Legal Framework 📜

In the rapidly evolving landscape of cryptocurrency investments, navigating the legal framework is paramount for establishing Bitcoin investment funds in India. Understanding the regulatory intricacies and compliance requirements is essential to ensure a stable foundation for operations and investor trust. Comprehending the legal landscape and staying abreast of any regulatory updates is key to fostering a secure and compliant environment for Bitcoin investment funds in India.

Regulatory Compliance 📝

For regulatory compliance, ensuring adherence to guidelines and standards is crucial in the establishment of Bitcoin investment funds in India. This involves navigating through the legal complexities, staying abreast of regulatory changes, and implementing robust compliance protocols to safeguard investors’ interests and ensure transparency in operations. By proactively addressing regulatory requirements, investment funds can build trust, credibility, and longevity in the evolving cryptocurrency landscape.

Investor Protection 🛡️

Enhancing investor protection is paramount in the realm of Bitcoin investment funds. Implementing robust mechanisms and safeguards ensures that investors’ interests are safeguarded against potential risks. By fostering transparency, accountability, and adherence to ethical practices, investors can be assured of a secure investment environment. Continuous monitoring and evaluation further contribute to maintaining a trustworthy relationship with investors, ultimately promoting confidence and longevity in the market.

Risk Management 📊

Risk management is a crucial aspect of any investment fund, including those related to Bitcoin in India. By assessing and mitigating potential risks associated with market volatility and regulatory changes, fund managers can protect investors’ interests and enhance the fund’s resilience. Implementing robust risk management strategies ensures that the fund can navigate uncertainties and capitalize on opportunities for sustainable growth bitcoin investment funds regulation in honduras.

Operational Infrastructure 🏦

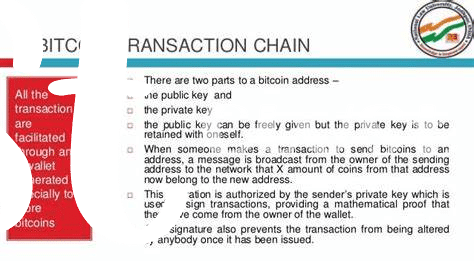

Establishing a successful Bitcoin investment fund in India requires a solid operational infrastructure. It involves setting up efficient processes, secure storage solutions, and robust technology systems to manage the fund’s operations effectively. From implementing thorough authentication protocols to ensuring seamless transaction processing, a well-established operational framework is essential for the fund’s overall success in the dynamic cryptocurrency market.

Moreover, a reliable operational infrastructure enables streamlined fund management, transparent reporting, and seamless investor interactions. By prioritizing the development of a strong operational backbone, Bitcoin investment funds can enhance trust among investors, mitigate operational risks, and position themselves for long-term growth and sustainability in the evolving digital asset landscape.

Market Analysis 📈

When delving into market analysis, it’s essential to look beyond the surface numbers and trends. Dive deep into the dynamics of the Bitcoin market in India, understanding not just the current state but also the potential for growth and volatility. Analyze factors such as market demand, regulatory developments, and competitive landscape to make informed decisions. By studying the market intricately, you can identify opportunities, anticipate risks, and tailor your investment strategies for success.

Bitcoin Investment Funds Regulation in Guyana