Legal Status of Bitcoin in Cabo Verde 📜

Bitcoin’s acceptance and legality in Cabo Verde is a topic of growing interest and debate. The digital currency has been operating in a legal gray area, with regulators closely monitoring its development. As of now, there is no specific legislation addressing the use of Bitcoin in the country. Entrepreneurs and individuals have shown interest in utilizing this decentralized form of currency for their transactions, but uncertainties remain regarding its legal status. This ambiguity presents both opportunities and challenges for the future of Bitcoin in Cabo Verde.

Impact on the Economy and Financial Sector 💸

Bitcoin’s presence in Cabo Verde has stirred discussions not only among enthusiasts but also within the country’s economic and financial spheres. The adoption of Bitcoin has sparked curiosity and speculation about its potential impact on the local economy and financial sector. With its decentralized nature and borderless transactions, Bitcoin stands as a disruptive force that could challenge traditional financial systems. The integration of Bitcoin into Cabo Verde’s economy could potentially open up new avenues for financial inclusion and international trade, offering alternatives to conventional banking systems.

Challenges and Regulatory Concerns 🚫

Challenges and Regulatory Concerns: As the adoption of Bitcoin surges in Cabo Verde, there are notable challenges and regulatory concerns that need to be addressed. Ensuring consumer protection, preventing money laundering, and maintaining financial stability are key areas that regulators must navigate. The decentralized nature of Bitcoin also poses unique challenges in terms of oversight and control. Balancing innovation with regulation will be crucial in harnessing the potential of cryptocurrencies while mitigating associated risks.

Potential for Growth and Adoption 📈

The increasing adoption of Bitcoin in Cabo Verde signifies a promising future for the cryptocurrency within the country. With a growing number of individuals and businesses exploring the benefits of digital currencies, there is a clear pathway for the expansion of Bitcoin’s usage in various sectors. As more people become familiar with the advantages of decentralized finance and the transparency offered by blockchain technology, the potential for growth in the adoption of Bitcoin is substantial. This growth is not only limited to individual users but also extends to potential collaborations with the government and financial institutions, paving the way for a more inclusive financial ecosystem.

For further insights into the evolution of cryptocurrency acceptance in different regions, including the regulatory frameworks that shape their status, one can explore the detailed analysis provided in the article “Is Bitcoin Recognized as Legal Tender in China?” on WikiCrypto News at https://wikicrypto.news/the-evolution-of-cryptocurrency-acceptance-in-comoros.

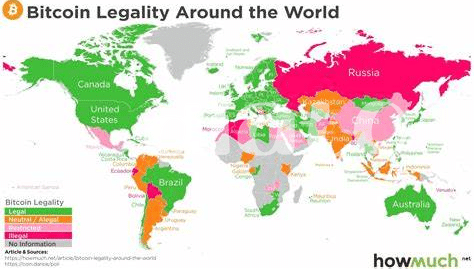

Comparison with Other Jurisdictions 🌍

When it comes to comparing how Bitcoin is viewed in different jurisdictions, it’s fascinating to see the varied approaches taken by different countries worldwide. Some regions, like Japan and Switzerland, have embraced Bitcoin with open arms, creating clear regulations that have fostered innovation in the cryptocurrency space. On the other hand, countries such as China and India have taken a more cautious stance, imposing restrictions or outright bans on certain aspects of Bitcoin trading and usage. These comparisons highlight the diverse attitudes and regulatory frameworks that shape the landscape of Bitcoin adoption on a global scale.

Recommendations for Policymakers and Investors 🔍

When considering recommendations for policymakers and investors in Cabo Verde regarding Bitcoin, it is essential to prioritize creating a clear regulatory framework that balances innovation with consumer protection. Policymakers should collaborate with industry experts and stakeholders to understand the potential impact of Bitcoin on the economy and financial sector. Additionally, providing guidance on tax implications and compliance requirements can help foster a transparent and thriving cryptocurrency ecosystem. Investors should conduct thorough due diligence before entering the market and consider the long-term sustainability of their investments. Furthermore, promoting financial literacy initiatives can enhance public understanding and adoption of cryptocurrencies. Collaboration between policymakers and investors is imperative for maximizing the benefits of Bitcoin while mitigating potential risks.

Insert Link: is bitcoin recognized as legal tender in comoros?