🏦 Traditional Banking Challenges in Liechtenstein

Liechtenstein’s banking sector faces unique challenges in a rapidly evolving financial landscape. With a focus on traditional values and privacy, the country must navigate the complexities of a digital world while preserving its reputation as a banking haven. Striking a balance between adherence to regulations and embracing innovation remains a key issue for Liechtenstein’s banks. Keeping pace with technological advancements, competition, and changing customer demands presents a formidable task for the country’s traditional banking institutions.

💡 Innovation through Bitcoin Integration

The incorporation of Bitcoin into Liechtenstein’s banking landscape represents a significant step towards embracing financial innovation. This integration not only diversifies the services offered by traditional banks but also opens up new avenues for digital transactions. By leveraging the decentralized nature of cryptocurrencies, Liechtenstein is at the forefront of merging technology with finance, fostering a more inclusive and efficient banking environment. The seamless interaction between Bitcoin and traditional banking systems is reshaping the financial sector, presenting opportunities for both customers and institutions to adapt to the evolving digital economy.

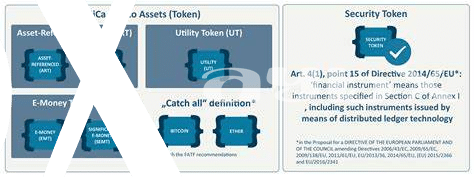

📈 Regulatory Compliance in the Digital Era

Navigating the ever-evolving landscape of the digital era, Liechtenstein’s banking sector is embracing regulatory compliance with new vigor. Embracing technology while upholding stringent regulations is crucial in ensuring a secure and transparent financial environment. By adapting to digital advancements, stakeholders can foster trust, enhance transparency, and stay ahead of compliance requirements in the dynamic realm of Bitcoin banking.

🌐 Global Impact of Liechtenstein’s Approach

Liechtenstein’s progressive approach to Bitcoin integration is making waves globally, reshaping the traditional banking landscape. Embracing this innovative technology opens up possibilities beyond borders, creating a ripple effect in the financial sector. Companies and individuals worldwide are taking notice of Liechtenstein’s forward-thinking stance on digital currencies, setting a precedent for other nations to follow suit. This shift not only influences local economies but also sparks conversations on a broader scale about the future of banking and compliance in the digital era. For more insights on securing your assets and navigating regulations in the evolving Bitcoin banking sphere, check out this resource on bitcoin banking services regulations in Lesotho.

💼 Business Opportunities in the New Landscape

Liechtenstein’s embrace of Bitcoin banking has paved the way for a wave of new business opportunities. Entrepreneurs are exploring innovative ways to connect traditional financial services with cryptocurrency, creating a dynamic landscape for growth and investment. The shift towards digital assets opens doors for startups and established firms alike, promising a future where financial innovation and technological advancement go hand in hand.

🔒 Ensuring Security and Trust in Bitcoin Banking

In the evolving landscape of Bitcoin banking, the cornerstone of success lies in establishing robust security measures and fostering trust among users. Utilizing advanced encryption technologies and stringent authentication protocols, financial institutions in Liechtenstein are prioritizing the protection of digital assets and sensitive information. By implementing multi-layered security frameworks and conducting regular audits, they aim to instill confidence in clients and ensure the integrity of transactions.

Amidst the growing interest in digital currencies, regulatory compliance plays a pivotal role in safeguarding the integrity of Bitcoin banking services. Countries like Laos have laid down comprehensive guidelines to govern the operations of such financial entities, ensuring transparency and accountability. To learn more about the regulations surrounding Bitcoin banking services in Lebanon, visit the official guidelines provided by the authorities.