Overview of Bitcoin Aml Compliance 🌎

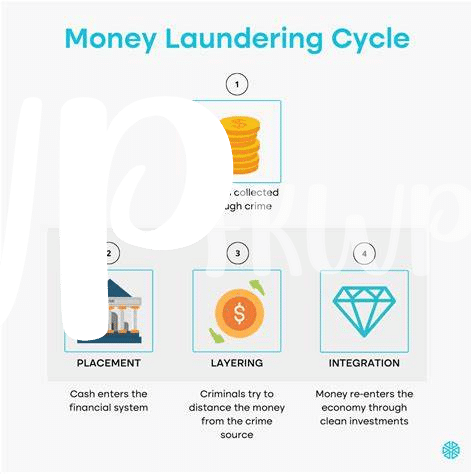

In today’s digital landscape, Bitcoin Anti-Money Laundering (AML) compliance plays a pivotal role in safeguarding financial transactions and upholding regulatory standards. Businesses and financial institutions are increasingly turning to innovative solutions to navigate the complexities of AML requirements in the realm of cryptocurrency. Understanding the nuances of Bitcoin AML compliance is not only essential for regulatory adherence but also for fostering trust and transparency in the rapidly evolving digital economy. Embracing emerging technologies and fintech advancements is key to enhancing AML processes, promoting secure transactions, and ensuring compliance with evolving regulatory frameworks.

Current Challenges in Compliance Processes 🚩

In the rapidly evolving landscape of financial technology, companies face numerous hurdles in navigating compliance processes. The intricate web of regulations, varying across jurisdictions, poses a significant challenge for businesses striving to ensure AML compliance. The lack of standardized protocols and the constant updates in regulatory requirements further complicate the compliance landscape. Additionally, the difficulties in verifying the legitimacy of transactions, particularly in the realm of cryptocurrencies like Bitcoin, present a unique set of challenges for compliance professionals. These obstacles underscore the critical need for innovative solutions that can streamline compliance processes while effectively identifying and mitigating risks.

Impact of Fintech Solutions on Aml Compliance 💡

Fintech solutions are revolutionizing AML compliance by streamlining processes and enhancing accuracy. These innovative technologies are enabling financial institutions to efficiently monitor, detect, and prevent money laundering activities. By leveraging advanced algorithms and automation, fintech solutions are significantly reducing the manual efforts required for compliance tasks. Real-time monitoring and data analytics capabilities empower organizations to stay ahead of evolving regulatory requirements and swiftly adapt to new challenges. The integration of fintech solutions not only enhances operational efficiency but also improves the overall effectiveness of AML compliance programs. With the continuous advancements in technology, the impact of fintech on AML compliance is poised to drive greater transparency, security, and trust in the financial ecosystem.

Examples of Innovative Blockchain Technologies 🔗

Innovative blockchain technologies have revolutionized the landscape of Anti-Money Laundering (AML) compliance in the realm of Bitcoin. From smart contracts to decentralized identity verification, these technologies offer transparent and immutable solutions for tracking transactions and ensuring regulatory compliance. By leveraging blockchain, companies can streamline their AML processes, reduce the risk of fraud, and enhance overall security measures. These examples showcase the potential of blockchain in transforming traditional compliance practices and setting new standards for financial accountability and transparency.

To learn more about the importance of Bitcoin Anti-Money Laundering (AML) regulations in Saint Kitts and Nevis, check out this insightful article on bitcoin anti-money laundering (AML) regulations in Saint Kitts and Nevis.

Benefits of Implementing Fintech in Compliance 📈

Innovative fintech solutions offer a streamlined approach to AML compliance, allowing for quicker and more efficient monitoring of transactions. By leveraging advanced technologies, such as machine learning and artificial intelligence, these solutions can automate processes, reducing human error and increasing accuracy. This not only saves time but also improves overall compliance by identifying potential risks more effectively and helping organizations stay ahead of evolving regulations in the dynamic landscape of cryptocurrency transactions.

Future Trends in Fintech for Aml Compliance 🚀

The rapid advancement of financial technology (Fintech) is reshaping the landscape of Anti-Money Laundering (AML) compliance for Bitcoin. Emerging trends indicate a shift towards more automated and sophisticated AML solutions, leveraging data analytics and artificial intelligence. Enhanced customer due diligence processes and risk-based approaches are expected to play a pivotal role in shaping the future of AML compliance in the Fintech space. Collaboration between regulatory bodies and industry stakeholders will be crucial in adapting to the evolving regulatory environment.

Bitcoin Anti-Money Laundering (AML) regulations in Russia with anchor Bitcoin Anti-Money Laundering (AML) regulations in Poland.