Legal Status of Bitcoin in the Netherlands 🇳🇱

Bitcoin has gained widespread attention globally, including in the Netherlands, where its legal status has been a subject of interest and debate. The Netherlands has not officially recognized Bitcoin as legal tender, distinguishing it from traditional fiat currencies like the Euro. Despite this, Bitcoin is not considered illegal in the country, and individuals are allowed to buy, sell, and hold cryptocurrencies like Bitcoin within the existing legal framework.

As the popularity of Bitcoin grows, discussions around its legal status continue to evolve, with regulatory bodies closely monitoring its impact on the financial landscape. While not classified as legal tender, the Netherlands has taken steps to address the use of cryptocurrencies, aiming to provide clarity and protection for consumers engaging in Bitcoin transactions within the country.

Comparison with Traditional Legal Tender 💶

When it comes to Bitcoin in the Netherlands, its comparison with traditional legal tender is a vital aspect to consider. While traditional currencies like the euro are backed by governments and central banks, Bitcoin operates on a decentralized platform, utilizing blockchain technology for transactions. This difference in structure impacts aspects such as security, transaction speed, and transparency, providing users with alternative options beyond conventional financial systems. Understanding these distinctions can help individuals navigate the evolving landscape of digital currencies and make informed decisions regarding their financial transactions.

In the realm of financial exchange, Bitcoin offers a unique perspective compared to traditional legal tender. Its decentralized nature and technological framework present both opportunities and challenges for users looking to embrace the digital currency revolution.

Consumer Protection and Risks Involved ⚠️

The evolving landscape of Bitcoin in the Netherlands brings forth a myriad of opportunities for consumers, yet it also ushers in new dimensions of risks. With the decentralized nature of cryptocurrencies, consumers are tasked with the responsibility of safeguarding their digital assets against hacking and fraudulent schemes. Unlike traditional banking systems with established protection mechanisms, the unregulated nature of Bitcoin transactions can leave consumers vulnerable to potential scams and market fluctuations. As individuals delve into the realm of digital currency, it becomes imperative to exercise caution, conduct thorough research, and adopt prudent measures to mitigate the inherent risks associated with this innovative form of monetary exchange.

Regulations Governing Bitcoin Transactions 📝

Bitcoin transactions in the Netherlands are subject to specific regulations aimed at ensuring transparency and security in the digital currency realm. These regulations govern various aspects of Bitcoin transactions such as reporting requirements, anti-money laundering measures, and the licensing of cryptocurrency service providers. By complying with these regulations, the Dutch government aims to create a supportive environment for the use of Bitcoin while also safeguarding against potential risks and illicit activities associated with virtual currencies.

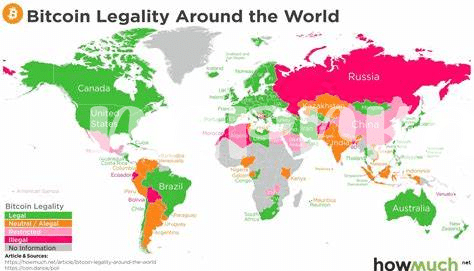

To dive deeper into the regulatory landscape surrounding Bitcoin transactions globally, including insights on other countries’ approaches to this issue, you can explore a detailed analysis on the legality of Bitcoin transactions in Nepal on WikiCrypto.News. The examination sheds light on the nuances of Bitcoin’s recognition as legal tender and the corresponding regulatory frameworks in different jurisdictions, providing a comprehensive perspective on the evolving landscape of cryptocurrency acceptance worldwide.

Tax Implications for Bitcoin Transactions 💸

– Future Outlook for Bitcoin Acceptance in the Netherlands 🌐

As the popularity of Bitcoin continues to rise in the Netherlands, the tax implications for Bitcoin transactions have become a significant area of interest. Individuals engaging in Bitcoin transactions need to be aware of the tax treatment applicable to their activities. The Dutch tax authorities have provided guidance on how virtual currencies like Bitcoin should be treated in terms of taxes, including income tax and VAT. It is essential for taxpayers to accurately report their Bitcoin transactions to comply with tax laws and prevent potential audits or penalties. Understanding the tax implications can help individuals navigate the complexities of cryptocurrency transactions and ensure compliance with Dutch tax regulations.

Future Outlook for Bitcoin Acceptance in the Netherlands 🌐

In the realm of digital currencies, Bitcoin’s future acceptance in the Netherlands seems promising, mirroring global trends of increasing adoption. The Netherlands has shown a progressive outlook towards blockchain and cryptocurrencies, paving the way for potential mainstream integration of Bitcoin into everyday transactions. With evolving regulations and growing public interest, it is likely that Bitcoin will continue to gain acceptance within the Netherlands’ financial landscape, potentially solidifying its position as a widely recognized form of digital currency.

is bitcoin recognized as legal tender in nepal?