Updates on Aml Regulations 🌐

The recent updates on AML regulations in the realm of Bitcoin compliance in Russia signify a pivotal shift in the regulatory landscape. These changes underline the growing importance of implementing stringent measures to combat money laundering and illicit activities within the cryptocurrency sector, reflecting a broader global trend towards enhancing financial transparency and security. Understanding these evolving regulations is crucial for businesses operating in the crypto space to ensure compliance and navigate the complex regulatory environment effectively.

Impact on Bitcoin Businesses 💼

Bitcoin businesses in Russia are experiencing significant shifts due to the recent updates in AML regulations. Entities engaging in cryptocurrency transactions are facing heightened compliance requirements, leading to operational adjustments and increased scrutiny. The regulatory landscape is evolving rapidly, prompting Bitcoin businesses to enhance their due diligence processes and establish robust compliance frameworks to navigate the changing environment effectively.

As Russian authorities ramp up enforcement efforts, Bitcoin businesses must stay proactive in ensuring adherence to AML regulations to avoid penalties and maintain their reputation in the market. International comparisons highlight varying approaches to AML compliance, emphasizing the importance of aligning with global standards while considering local nuances. Maneuvering through these developments, Bitcoin businesses are poised to adopt innovative solutions and strategic partnerships to thrive in the evolving regulatory landscape and safeguard against potential risks.

Compliance Challenges and Solutions 🔍

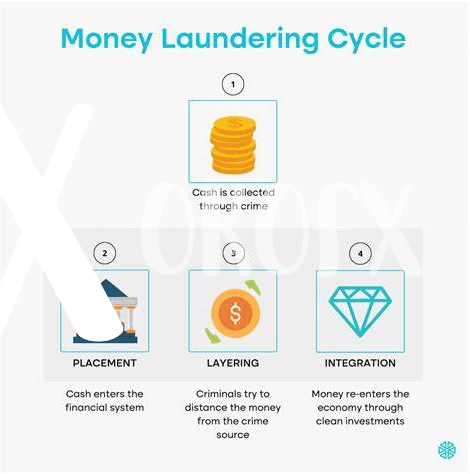

Navigating the intricate landscape of AML compliance in the realm of Bitcoin operations presents a myriad of challenges. One crucial hurdle is the evolving nature of regulations, which often struggle to keep pace with the rapid advancements in cryptocurrency technology. This dynamic environment demands constant vigilance and adaptability from businesses to ensure they remain compliant at all times. Solutions lie in proactive monitoring and robust internal controls that can swiftly address any emerging compliance issues.

Fostering a culture of compliance within Bitcoin enterprises is essential to mitigate risks and uphold regulatory standards. Implementing sophisticated blockchain analytics tools can aid in tracking and verifying transactions, enhancing transparency and accountability. Collaborating closely with regulatory authorities and industry peers can also offer valuable insights and best practices for achieving and maintaining AML compliance effectively.

Role of Russian Authorities 🇷🇺

Within the landscape of Bitcoin AML compliance in Russia, the authorities play a crucial role in shaping regulations and enforcing adherence. The collaboration between government agencies and Bitcoin businesses is instrumental in maintaining transparency and accountability within the industry. By closely monitoring transactions and ensuring compliance with established protocols, the Russian authorities aim to mitigate the risk of illicit activities while promoting the legitimate use of digital currencies. This concerted effort contributes to a more robust and secure ecosystem for cryptocurrency transactions. To gain further insights, you can explore the innovative approach taken by Poland in tackling Bitcoin anti-money laundering (AML) regulations [here](https://wikicrypto.news/rwandas-approach-to-bitcoin-aml-regulations-unveiled).

International Implications and Comparisons 🌍

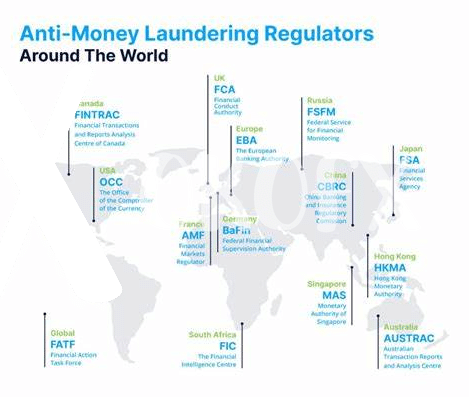

Bitcoin’s AML compliance landscape in Russia is not immune to global dynamics. When considering international implications, it becomes evident that various countries are adopting diverse approaches to regulating cryptocurrency activities. For instance, while some nations are embracing a more relaxed stance to foster innovation, others are tightening their AML regulations to combat illicit financial activities. These differences highlight the challenges faced by companies operating in multiple jurisdictions and the need for harmonization to ensure a level playing field in the global Bitcoin ecosystem. Moreover, cross-border comparisons shed light on best practices that can be adopted to enhance AML compliance standards worldwide.

By analyzing how different countries navigate the intersection of Bitcoin and AML regulations, stakeholders can gain valuable insights into emerging trends and potential regulatory developments. Such comparative studies not only facilitate knowledge sharing but also encourage collaboration among international authorities to address common challenges collectively. As Bitcoin continues to gain prominence on the global stage, understanding and adapting to varying AML compliance frameworks across countries will be essential for businesses to thrive and contribute to a more secure and transparent cryptocurrency environment.

Future Trends and Predictions 🚀

As the landscape of Bitcoin AML compliance continues to evolve, the future holds exciting developments and challenges. Emerging technologies, such as blockchain analytics tools and AI-driven solutions, are expected to play a significant role in enhancing compliance efforts. With regulators around the world tightening their grip on cryptocurrency businesses, industry players will need to innovate and adapt to meet regulatory requirements. Collaboration between industry stakeholders and government authorities will be crucial in shaping the future of AML compliance in the Bitcoin space. As the global regulatory landscape evolves, it is essential for businesses to stay ahead of the curve and proactively address compliance challenges to ensure long-term success and sustainability.bitcoin anti-money laundering (aml) regulations in rwanda