Legal Framework: Understanding Current Regulations 📜

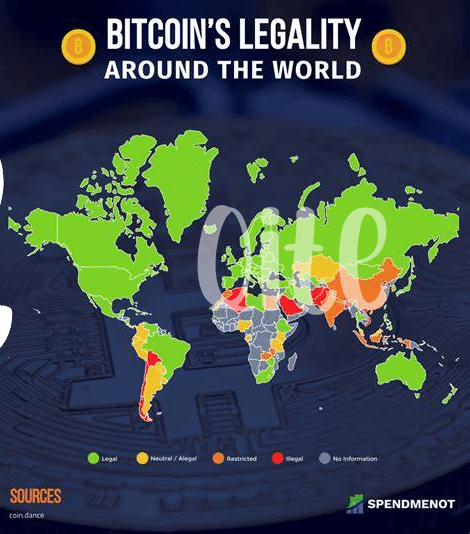

The legal framework surrounding self-managed super funds investing in Bitcoin is crucial to navigate successfully. Understanding the current regulations is essential for ensuring compliance and avoiding any potential legal pitfalls. Regulations related to cryptocurrencies can be complex and rapidly evolving, making it important to stay informed and seek professional advice to ensure full compliance.

| Legal Framework: Understanding Current Regulations |

|—————————————————-|

| It is essential to grasp the legal landscape that governs the involvement of self-managed super funds with Bitcoin investments. Staying abreast of the latest regulatory requirements and guidelines will help in making informed decisions and mitigating any legal risks. Seeking clarity on how these regulations impact your investments will pave the way for a secure and compliant approach to utilizing Bitcoin within self-managed super funds. |

Investment Risks: Navigating the Volatile Market 📊

When delving into the realm of cryptocurrency investments, it’s essential to be mindful of the dynamic nature of the market. Fluctuations in Bitcoin’s value can occur rapidly, presenting both opportunities and risks for investors. Understanding how to navigate these shifts is crucial for making informed decisions and managing potential losses. By staying informed about market trends and assessing risk tolerance, investors can effectively navigate the volatile landscape of cryptocurrency investments. Engaging with reputable sources and seeking professional advice can further aid in mitigating risks and maximizing the potential for returns in this ever-evolving market.

Tax Implications: Unpacking the Complexity 📑

Navigating the world of cryptocurrency investments within self-managed super funds can bring about a myriad of tax implications that require careful consideration. From capital gains tax treatment to the complexities of determining the acquisition cost of digital assets, the landscape is filled with nuances that demand clarity. Understanding the tax implications entails unraveling the intricate web of regulations surrounding digital currencies and translating them into practical strategies for compliance. Moreover, the evolving nature of cryptocurrencies poses additional challenges, as tax authorities continually refine their approach to address this innovative asset class. Effectively unpacking the tax complexities associated with investing in Bitcoin within self-managed superannuation funds requires a diligent approach that integrates legal, financial, and regulatory insights to navigate this ever-changing terrain.

Compliance Requirements: Meeting Legal Obligations 🛡️

Navigating the realm of self-managed super funds investing in Bitcoin entails a critical focus on compliance requirements to ensure alignment with legal obligations. As the regulatory landscape continues to evolve, staying abreast of these mandates is paramount in safeguarding the fund’s integrity and mitigating potential risks. By proactively addressing compliance considerations, investors can navigate the intricate web of legalities that govern this burgeoning asset class. Seeking professional advice and guidance becomes imperative in deciphering the nuanced requirements and charting a course that aligns with current regulations. A comprehensive approach to compliance not only fosters transparency and accountability but also fortifies the fund against unforeseen challenges. Embracing these obligations underscores a commitment to operational excellence and regulatory adherence within the dynamic realm of Bitcoin investments. For a comprehensive guide on regulatory guidance in Bahrain, visit regulatory guidance on Bitcoin investments in Bahrain.

Estate Planning: Ensuring Smooth Transitions 🏦

Estate planning is a critical aspect of managing investments, ensuring a smooth transition of assets to beneficiaries when the time comes. By carefully outlining your wishes and structuring your estate plan, you can help avoid potential conflicts or confusion among family members. It’s essential to review and update your estate plan regularly to reflect any changes in your financial situation or personal circumstances, guaranteeing that your investments, including Bitcoin holdings, are distributed according to your desires.

Here is a table to summarize key points related to estate planning:

| Estate Planning Considerations | Tips |

| ———– | ———– |

| Review and update estate plan regularly | Reflect changes in financial and personal circumstances |

| Clearly outline distribution wishes for Bitcoin holdings | Avoid conflicts and ensure smooth transitions |

| Seek professional guidance for comprehensive estate planning | Ensure legal compliance and efficient asset distribution |

By incorporating these strategies into your estate planning efforts, you can safeguard your investments and provide clarity for your loved ones in the future.

Professional Advice: Seeking Expert Guidance 🤝

When delving into the realm of self-managed super funds investing in Bitcoin, seeking professional advice is paramount. Expert guidance can provide invaluable insights and help navigate the complexities of this investment venture. A knowledgeable advisor can offer tailored strategies based on individual circumstances, ensuring informed decision-making and risk management. With the evolving landscape of cryptocurrency regulations and market dynamics, having a seasoned professional by your side can make a significant difference in optimizing your investment portfolio. Consulting with experts in the field can offer a sense of security and confidence in your financial decisions, allowing for a proactive approach to market fluctuations and regulatory changes. In the fast-paced world of Bitcoin investments, the expertise of professionals can be a guiding light towards achieving your financial goals.

Regulatory guidance on bitcoin investments in Bangladesh