Cryptocurrency Investments 📊

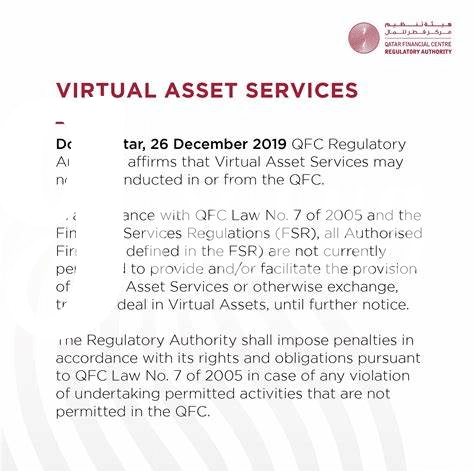

Cryptocurrency investments have garnered increasing attention worldwide, offering individuals the opportunity to venture into the digital asset realm. The allure of potential financial gains, technological innovation, and decentralization has captivated many investors. In Qatar, the landscape for cryptocurrency investments is evolving, presenting both opportunities and considerations for investors. Understanding the dynamic nature of the cryptocurrency market and how it aligns with traditional financial frameworks is essential for navigating this new asset class. As investors explore this realm, staying informed about regulatory developments and market trends is crucial for making well-informed investment decisions.

Tax Regulations in Qatar 📝

Qatar’s tax regulations have a significant impact on Bitcoin investors. Understanding the tax laws in Qatar is essential for anyone involved in cryptocurrency investments. It is crucial to stay informed and compliant with the tax obligations to avoid any potential issues. Seeking professional advice can help navigate the complexity of tax implications and reporting requirements. Being aware of the tax regulations and staying updated on any changes is key to managing your Bitcoin investments effectively. Additionally, having record-keeping strategies in place can simplify the taxation process and ensure compliance with Qatar’s tax laws. With the proper knowledge and guidance, Bitcoin investors in Qatar can navigate the tax landscape with confidence.

Reporting Requirements 📋

Cryptocurrency investments can lead to various reporting requirements for Qatar-based investors. When it comes to tax obligations, keeping accurate records of your transactions and investments is essential. This includes documenting the purchase price, sale price, dates of transactions, and any related expenses. Failure to comply with reporting requirements can result in penalties or audits by tax authorities. Being diligent in maintaining detailed records will not only help you fulfill your tax obligations but also provide clarity and transparency in your cryptocurrency activities. Stay organized and proactive in meeting these reporting requirements to ensure smooth compliance with Qatar’s tax regulations.

Potential Tax Implications 💸

When considering your investments in cryptocurrency, it is imperative to be aware of the potential tax implications that may arise. Understanding how your profits and losses from Bitcoin trading could impact your tax obligations is crucial for financial planning and compliance. To navigate this complex landscape, seeking guidance from tax experts or financial advisors can provide invaluable insights to optimize your tax situation. By staying informed about the tax implications of cryptocurrency investments, you can make informed decisions and ensure that you are meeting your tax responsibilities. To delve deeper into this topic, you may refer to the informative article on tax implications of bitcoin trading in Poland available at WikiCrypto News.

Seek Professional Advice 🕵️♂️

Seeking professional advice is crucial when navigating the complexities of tax obligations for cryptocurrency investments. A knowledgeable tax consultant can provide tailored guidance to ensure compliance with Qatar’s tax regulations and reporting requirements. They can also help outline the potential tax implications of your Bitcoin investments. By enlisting the expertise of a professional, you can make informed decisions and strategize effectively to manage your tax obligations efficiently.

Stay Informed and Compliant 📚

When it comes to navigating the complex world of income tax obligations for Bitcoin investors in Qatar, it’s crucial to stay informed and compliant at all times. By regularly keeping up-to-date with the latest regulations and guidelines surrounding cryptocurrency investments, you can ensure that your tax reporting is accurate and in line with the law. Additionally, remaining compliant not only mitigates potential risks of penalties or audits but also fosters a sense of financial responsibility and transparency in your investment endeavors.

For more information on the tax implications of Bitcoin trading in Rwanda, click here: Tax Implications of Bitcoin Trading in Romania. Stay vigilant, educated, and proactive in your tax obligations to navigate the evolving landscape of Bitcoin investments successfully.