Understanding Inflation: Why It Eats Your Savings 📉

Imagine every dollar in your pocket is a slice of pie. Now, imagine that pie slowly getting smaller each day, not because you’re eating it, but because someone keeps shaving off tiny slivers when you’re not looking. That’s what inflation does to your money; it gradually reduces its value, leaving you with less pie over time, even if the number of slices stays the same. Inflation is like an invisible tax on your savings, steadily eating away at the purchasing power of your money. This means, what you can buy with, say, $100 today, might cost you $105 or more next year. It’s a silent but relentless drain on your savings and a challenge for anyone trying to preserve their wealth. To give a clearer picture, here is how inflation has impacted the buying power of $100 over the years:

| Year | Value of $100 in Today’s Dollars |

|---|---|

| 1990 | $196.30 |

| 2000 | $151.70 |

| 2010 | $122.40 |

| 2020 | $100 |

The table shows just how much “pie” has been lost over time. This stealthy slice thief pushes many to seek protective investments, like digital darlings or timeless treasures, that can weather the storm, keeping our future slices safe and sound.

Bitcoin: the Digital Gold Against Inflation? 💻

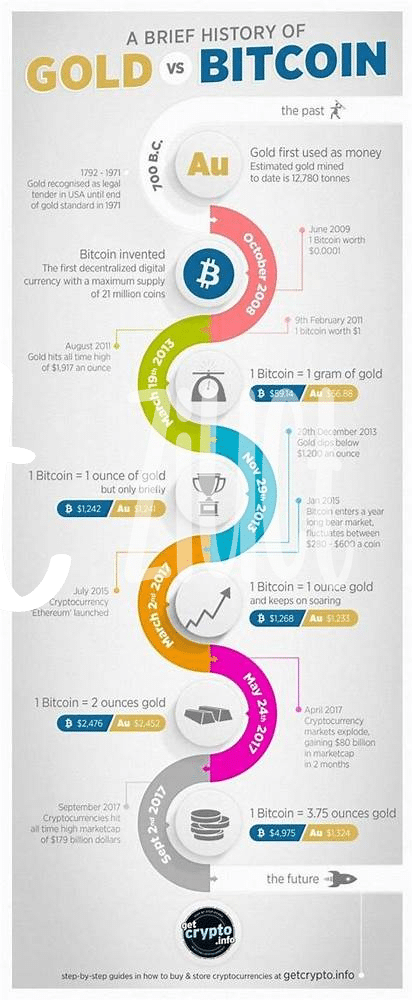

Imagine your piggy bank slowly getting lighter without you taking anything out. That’s what inflation can do to your savings; it decreases their value over time. Enter Bitcoin – often hailed as ‘digital gold.’ Just as adventurers once sailed across oceans for gold, today’s tech-savvy explorers mine Bitcoin on the internet. Its value has seen dramatic climbs and falls, sparking debates around its effectiveness as an inflation shield. Unlike traditional money, which governments can print more of, causing inflation, Bitcoin has a cap. There will only ever be 21 million bitcoins. This scarcity is similar to gold’s, which has historically made both valuable during times of inflation. However, understanding Bitcoin’s environmental footprint is essential. For a deeper dive into its impacts, consider exploring https://wikicrypto.news/the-role-of-large-investors-in-bitcoin-price-changes. As we navigate through these digital waves, it’s crucial to weigh the promise against the pitfalls, considering both the shiny allure of Bitcoin and the shadows it casts.

Gold: the Timeless Protector of Wealth 💰

When we think about protecting our money, many of us picture a heavy, shining bar of gold. It’s not just a pretty metal; gold has been a symbol of wealth and security for thousands of years. Unlike paper money that can lose value when prices go up (that’s what we call inflation), gold has stood its ground. It’s like a financial lifeboat, always ready to help when the economic seas get choppy. People all around the world look at gold as a way to pass on and preserve their wealth from one generation to the next.

Now, you might wonder, how does it actually protect your savings? Imagine you have a treasure chest. Instead of filling it with dollars that might buy less tomorrow than they do today, you fill it with gold. Over time, even if the cost of bread and milk goes up, the gold in your chest could be exchanged for about the same amount of groceries, or maybe even more, as it often increases in value when other investments are sinking. It’s no magic trick; it’s just how gold has worked as a steadfast keeper of value, making it a favorite for those wanting to safeguard their wealth against the rollercoaster ride of the economy. 🏦✨

Comparing Apple to Oranges: Bitcoin Vs. Gold 🍏🍊

Talking about Bitcoin and Gold as ways to keep your money safe is a bit like comparing apples and oranges. They’re both fruit, sure, but they taste entirely different. Bitcoin, a kind of digital money, is pretty new on the scene and dances to the beat of its own drum. It’s like that flashy, new tech gadget everyone’s talking about – innovative and full of potential. On the other side, Gold is like that classic vinyl record player – it’s been around for ages and has withstood the test of time, offering a sense of stability and reliability that’s hard to beat. When deciding if you’re more of a Bitcoin enthusiast or a Gold traditionalist, it’s essential to weigh their differences. Bitcoin’s value can jump up and down like a yo-yo, which might worry some. But for others, its cutting-edge appeal and the chance to ride the wave of the digital future is too good to pass up. Then there’s Gold, steady and shining, always there like a trusted friend. It might not give you the thrill of a rollercoaster ride, but it promises a smoother journey. For those curious about navigating the digital currency’s ups and downs, what are the risks of bitcoin and the blockchain provides insights that are worth exploring.

Risks and Rewards: Navigating Volatile Waters ⛵

When you decide to sail into the world of investing, especially with options like Bitcoin and Gold, think of it as setting out on a vast ocean. Each has its perks. For instance, Bitcoin is like a speedy motorboat. It’s modern, fast, and can get you where you want to go quickly, but it can also be a bit risky when the weather turns bad (think big price changes). On the other hand, Gold is like a sturdy sailboat. It might not move as fast, but it has proven reliable over many storms (or economic downturns).

| Investment | Rewards | Risks |

|---|---|---|

| Bitcoin | High potential returns, modern appeal | Price volatility, regulatory changes |

| Gold | Stability over time, hedge against inflation | Lower potential returns, storage costs |

Despite their differences, both have valuable roles in your portfolio. Diversifying with both may not only help protect your wealth from inflation but also offer a balanced approach to weathering economic uncertainties. It’s all about knowing how to navigate these volatile waters—taking advantage of each investment’s strengths while being mindful of the risks.

Practical Steps to Diversify with Bitcoin and Gold 🛠️

Dipping your toes into the world of investment to shield your wealth from inflation can seem like navigating through a thick fog at dawn. Yet, with a bit of guidance, the path becomes clear. Imagine your portfolio as a garden, where diversity—planting different types of flowers and vegetables—ensures blooms in every season, safeguarding against pests or bad weather. Similarly, sprinkling your investments between Bitcoin 📉 and gold 💰 provides a safety net against economic tremors. To start, educate yourself on the market dynamics; understanding when was Bitcoin created versus Ethereum is a good foundation. Next, allocate a small portion of your savings to both, adjusting as you become more comfortable and aware of their performances over time. Remember, consultation with a financial advisor can provide personalized advice tailored to your situation, ensuring your investment garden is not only diverse but flourishing.