Overview of Bitcoin Funds in Estonia 🌍

Investing in Bitcoin Funds in Estonia offers a unique opportunity for investors to gain exposure to the world of cryptocurrency. With the increasing popularity of digital assets, Bitcoin Funds in Estonia serve as a gateway for individuals looking to diversify their portfolios. These funds provide a convenient way to participate in the growth potential of Bitcoin without the need to directly hold the cryptocurrency. Additionally, Bitcoin Funds in Estonia are regulated entities that adhere to specific guidelines, offering a sense of security and legitimacy to investors.

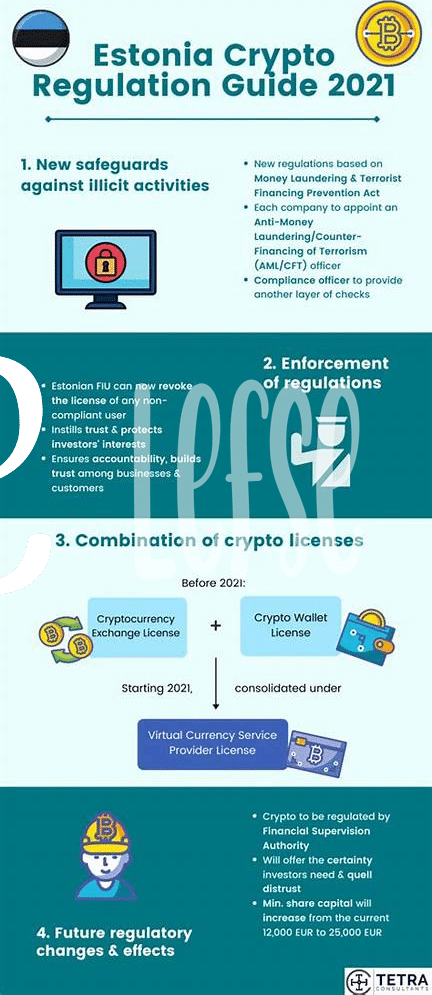

Regulatory Landscape for Bitcoin Investments 📜

The regulatory environment surrounding Bitcoin investments in Estonia has been a subject of increasing interest and scrutiny. Government agencies are continuously working to adapt existing regulations and frameworks to address the unique challenges posed by digital assets. In recent years, there have been notable developments in the legal landscape that have shaped the way investors can engage with Bitcoin funds in Estonia. These changes have aimed to provide clarity and security for individuals and institutions looking to participate in the dynamic world of cryptocurrency investments.

Benefits of Investing in Bitcoin Funds 💰

Bitcoin funds offer investors a gateway to the world of digital assets, providing exposure to the potential growth and diversification benefits of cryptocurrencies. By investing in these funds, individuals can access the dynamic and innovative space of virtual currencies without the need for direct ownership or management. The flexibility and convenience of bitcoin funds make it easier for both novice and seasoned investors to participate in this evolving financial landscape, opening up new opportunities for portfolio growth and exploration in the digital realm.

Risks and Challenges to Consider ⚠️

When considering investing in Bitcoin funds, it is essential to be aware of the potential risks and challenges involved. The volatility of the cryptocurrency market can lead to significant price fluctuations, impacting investment returns. Additionally, regulatory changes or government interventions can affect the legality and operation of Bitcoin funds. It is crucial for investors to stay informed and be prepared for unexpected developments to mitigate these risks effectively.

Insert the link: insurance coverage for bitcoin wallets and exchanges in Spain

Top Bitcoin Funds Available in Estonia 📊

When considering Bitcoin funds in Estonia, investors have a range of options to choose from. These funds vary in their investment strategies, risk levels, and fees, providing diverse opportunities for both new and experienced investors. Some funds may focus on specific market segments or investment approaches, while others offer a more diversified portfolio. Understanding the characteristics of each fund, such as past performance, management team, and regulatory compliance, is essential for making informed investment decisions. By exploring the top Bitcoin funds available in Estonia, investors can assess the best fit for their financial goals and risk tolerance.

Future Outlook for Bitcoin Funds in Estonia 🔮

In the evolving landscape of Bitcoin funds in Estonia, the future holds promising opportunities for investors seeking to diversify their portfolios. As the regulatory framework continues to adapt and integrate digital assets, the potential for growth and innovation in the Bitcoin investment space in Estonia looks bright. This forward-looking approach positions Estonia as a potential hub for digital currency investments in the region, attracting both domestic and international investors eager to capitalize on the emerging trends in the cryptocurrency market.

For more insights on Bitcoin investment fund regulations in Equatorial Guinea, check out the comprehensive guidelines on bitcoin investment funds regulation in Eritrea.