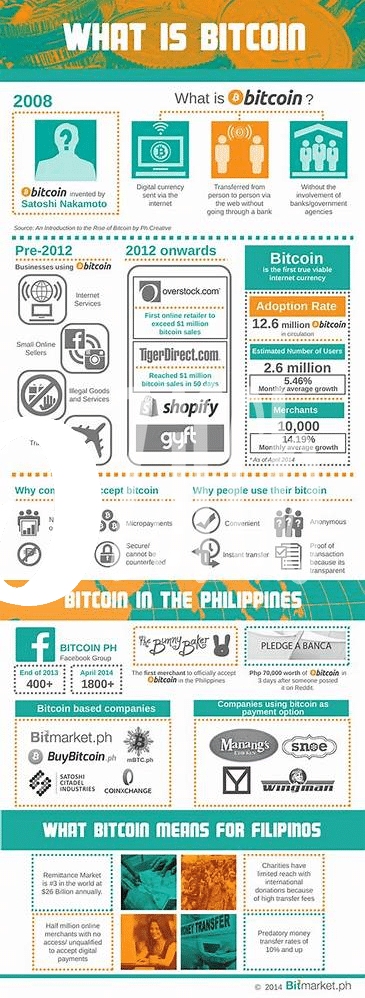

Sec Regulations Overview 📜

– The Securities and Exchange Commission (SEC) plays a crucial role in overseeing financial markets, including the regulation of cryptocurrency trading. Its regulations aim to protect investors, ensure market integrity, and promote transparency. By setting guidelines and rules for trading activities, the SEC strives to prevent fraud and misconduct within the industry, thus creating a more secure environment for investors and market participants. Understanding the SEC regulations is essential for anyone involved in Bitcoin trading to comply with legal requirements and navigate the evolving landscape of digital asset investments.

– In the world of cryptocurrencies like Bitcoin, the impact of SEC regulations can influence market trends, investor behavior, and the overall future of trading. As the SEC continues to adapt its regulatory framework to accommodate the growing popularity of digital assets, staying informed about these changes becomes increasingly important for traders and investors alike. By monitoring the SEC’s actions and compliance requirements, market participants can better position themselves to seize opportunities for growth and navigate potential challenges in the evolving landscape of Bitcoin trading.

Impact on Bitcoin Market 📉

Sec Regulations play a pivotal role in shaping the landscape of Bitcoin trading, influencing market dynamics, investor behaviors, and regulatory frameworks. As the regulatory environment fluctuates, the price volatility of Bitcoin often reflects these changes, impacting its market value and trading trends. Investor sentiment towards Bitcoin can shift based on regulatory developments, leading to fluctuations in trading volumes and market participation. Regulatory compliance presents challenges for both traders and platforms, requiring adherence to evolving standards to ensure operational continuity. Despite these obstacles, the future of Bitcoin trading holds promise, with opportunities for growth and innovation amidst a changing regulatory landscape.

Link to article: Regulatory Challenges for Bitcoin in PNG

Investor Sentiment Changes 🧐

Investors in the cryptocurrency space have witnessed a shift in sentiment as a result of recent SEC regulations. The uncertain regulatory landscape has left many feeling cautious and wary about the future of Bitcoin trading. This change in sentiment has prompted investors to closely monitor developments in the regulatory space, influencing their decision-making processes and investment strategies moving forward.

Regulatory Compliance Challenges 💼

In the realm of Bitcoin trading, navigating regulatory compliance can pose significant challenges for market participants. The ever-evolving landscape of regulations requires constant vigilance, potentially impacting trading strategies and operations. Ensuring adherence to compliance standards not only demands time and resources but also risks regulatory repercussions if not diligently followed. This aspect introduces a layer of complexity in the trading environment that traders and platforms need to address proactively. For a detailed examination of the legal implications of Bitcoin transactions in Paraguay, visit legal consequences of bitcoin transactions in Paraguay.

Future of Bitcoin Trading ⏳

The evolving landscape of Bitcoin trading is poised for significant transformations in response to SEC regulations. This shift invites renewed considerations of market dynamics and potential avenues for growth. As the regulatory framework continues to take shape, the future of Bitcoin trading holds a blend of challenges and opportunities, offering a space for innovation and adaptation in the digital asset realm. The regulatory landscape will play a pivotal role in shaping how Bitcoin is traded, influencing market behaviors, and fostering a more robust ecosystem for investors looking to engage in cryptocurrency trading.

Opportunities for Growth 📈

The evolving landscape of Bitcoin trading presents a realm filled with various Opportunities for Growth 📈. As regulations become clearer and market participants adapt, new avenues for innovation and expansion emerge. This shift towards compliance and oversight can enhance investor trust and attract more institutional involvement, ultimately leading to a more robust and sustainable trading environment. Additionally, as the market matures, new products and services tailored to institutional needs may arise, further stimulating growth and diversification. Amid these developments, staying informed and agile will be key for participants to capitalize on the evolving opportunities in the dynamic Bitcoin trading space. To understand more about the legal consequences of bitcoin transactions in Panama, check out insights on legal consequences of bitcoin transactions in Papua New Guinea.