Origins of Cryptocurrency Ponzi Schemes in Syria 🔍

The entry of cryptocurrency Ponzi schemes into Syria can be traced back to the growing popularity of digital currencies and the allure of quick and significant returns. With limited regulatory oversight and a lack of investor education, these schemes found fertile ground in the country. Promoters often targeted vulnerable populations with promises of high profits and minimal risks, exploiting the trust and desperation of individuals seeking financial stability.

| Origin Factors | Description |

| ————– | ———– |

| Digital Currency Hype | Cryptocurrency’s appeal as a new and lucrative investment avenue fueled interest in Ponzi schemes. |

| Regulatory Gaps | Weak oversight and enforcement mechanisms allowed fraudulent schemes to flourish unchecked in Syria. |

| Prevalence of Economic Challenges | Economic instability and a lack of traditional investment options made individuals more susceptible to Ponzi schemes. |

Impact on Syrian Economy and Society 💰

Cryptocurrency Ponzi schemes have had a significant impact on the Syrian economy and society. These fraudulent schemes often promise high returns on investment, attracting unsuspecting individuals looking to improve their financial situation. As more people fall victim to these scams, the overall economic stability and trust within the Syrian society are undermined.

The influx of Ponzi schemes in Syria has led to a loss of savings for many individuals and families, exacerbating financial hardships in an already challenging economic environment. Furthermore, the social fabric of Syrian communities is strained as trust erodes due to the prevalence of these deceptive schemes. Addressing the impact of cryptocurrency Ponzi schemes on both the economy and society in Syria is crucial in safeguarding the financial well-being and overall cohesion of the population.

Tactics Used to Promote Ponzi Schemes 🎣

Cryptocurrency Ponzi schemes in Syria often rely on enticing tactics to lure in unsuspecting victims. These schemes may promise quick and guaranteed returns on investments, playing on people’s desire to make easy money. These scammers use flashy marketing techniques, social media influencers, and fake testimonials to create an illusion of credibility. Additionally, they may employ tactics like creating a sense of urgency or exclusivity to pressure individuals into investing without conducting proper due diligence. By presenting an attractive facade, these promoters exploit the lack of awareness surrounding cryptocurrencies and prey on the vulnerable with false promises of wealth.

Regulatory Responses and Challenges 🛡️

One of the key challenges faced in regulating cryptocurrency Ponzi schemes in Syria is the decentralized nature of these digital assets. Unlike traditional financial systems, cryptocurrencies operate without a central authority, making it difficult for regulators to track and enforce compliance. Moreover, the lack of clear international guidelines adds another layer of complexity to combating fraudulent schemes. As authorities work to adapt existing regulations to the digital landscape, the evolving nature of cryptocurrencies presents an ongoing challenge in staying ahead of scammers and protecting investors’ interests.

For more insights on uncovering fraudulent practices in the realm of cryptocurrency, refer to this detailed report on bitcoin fraud and scam reporting in South Sudan: bitcoin fraud and scam reporting in South Sudan.

Case Studies of Ponzi Schemes in Syria 📊

Case Studies of Ponzi Schemes in Syria bring to light the stark reality of unsuspecting individuals falling prey to fraudulent schemes promising high returns. In one instance, a cryptocurrency investment platform lured investors with promises of guaranteed profits, only to vanish overnight with all funds. Another case involved a Ponzi scheme masquerading as a legitimate trading platform, trapping investors in a web of deceit. These fraudulent operations not only result in financial losses but also shatter trust within the community, leaving many disillusioned and financially crippled.

| Date | Scheme Description | Amount Lost |

|————|———————|————-|

| 05/2019 | Fake Mining Pool | $100,000 |

| 12/2020 | Ponzi Trading App | $150,000 |

| 08/2021 | Investment Group | $80,000 |

Investors must remain vigilant and conduct thorough research before investing in any cryptocurrency opportunity, as these Ponzi schemes continue to prey on the vulnerabilities of unsuspecting victims. By sharing these case studies, awareness can be raised to help others avoid falling victim to such malicious schemes.

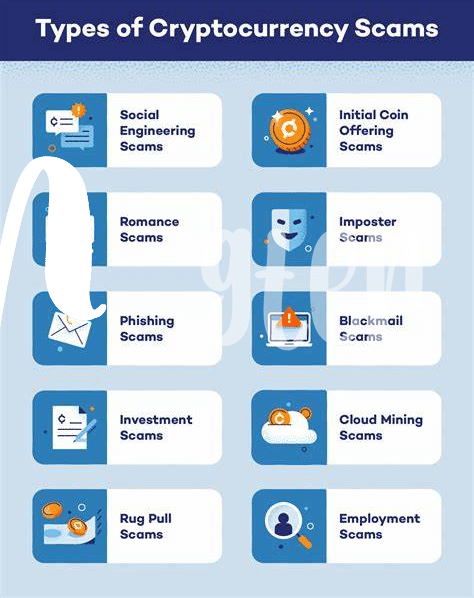

Ways to Identify and Avoid Cryptocurrency Scams 🚨

Cryptocurrency scams can be tricky to spot, but there are some key red flags to watch out for. One important way to protect yourself is to research and verify the legitimacy of any investment opportunity before committing your funds. Be wary of promises of high returns with little to no risk, as these often signal a potential scam. Additionally, watch out for unsolicited offers, pressure tactics to invest quickly, and unregistered or unlicensed sellers. Always remember that if something seems too good to be true, it probably is.

For more tips on avoiding cryptocurrency scams, you can visit the bitcoin fraud and scam reporting in Spain website for resources and guidance on how to stay safe in the digital currency space. Educating yourself and staying vigilant are essential steps in safeguarding your investments and financial well-being.