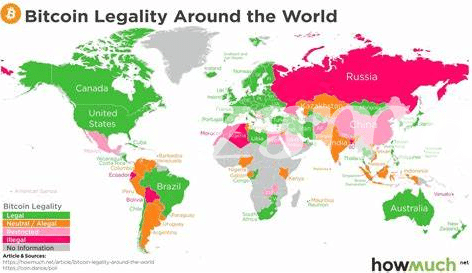

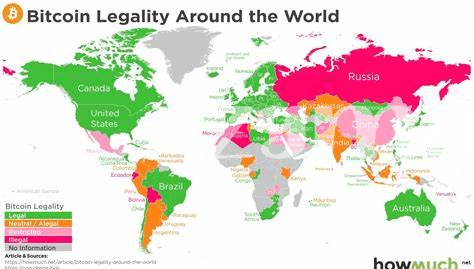

Bitcoin Legal Status in Mauritius 🇲🇺

In Mauritius, Bitcoin operates within a legal gray area, with no specific regulations categorically approving or banning its use. This ambiguity leaves room for innovation and growth within the cryptocurrency space. Individuals in Mauritius can buy, sell, and hold Bitcoin, but the lack of clear legal status raises questions about its long-term acceptance and recognition by authorities. Despite the uncertainty, the government has shown interest in exploring blockchain and digital currencies, signaling a potential shift towards a more defined regulatory approach in the future.

Overall, the legal landscape surrounding Bitcoin in Mauritius is dynamic, presenting both opportunities and challenges for users and businesses navigating this evolving sector. Stay tuned for updates on any developments that may shape the official stance on Bitcoin within the country.

Regulatory Framework and Compliance 📜

In Mauritius, the regulatory framework surrounding Bitcoin is designed to ensure compliance and transparency in cryptocurrency transactions. The government has established guidelines and rules to govern the use of Bitcoin, aiming to protect investors and prevent illegal activities. By adhering to these regulations, individuals and businesses can operate within the legal boundaries set by the authorities. This framework not only safeguards the interests of users but also promotes the growth and stability of the cryptocurrency market in Mauritius. Compliance with these regulations is essential for fostering trust and confidence in Bitcoin transactions, contributing to a secure and regulated environment for all participants involved.

Tax Implications for Bitcoin Holders 💰

Bitcoin holders in Mauritius face various tax implications, with the country’s tax authority closely monitoring cryptocurrency transactions. Capital gains from Bitcoin investments are subject to taxation, and individuals must ensure proper record-keeping for accurate reporting. Additionally, businesses accepting Bitcoin payments must adhere to specific tax laws, including VAT regulations. Understanding these tax implications is crucial for both individual investors and companies utilizing Bitcoin in Mauritius. As the cryptocurrency landscape continues to evolve, staying informed about taxation policies and obligations is essential for a smooth and compliant financial experience.

Consumer Protection and Safeguards 🔒

Consumer protection and safeguards in Mauritius play a crucial role in ensuring the security and rights of Bitcoin users. Regulations are in place to safeguard against potential fraud, ensuring transparency in transactions and protecting consumer interests. These measures help in building trust and confidence in the use of Bitcoin as a legitimate form of financial transactions, promoting a safe and secure environment for users to engage with digital currencies. Additionally, consumer protection laws aim to address any potential risks or issues that may arise, providing recourse for individuals in case of disputes or malpractices.

As the landscape of digital currencies continues to evolve, consumer protection remains a key focus to mitigate risks and enhance the overall experience for Bitcoin holders. By fostering a regulatory environment that prioritizes consumer safeguards, Mauritius aims to create a conducive ecosystem for the adoption and utilization of Bitcoin, striking a balance between innovation and protection for individuals participating in the digital economy.

Impact on Financial Institutions 🏦

The integration of Bitcoin into the financial landscape of Mauritius has sparked a transformative shift, influencing various financial institutions within the country. With the adoption of Bitcoin, traditional financial entities such as banks are now exploring new avenues to incorporate digital currencies into their operations. This shift has not only resulted in the enhancement of financial services but has also prompted a reevaluation of conventional banking practices to adapt to the evolving financial ecosystem. As a result, financial institutions are beginning to explore the potential benefits and challenges associated with embracing Bitcoin and other cryptocurrencies.

The emergence of Bitcoin in Mauritius has not only presented opportunities for financial institutions to diversify their services but has also catalyzed a collaborative effort to innovate and remain competitive in an increasingly digital economy. With a growing emphasis on blockchain technology and digital assets, financial institutions are positioned to leverage the advantages of Bitcoin to enhance their offerings and provide customers with access to cutting-edge financial solutions. This proactive approach underscores the significance of embracing technological innovation within the financial sector to ensure sustained growth and relevance in a rapidly evolving financial landscape.

Future Outlook and Potential Developments 🔮

As the landscape for Bitcoin in Mauritius continues to evolve, there are exciting future outlooks and potential developments on the horizon. With advancements in technology and increasing adoption rates, the cryptocurrency market in Mauritius is poised for further growth and innovation. Regulatory bodies are actively working towards creating a conducive environment for digital assets, paving the way for new opportunities and investment possibilities in the blockchain space. As the nation embraces these changes, the future of Bitcoin in Mauritius looks promising with potential developments that may shape its role in the global financial ecosystem.

is bitcoin legal in moldova?