History of Legal Tender Laws in Greece 🏛️

Legal tender laws in Greece have evolved over time, reflecting the country’s economic circumstances and societal needs. These laws determine the official forms of payment accepted within the nation’s borders, providing a foundation for financial transactions. Understanding the historical context of legal tender laws in Greece sheds light on the significance of these regulations and their impact on the economy. The development of these laws has been influenced by various factors, including trade relationships, domestic policies, and technological advancements. Analyzing the evolution of legal tender laws in Greece offers insight into the country’s financial landscape and its approach to currency regulation.

Status of Bitcoin under Greek Financial Regulations 💸

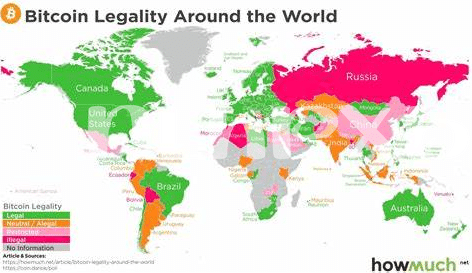

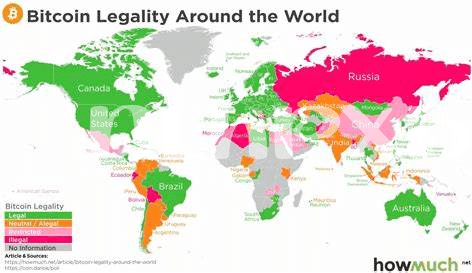

In the realm of Greek Financial Regulations, Bitcoin exists as a digital asset that navigates a landscape governed by evolving policies and frameworks. The recognition and treatment of Bitcoin within the Greek financial system are subject to scrutiny and adaptation as the concept and application of cryptocurrency continue to shape the global financial landscape. This dynamic interaction between a decentralized digital currency and traditional financial regulations underscores the need for ongoing dialogue and examination to determine the place of Bitcoin within the broader economic framework.

Common Myths and Misconceptions about Bitcoin 🤔

Misconceptions about Bitcoin often stem from a lack of understanding about how it works and its purpose in the financial world. One common myth is that Bitcoin is completely anonymous and only used for illegal activities. In reality, Bitcoin transactions are recorded on a public ledger called the blockchain, which means they can be traced back to individual addresses. Another misconception is that Bitcoin has no intrinsic value and is a bubble waiting to burst. However, the underlying technology of Bitcoin, known as blockchain, has the potential to revolutionize various industries beyond just finance. Understanding these myths and separating them from reality is key to grasping the true potential of Bitcoin in the modern economy.

Factors Influencing the Acceptance of Bitcoin 💼

Factors influencing the acceptance of Bitcoin include the growing trend towards digital payments, increased awareness and education about cryptocurrencies, and the expanding use of blockchain technology in various industries. Additionally, the decentralized nature of Bitcoin and its potential as a hedge against traditional financial systems play a role in its adoption. Overall, the combination of technological advancements, financial innovation, and shifting attitudes towards traditional currencies contributes to the increasing acceptance of Bitcoin as a legitimate form of payment. To explore more about the legal perspectives on Bitcoin adoption, check out is Bitcoin legal in Gambia?.

Role of Technology in Shaping the Future of Currency 🌐

The rapid advancement of technology is revolutionizing the way we perceive and utilize currency. Digital innovations are reshaping the financial landscape, offering new possibilities for transactions and storage of value. With the rise of cryptocurrencies like Bitcoin, the role of technology in shaping the future of currency is profound. Blockchain technology, the backbone of cryptocurrencies, enables secure, decentralized transactions globally. This decentralized nature eliminates the need for traditional intermediaries, reducing transaction costs and increasing efficiency. As technology continues to evolve, its impact on currency and financial systems is likely to grow, paving the way for a more interconnected and digital economy.

Implications of Bitcoin’s Non-legal Tender Status in Greece 🔍

The absence of legal tender status for Bitcoin in Greece raises several implications for its users and the overall financial landscape. While it may limit the direct acceptance of Bitcoin in everyday transactions, it also signifies a cautious approach by regulators towards integrating digital currencies into the formal economy. This non-legal tender status prompts individuals and businesses engaging with Bitcoin to navigate uncertainties around taxation, consumer protections, and dispute resolutions within the Greek context. Additionally, the lack of legal tender designation underscores the need for further clarity and regulatory frameworks to facilitate the responsible use and broader acceptance of cryptocurrencies in Greece.

is bitcoin legal in fiji?