What’s Inflation, Anyway? 🤷

Imagine you’re at your favorite store, eyeing a chocolate bar that used to cost $1 last year but now it’s $1.50. That jump in price? That’s inflation at work. Inflation is like a shadow creeping over our money, making it worth a bit less over time. It’s why things seem pricier even though they’re the same old stuff we love. By reducing the purchasing power of our currency, it means we have to spend more to get the same goods and services we did before.

| Year | Price of Chocolate Bar | Rate of Inflation (%) |

|---|---|---|

| 2022 | $1.00 | 0% |

| 2023 | $1.50 | 50% |

This sneaky effect doesn’t happen in a vacuum. It’s influenced by various factors, including how much money is floating around in the economy and how pricey the ingredients to make stuff are. So, when you hear that inflation is ticking up, it means your dollar is starting to stretch a bit thinner, buying less chocolate—or anything else—than before. 🛒💸

Why Prices Keep Going up 🚀

Imagine going to the store and noticing that the price of your favorite chocolate bar has gone up. Then, next month, it’s even higher. This isn’t just happening to chocolate – it’s happening to almost everything, from groceries to gasoline. The reason behind these rising prices is what economists call inflation. In simple terms, inflation is when money buys less than it used to. Several factors can cause this, like when there’s more demand for goods than the supply can meet, or when costs for making and moving goods go up.

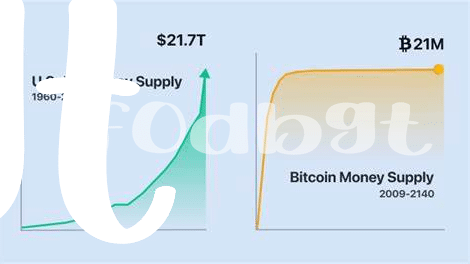

On the deeper end, inflation is like a slow tide that creeps up on us. Governments around the world print money for various reasons, such as to pay off debt or to stimulate the economy during tough times. However, when too much money chases too few goods, prices surge. It’s a complex dance between supply, demand, and the value of currency. Understanding this helps us grasp why our purchasing power changes over time, making things feel more expensive even if our own basket of goods hasn’t changed. For those intrigued about safeguarding their financial future against such uncertainties, diving into how to protect your investments, like Bitcoin, can offer some insights. To understand more about Bitcoin safety, consider https://wikicrypto.news/protecting-your-bitcoin-wallet-from-cyber-thieves for a deep dive into securing your digital gold.

Enter Bitcoin: Digital Gold? 💰

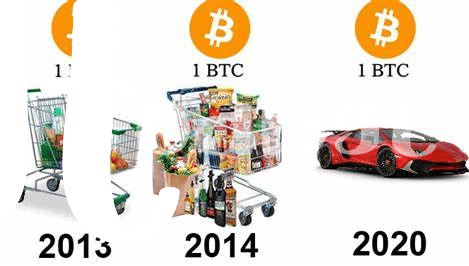

So, you’ve probably heard about Bitcoin, right? It’s like that cool, digital version of money that’s been making waves across the globe. People often call it ‘digital gold,’ and here’s why: Just like gold, there’s only a certain amount of Bitcoin available, which makes it quite special. Imagine having a rare coin that not many people can own; that’s how Bitcoin operates. It runs on this fancy technology called blockchain, which ensures that everything is above board and secure. This unique blend of rarity and security is what gets people excited, comparing it to gold, which has been a valuable asset for centuries.

Now, let’s dive a little deeper 🤿. Unlike the money in your bank, which can lose value when prices go up (hello, inflation!), Bitcoin operates on its own terms. Since it’s not controlled by any single government or institution, it dances to its own beat. This independence is a big deal because it means Bitcoin could potentially be a safe spot during stormy economic times. Just imagine having a lifeboat in the middle of a financial tempest 🌊. That’s the kind of safety net people are looking for, and it’s why the idea of Bitcoin being a ‘digital gold’ is catching on like wildfire.

Bitcoin Vs. Inflation: Can It Hold Up? 🛡️

When we think about money and its value, the creeping menace of inflation is like a shadow, always looming. Picture this: you’ve worked hard to save, but each year, that ‘savings mountain’ buys you less and less. That’s inflation at work – the silent savings eater. Now, let’s talk about the hero in our story, or so it seems to some, Bitcoin. This digital maverick has been dubbed by enthusiasts as the modern-day gold, a sort of digital safe haven against the financial storm clouds. But how sturdy is this shelter? Imagine Bitcoin as a sturdy ship navigating the choppy waters of financial uncertainties. Its value swings wildly at times, making some critics question its reliability as a shield against inflation. Yet, proponents argue that, over time, it has shown resilience, bouncing back with vigor, and outpacing inflation’s bite. For an accessible dive into how Bitcoin is reshaping our approach to money, don’t miss bitcoin in literature and film for beginners. Like any good story, the debate is filled with twists and turns, but one thing’s for certain: In the ever-evolving narrative of money, Bitcoin is playing a lead role, promising a plot thick with potential and pitfalls alike. 📈💼🔍

Risks of Using Bitcoin as a Safe Haven 🌪️

When thinking about tucking your money into Bitcoin as a safety net against the rollercoaster of everyday prices, it’s a bit like deciding to carry an umbrella in what might suddenly turn into a hurricane. Firstly, the value of Bitcoin dances to its own tune 🎵, swinging up and down like a yo-yo. This means one day you could be basking in the glow of a great decision, and the next, you might find your savings have slipped down a surprising slide. Next, consider the digital landscape 🌐 itself – it’s a bit like the wild west. Hackers, ever a crafty bunch, are always on the prowl, looking for a digital treasure chest to plunder. So, if your digital wallet becomes their next target, your safety net might suddenly vanish. Understandably, regulations are also as steady as quicksand. Depending on where you live, new rules could pop up, impacting how you can use or even access your Bitcoin.

| Risk Factor | Implications |

|---|---|

| Volatility | Unexpected high swings in value can result in sudden financial loss. |

| Security Concerns | Vulnerability to hacking can lead to loss of investment. |

| Regulatory Changes | New laws may affect Bitcoin’s usability and accessibility. |

Before making the leap, it’s wise to weigh these factors, ensuring you’re prepared for what might feel like setting sail in uncharted waters.

Making Sense of It All: Should You Dive In? 🏊

Diving into the digital currency pool might seem like a refreshing idea, especially when the sun of inflation is blazing hot. We’ve talked about how inflation is like a slowly rising tide, making everything more expensive, and how Bitcoin beckons from the shores as a possible shelter. But is it the right kind of shade for everyone? Well, it’s a bit like deciding to swim in the open sea. It can be exhilarating and freeing, but it also comes with its share of waves and undercurrents. 🌊💡

Before jumping in, it’s crucial to learn how to navigate these waters. Bitcoin, with its promise of decentralization and global inclusion, offers a new way of looking at money. It’s not just about the potential profits; it’s about understanding a system that could change how we interact with finances. For those curious about how this intersects with broader societal issues, diving into resources like bitcoin and cybercrime for beginners and bitcoin and financial inclusion for beginners can provide deeper insights. Remember, every investment carries risks, and Bitcoin is no exception. So, take a moment, do your homework, and decide if you’re ready to dip your toes into these digital waters. 📚🏄♂️