What Are Interest Rates? 🤔

Imagine you’ve lent your bike to a friend for a week, and when they return it, they surprise you with a chocolate bar as a thank you. That’s a bit like interest rates. But instead of bikes and chocolate, we’re talking about money. When you put your money in a bank or lend it to someone, the “thank you” comes in the form of additional money, called interest. It’s a way for the borrower to say thanks for letting them use your money. The amount of this “thank you” money depends on the interest rate, which can be thought of as the price of borrowing money. It tells you how big a chocolate bar you’re getting – or in bank terms, how much extra money you’ll earn as a borrower pays you back.

Interest rates aren’t just random numbers banks throw out there. They’re carefully set based on various factors, such as how the economy is doing and what the central bank decides. These rates directly affect how much you can earn from saving or lending your money. Here’s a simple example to put it into perspective:

| Initial Amount | Interest Rate (%) | Time (Years) | Total Amount Earned |

|---|---|---|---|

| $1,000 | 5 | 1 | $1,050 |

So, in this case, if you lend $1,000 at an interest rate of 5% for a year, you’ll end up with $1,050. Not a huge chocolate bar, but definitely a sweet one! 🍫👍

The Basics of Bitcoin 💰

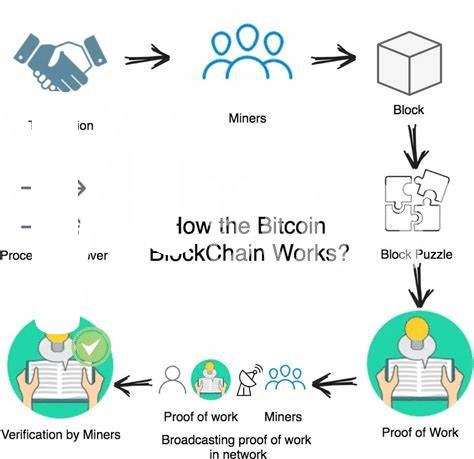

Imagine you’ve just discovered a digital treasure chest, but instead of gold or jewels, it’s filled with something called Bitcoin. Picture Bitcoin as virtual coins you can send through the internet. No banks, no borders, just you and a global network exchanging these digital coins as easily as sending an email. Created by a mysterious figure known as Satoshi Nakamoto in 2009, Bitcoin operates on a technology called blockchain. Think of this as a super secure, public ledger that records every transaction. It’s like a huge, unchangeable receipt that everyone can see, ensuring no one can cheat the system. Why do people like it? Well, some appreciate Bitcoin for its privacy and the control it gives them over their own money. Others see it as an investment, hoping its value goes up over time. Just remember, like a rollercoaster, Bitcoin’s value can go up and down, making it both exciting and a bit unpredictable.

Exploring Bitcoin Lending Platforms 🔍

Imagine a digital marketplace, but instead of buying and selling things like books or clothes, people are exchanging Bitcoin for some extra cash in the form of interest. These digital marketplaces are what we call Bitcoin lending platforms. They work a bit like a bank for your digital coins. You lend out your Bitcoin, and in return, you get some interest back, just like if you’d put your money in a savings account. It’s a way to grow your Bitcoin without doing much at all.

However, it’s not all about sitting back and watching your Bitcoin grow. 🌱 You need to understand how these platforms work. They connect people who want to borrow Bitcoin with those willing to lend it, all through the internet. It’s fascinating, really, how technology allows us to be part of this global finance experiment from the comfort of our homes. 🏠💻 But as with anything that involves money and the internet, there’s a bit to learn to make the most of it while keeping your digital coins safe.

How Interest Gets You More Bitcoin 📈

Imagine you’ve got a garden, but instead of growing plants, you’re growing your digital money, Bitcoin. This garden is a special place on the internet where you can lend out your Bitcoin, kind of like how a bank lends out money. In return for lending your digital coins, you get more Bitcoin over time. It works like this: when you lend your Bitcoin, you’re promised more Bitcoin back later, thanks to something called interest. It’s a bit like planting a seed and watching it grow extra leaves over time. This growth happens because the lending platforms need to borrow your Bitcoin to let other people use it. In exchange, they pay you back more than what you gave them, rewarding you for letting them use your digital coins.

However, diving into this world needs a bit of know-how, especially understanding the tech behind Bitcoin and how it makes things like bitcoin and cross-border payments and the blockchain possible and secure. It’s fascinating how these technologies interweave to make lending platforms a reality, allowing your digital stash to grow. Just always remember, while lending out your Bitcoin can increase your digital garden, it’s important to know the ins and outs to protect your greenery from any online pests, ensuring you can enjoy the fullest bloom of your investment.

Risks of Lending Bitcoin: Stay Safe! ⚠️

When you dive into the world of Bitcoin lending, picture it like lending a friend money, but in this case, your friend is the internet, and just like in real life, there can be risks. 🚨 One big worry is trust—if the platform or person you lend to doesn’t give your Bitcoin back, it’s like your friend moving cities without telling you. Then, there’s the value dance 💃—the value of Bitcoin can go up and down like a yo-yo. If it drops a lot while your Bitcoin is being borrowed, you might end up feeling a bit sour. Also, not all playgrounds are safe; some platforms might not be strong fortresses but rather houses of cards, ready to topple at the slightest breeze. Here’s a simple look at what to keep your eyes peeled for:

| Risk Factor | What It Means |

|---|---|

| Trustworthiness of Platform | Is the platform reliable and secure? |

| Value Fluctuation | Bitcoin’s value can change rapidly. |

| Regulatory Changes | Laws affecting Bitcoin can shift. |

Enter this world with your eyes wide open, a bit of caution, and a good dose of research to navigate these waters safely. 🧐

Maximizing Returns on Bitcoin Lending 👑

When diving into the world of Bitcoin lending, your aim is to grow your digital treasure chest, right? 💼🚀 Imagine lending platforms as little workshops where your Bitcoins get to work, not just sit pretty. To get the most out of these platforms, it’s like finding the right tools for a job or the best pot for a plant. First, do a bit of homework on which platforms offer sweet deals – think lower fees and higher interest rates. 🧐 But, hey, don’t just stop at the numbers; consider the health and trustworthiness of the platform. Safety first! 🔒 Also, timing can be everything. Picture this: You’re surfing, waiting for the perfect wave. Similarly, keep an eye on market trends and bitcoin software updates and the blockchain, as they can significantly affect interest rates. Diving in at the right moment can boost your returns big time. Lastly, diversification is your friend. Don’t put all your Bitcoins in one basket. Spread them out across different platforms or loan types to balance out your risk and potential rewards. 🌐 Remember, every Bitcoin counts in this quest for financial growth.