Legal Standing 📜

When it comes to the legal standing of Bitcoin in Saint Vincent, it’s essential to navigate the existing regulations which may impact its use. Understanding how cryptocurrencies fit within the legal framework of the country is crucial for individuals and businesses looking to engage in Bitcoin transactions. The evolving landscape of digital currencies often requires a close examination of current laws to ensure compliance and mitigate any potential risks. This aspect of the discussion sheds light on the permissible uses and limitations of Bitcoin within Saint Vincent’s legal system.

Regulatory Environment 🌐

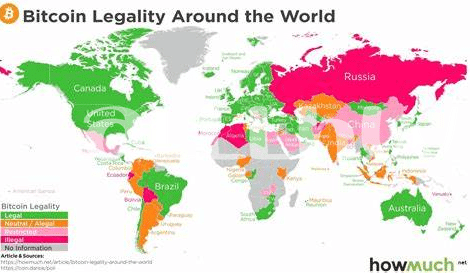

Saint Vincent boasts a dynamic regulatory environment that’s gradually embracing the potential of Bitcoin transactions. With a growing recognition of digital currencies, the government is actively shaping policies to accommodate and regulate cryptocurrency use. The Financial Services Authority plays a pivotal role in overseeing the sector, working towards fostering innovation while safeguarding investor interests. As Saint Vincent navigates the complexities of this evolving landscape, collaboration with international bodies and ongoing dialogue with industry stakeholders are key to ensuring a balanced and conducive regulatory framework. For more insights on how other countries have approached Bitcoin regulations, you can explore the comparisons with Saint Kitts and Nevis and San Marino.

Tax Implications 💸

Exchanging Bitcoin in Saint Vincent carries tax implications that individuals should be aware of. Depending on how Bitcoin is used, it may be subject to capital gains tax, similar to other forms of investment. Understanding the tax treatment of Bitcoin transactions is essential to avoid potential penalties or legal issues. It’s advisable to consult with a tax professional to ensure compliance with local tax laws and to accurately report any gains or losses from Bitcoin transactions. Being proactive in addressing tax implications can help individuals navigate the complex regulatory landscape and stay in good standing with the authorities.

Aml/cft Compliance 🔒

Bitcoin transactions in Saint Vincent require adherence to strict anti-money laundering (AML) and combating the financing of terrorism (CFT) regulations. Maintaining compliance with these measures is essential for businesses dealing in cryptocurrencies to prevent illicit activities and safeguard financial systems. By following stringent AML/CFT protocols, companies can enhance transparency and accountability in their operations, fostering trust among stakeholders and regulators.

For more insights on the legal landscape of operating with Bitcoin in the Caribbean region, check out the article “is bitcoin legal in Saint Kitts and Nevis?” on WikiCrypto News. Understanding the evolving regulatory framework is crucial for businesses seeking to navigate the complexities of cryptocurrency transactions effectively.

Consumer Protection 🛡️

Consumer protection measures in the context of Bitcoin usage in Saint Vincent are crucial for safeguarding individuals from potential risks. Ensuring fair practices, transparent transactions, and accountability within the digital currency sphere fosters trust and confidence among users. By implementing regulations and oversight that prioritize consumer interests, the authorities can mitigate fraud, scams, and unauthorized activities, thus promoting a secure environment for Bitcoin transactions. Educating the public about their rights and providing mechanisms for dispute resolution play a pivotal role in enhancing consumer protection in the evolving landscape of cryptocurrency usage.

Future Prospects 🔮

Saint Vincent is gradually embracing the use of Bitcoin, paving the way for intriguing future prospects in the realm of digital currency. As more businesses and individuals in the region delve into the world of cryptocurrency, the potential for innovative financial solutions and increased economic opportunities expands. With a growing awareness of the benefits and challenges associated with Bitcoin, Saint Vincent could position itself as a trailblazer in the integration of digital assets into its financial ecosystem. By fostering a supportive environment for blockchain technology and digital currencies, the country may attract tech-savvy entrepreneurs and investors seeking to capitalize on this evolving landscape.

Insertion: is bitcoin legal in Saint Lucia?