Regulatory Challenges 🚫

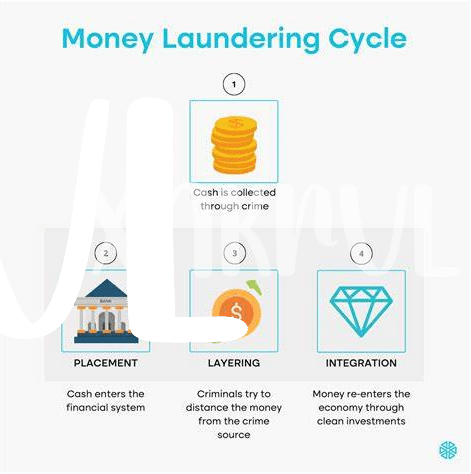

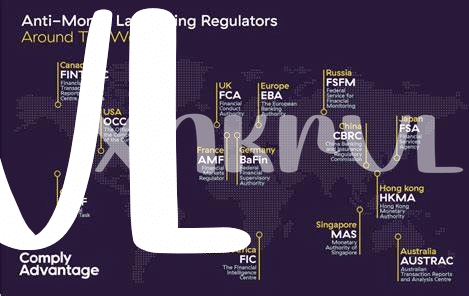

Navigating the landscape of AML laws presents a formidable challenge for Bitcoin adoption in Kyrgyzstan. The stringent regulations impose compliance burdens on businesses, hindering the ease of integrating cryptocurrency into the financial ecosystem. This creates an environment of uncertainty and complexity, deterring potential investors and businesses from fully embracing the benefits of Bitcoin. Overcoming these regulatory hurdles is essential for fostering a conducive environment that promotes innovation and growth in the cryptocurrency sector.

Public Perception and Education 🧐

When it comes to the realm of Bitcoin adoption in Kyrgyzstan, one cannot overlook the critical interplay between public perception and education. 🧐 Within the country, there exists a wide spectrum of views regarding cryptocurrencies, with some seeing them as novel and revolutionary, while others remain cautious due to perceived risks. Bridging this gap requires a concerted effort towards raising awareness and providing clear, accessible information to the general populace. By empowering individuals with knowledge about the benefits and potential pitfalls of Bitcoin, the path towards wider adoption can be significantly smoothed. Furthermore, fostering a culture of understanding and confidence in digital currencies can serve as a catalyst for broader financial literacy and technological empowerment within the society.

Technological Infrastructure Limitations ⚙️

In Kyrgyzstan, the advancement of Bitcoin adoption faces an uphill battle due to technological infrastructure limitations. The country’s existing systems may not fully support the integration and utilization of cryptocurrencies. This poses a significant challenge as seamless technology is crucial for the widespread acceptance and functionality of Bitcoin within the region.

Addressing these technological infrastructure limitations is vital for the successful integration of Bitcoin into the Kyrgyzstani market. Without the necessary upgrades and innovations, the adoption process may be hindered, affecting both individuals and businesses looking to incorporate Bitcoin into their financial transactions. Efforts to enhance the technological foundation can pave the way for a more robust and sustainable Bitcoin ecosystem in Kyrgyzstan.

Market Volatility and Investor Risks 💰

Market volatility in the realm of Bitcoin can be likened to a rollercoaster ride, with prices experiencing significant fluctuations within short timeframes. This unpredictability poses inherent risks for investors, as values can skyrocket one day and plummet the next, making it crucial for market participants to exercise caution and conduct thorough research before diving in. Additionally, the decentralized nature of cryptocurrencies means that they are not backed by any centralized authority, further amplifying the potential uncertainties and vulnerabilities that investors may face in the fluctuating cryptocurrency landscape. Understanding these dynamics is essential for anyone looking to navigate the complexities of the digital asset market.

For more insights on navigating the legal landscape of Bitcoin in the context of anti-money laundering regulations, particularly in Kuwait, check out the detailed guide on bitcoin anti-money laundering (AML) compliance for investors provided at bitcoin anti-money laundering (AML) regulations in Kuwait.

Opportunities for Financial Inclusion 💳

– Opportunities for Financial Inclusion 💳

Enhancing financial inclusion through Bitcoin presents a gateway to individuals with limited access to traditional banking services. By leveraging blockchain technology, marginalized communities in Kyrgyzstan can secure their financial transactions transparently and affordably. This opens avenues for unbanked populations to participate in the global economy, fostering economic empowerment and reducing the disparity in financial services accessibility.

The integration of Bitcoin into the financial ecosystem of Kyrgyzstan not only facilitates secure and cost-effective transactions but also promotes greater financial literacy among the population. Empowering individuals with digital financial tools contributes to a more inclusive and robust economy, paving the way for sustainable growth and development in the region.

Future Prospects and Potential Growth 🌱

The future of Bitcoin adoption in Kyrgyzstan holds promising potential for growth, driven by evolving regulatory frameworks, increasing public awareness, and advancing technological capabilities. As the country navigates through regulatory challenges and embraces AML laws, Bitcoin’s acceptance and integration into mainstream financial systems are poised to expand. Market volatility and investor risks remain critical considerations, yet they present opportunities for learning and refinement in Kyrgyzstan’s cryptocurrency landscape. With a focus on financial inclusion and the accessibility of digital assets, the nation can cultivate a thriving ecosystem that empowers diverse sectors of society.

For further insights on global AML regulations concerning Bitcoin, explore the intricate dynamics of Bitcoin anti-money laundering (AML) regulations in Japan and Kenya.