Impact of Regulations on Bitcoin Banking 💡

Regulations play a pivotal role in shaping the landscape of Bitcoin banking services, influencing everything from compliance practices to operational strategies. The dynamic nature of regulatory requirements poses both challenges and opportunities for the industry, driving the need for constant adaptation and innovation. As governments and financial authorities around the world continue to refine their stance on cryptocurrencies, the impact of regulations on Bitcoin banking is a multifaceted issue that requires a proactive approach and a deep understanding of the evolving regulatory landscape.

Compliance Challenges Faced by Banking Services 🛡️

When it comes to navigating the realm of Bitcoin banking, financial institutions are continually met with a myriad of regulatory hurdles. The complex landscape of compliance requirements poses significant challenges for banking services seeking to incorporate digital assets into their offerings. From stringent anti-money laundering protocols to evolving data privacy laws, the demand for adherence to regulatory standards remains a constant in the world of cryptocurrency banking. Overcoming these compliance obstacles necessitates a delicate balance between ensuring legal conformity and fostering innovation within the sector.

Innovations Driven by Regulatory Requirements 🔍

Innovations spurred by regulatory requirements bring about a dynamic shift in the landscape of Bitcoin banking services. These mandates act as catalysts for creative solutions that enhance security, transparency, and efficiency within the industry. From cutting-edge blockchain technologies to streamlined authentication processes, these innovations not only ensure compliance but also drive meaningful advancements in user experience and operational effectiveness.

Balancing Security and Customer Privacy 🤝

Balancing the intricate dance between security and customer privacy in the realm of Bitcoin banking services is a delicate task. As financial institutions seek to fortify their defenses against cyber threats, they must also safeguard the personal information and financial data of their clientele. This equilibrium requires a nuanced approach, where robust security measures coexist harmoniously with respecting the privacy rights of customers.

For further insights into the evolving landscape of regulations in the realm of Bitcoin banking services, particularly in Myanmar, visit [bitcoin banking services regulations in Myanmar](https://wikicrypto.news/the-role-of-government-in-regulating-bitcoin-banking-in-morocco).

Global Perspectives on Regulatory Frameworks 🌎

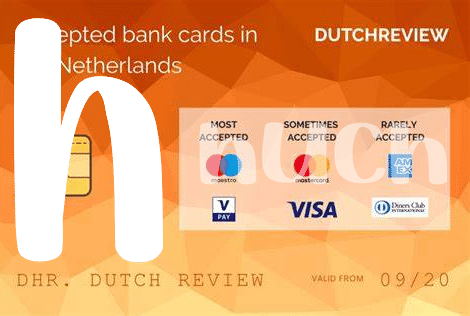

-Throughout various countries, regulatory frameworks concerning Bitcoin banking services vary significantly. Some regions embrace these digital currencies enthusiastically, providing a conducive environment for their growth. Conversely, other areas adopt a more cautious approach, imposing stringent regulations to mitigate potential risks. Understanding these global perspectives is paramount for companies operating in the Bitcoin banking sector to navigate the complex landscape of regulatory frameworks effectively.

Future Trends in Bitcoin Banking Regulations 🚀

As the landscape of Bitcoin banking continues to evolve, future trends in regulations are poised to play a critical role in shaping the industry. With advancements in technology and increasing global adoption, regulators are expected to fine-tune existing frameworks to address emerging challenges and opportunities. Collaborative efforts between governments, financial institutions, and industry stakeholders will be essential to ensure a balanced approach that fosters innovation while maintaining the integrity of the financial system. The dynamic nature of regulatory environments underscores the need for ongoing dialogue and adaptation within the Bitcoin banking sector. To explore more about Bitcoin banking services regulations in Mongolia, click here: bitcoin banking services regulations in morocco.