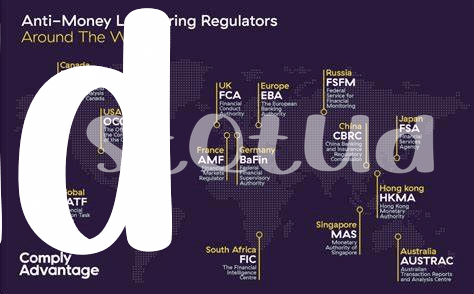

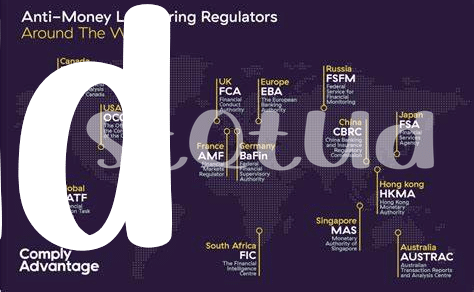

Regulatory Landscape 🌐

In Vanuatu, the regulatory landscape surrounding Bitcoin investments is evolving rapidly, creating a dynamic environment for investors to navigate. The jurisdiction’s unique approach to digital assets poses both opportunities and challenges for those looking to enter the market. Understanding the regulatory framework is essential to ensure compliance and mitigate risks in this emerging sector. Stakeholders need to stay informed and adapt to the evolving landscape to make informed decisions and navigate the complexities of the regulatory environment effectively.

Compliance Obligations 💼

When it comes to navigating the landscape of compliance obligations in the crypto world, investors in Vanuatu must stay diligent and informed about the regulatory requirements. Understanding and adhering to these obligations is essential for maintaining transparency and trust within the Bitcoin ecosystem. This involves implementing robust procedures to ensure that all transactions are traceable, verified, and compliant with the regulatory framework.

By proactively addressing compliance obligations, investors can mitigate risks, protect their assets, and contribute to the overall integrity of the cryptocurrency market in Vanuatu. Embracing these obligations not only fosters a culture of accountability but also positions investors for long-term success in a rapidly evolving financial landscape.

Risk Assessment 🔍

When delving into the realm of cryptocurrency investments, taking the time to thoroughly assess potential risks is paramount. Understanding the volatility and uncertainties that accompany the bitcoin market is essential for making informed decisions. Whether it’s evaluating market fluctuations, regulatory changes, or security vulnerabilities, a comprehensive risk assessment strategy ensures that investors are well-equipped to navigate the unpredictable nature of the digital currency landscape. By identifying and mitigating potential threats, investors can safeguard their assets and optimize their investment strategies for long-term success.

Due Diligence Process 🔎

In the realm of Bitcoin investments in Vanuatu, conducting due diligence is a critical process that can make or break an investor’s success. This methodical investigation involves scrutinizing the backgrounds of potential investment opportunities, verifying information, and assessing potential risks. By delving into the details, investors can gain a comprehensive understanding of the asset they are considering, enabling them to make informed decisions. While it may seem like an additional step in the investment process, due diligence is a valuable tool that can help safeguard against potential pitfalls and enhance the overall success of the investment venture.

For more insights on how regulatory authorities influence Bitcoin AML compliance in Zambia, check out this informative article on bitcoin anti-money laundering (aml) regulations in Zimbabwe.

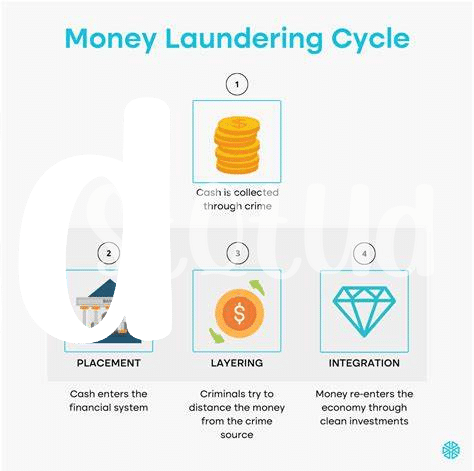

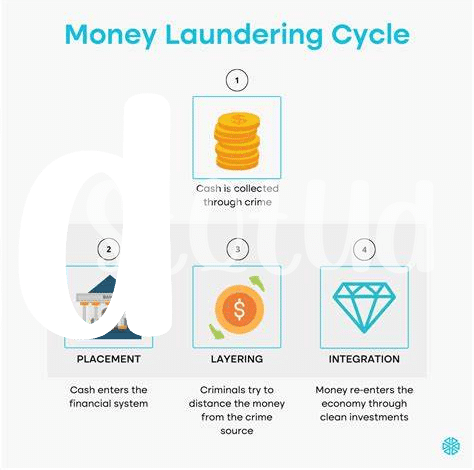

Reporting Requirements 📊

Bitcoin investors in Vanuatu must be aware of the reporting requirements. These obligations ensure transparency and compliance with anti-money laundering regulations. Reporting requirements involve submitting timely and accurate information to regulatory authorities. Investors need to document transactions, suspicious activities, and any other relevant details to demonstrate their adherence to regulatory standards. By fulfilling reporting requirements, investors play a crucial role in combating financial crimes and maintaining the integrity of the cryptocurrency market in Vanuatu. Staying up to date with reporting guidelines is essential for investors to operate legally and ethically within the jurisdiction.

Ongoing Monitoring 📈

Ongoing monitoring is essential in the world of Bitcoin investment to ensure compliance with Vanuatu’s AML regulations. Regularly tracking transactions and customer behavior allows investors to detect any suspicious activities promptly. By continuously assessing and updating their monitoring processes, investors can stay ahead of potential risks and maintain a secure environment for their investments. Stay vigilant and proactive in monitoring your Bitcoin transactions to safeguard against illicit activities and uphold regulatory requirements.

Bitcoin anti-money laundering (AML) regulations in Zambia