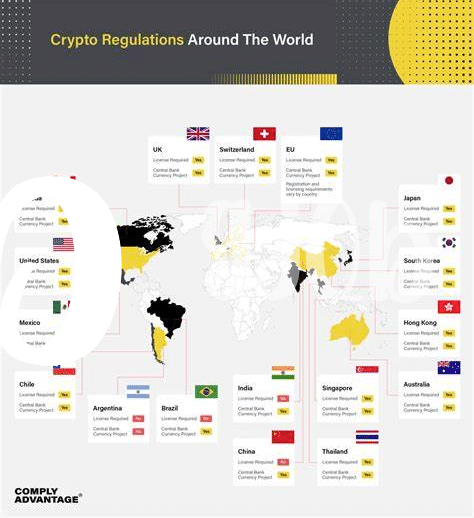

Understanding Regulatory Landscape 🌍

In the context of pursuing licensing for crypto exchanges in Gambia, it is crucial to navigate the intricate Regulatory Landscape with vigilance and an open mind. Understanding the dynamic framework of laws, guidelines, and policies set forth by regulatory bodies is fundamental to ensuring compliance and sustainable operations within the cryptocurrency market. Engaging with the regulatory landscape involves staying abreast of changes, interpreting complex legal language, and aligning business practices with the evolving regulations. By cultivating a deep understanding of the regulatory environment, crypto exchanges can proactively adapt their strategies to meet the evolving standards and expectations set by authorities.

Licensing Application Process 📝

Navigating the journey of obtaining a license for crypto exchanges involves several critical steps and considerations. Understanding the regulatory landscape is fundamental, ensuring alignment with the legal framework governing the operation of exchanges. The licensing application process requires meticulous attention to detail, with documentation and information submission playing a pivotal role in the approval process. Meeting the set financial requirements and having adequate capital reserves demonstrate the exchange’s stability and commitment to operating within the specified guidelines. Security measures and compliance standards are core focal points, emphasizing the importance of safeguarding user assets and maintaining integrity within the exchange ecosystem. Ongoing monitoring and reporting practices are essential for upholding transparency and accountability, contributing to a robust regulatory environment. Continuous staff training and development initiatives further strengthen the exchange’s capabilities, fostering a culture of compliance and professionalism.

Financial Requirements and Capital Reserves 💰

Understanding and meeting the financial requirements and maintaining adequate capital reserves are crucial aspects for crypto exchanges operating in Gambia. These standards ensure the stability and sustainability of the exchange, safeguarding both the business and the users. By demonstrating a sound financial position and having sufficient reserves, exchanges can instill confidence among stakeholders, including regulators, investors, and customers.

Solid financial foundations not only fulfill regulatory obligations but also serve as a testament to the exchange’s commitment to responsible and ethical operations. By diligently managing their finances and maintaining adequate capital reserves, exchanges can navigate market fluctuations, mitigate risks, and uphold trust in the crypto ecosystem. Prioritizing financial requirements and capital reserves furthers the exchange’s credibility and viability in the dynamic landscape of the cryptocurrency industry.

Security Measures and Compliance Standards 🔒

When it comes to ensuring the security and compliance of crypto exchanges in Gambia, implementing robust measures is essential. By incorporating advanced encryption technologies to protect user data and funds, exchanges can safeguard against cyber threats and unauthorized access. Alongside security measures, adherence to compliance standards plays a crucial role in building trust with regulators and users alike. Implementing KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures helps prevent illicit activities and ensures transparency within the exchange operations. Striking the right balance between security measures and compliance standards is vital for the sustainable growth and reputation of cryptocurrency exchanges in the region.

For more detailed insights on meeting cryptocurrency exchange licensing requirements in Gambia, refer to this comprehensive guide: Cryptocurrency exchange licensing requirements in Gabon.

Importance of Ongoing Monitoring and Reporting 📊

Continuous monitoring and timely reporting are crucial components for crypto exchanges in Gambia. This ongoing process ensures adherence to regulatory requirements, detects any potential risks or anomalies, and helps in maintaining trust with stakeholders. By consistently monitoring activities and promptly reporting any issues, exchanges can demonstrate transparency, accountability, and commitment to upholding industry standards. This proactive approach not only enhances credibility but also facilitates prompt action in addressing emerging challenges, ultimately contributing to a robust and compliant operational framework.

Continuous Staff Training and Development 📚

In the realm of staff training and development for crypto exchanges, a proactive approach is vital. Continuous learning and skill enhancement not only boost employee morale and performance but also ensure compliance with evolving regulations. Implementing regular training programs on security protocols, regulatory updates, and customer service practices is crucial. Encouraging professional growth through certifications and workshops fosters a culture of expertise and adaptability within the team. Embracing a culture of ongoing improvement lays a solid foundation for long-term success and sustainability.

Insert the link to cryptocurrency exchange licensing requirements in Eswatini with the anchor “cryptocurrency exchange licensing requirements in Estonia” organically in this post.