Additionally, there have been instances of ransomware attacks targeting businesses and individuals, demanding Bitcoin payments in exchange for unlocking encrypted data. These case studies underscore the urgent need for enhanced regulatory measures and strengthened enforcement mechanisms to deter and prosecute perpetrators of Bitcoin fraud effectively.

Strategies for Preventing and Combating Bitcoin Fraud 🛡️

When it comes to preventing and combating Bitcoin fraud, staying informed and cautious is key. Educating individuals about the risks associated with Bitcoin transactions, such as phishing scams and Ponzi schemes, can help reduce the likelihood of falling victim to fraud. Implementing secure storage practices, such as using hardware wallets and enabling two-factor authentication, adds an extra layer of protection. Additionally, monitoring transactions regularly for any suspicious activity and reporting it to the appropriate authorities can help in identifying and prosecuting fraudsters. Collaborating with law enforcement agencies and financial institutions to share information and best practices is essential in creating a united front against Bitcoin fraud. By staying vigilant and proactive, individuals can contribute to a safer Bitcoin ecosystem for everyone.

Legal consequences of bitcoin transactions in libya