💡 Overview of Bitcoin Investments in Luxembourg

In the bustling world of Bitcoin investments in Luxembourg, a growing interest has been observed among investors seeking to tap into the potential of this digital currency. With the global rise in crypto adoption, Luxembourg has positioned itself as a key player in embracing blockchain technology and digital assets. Investors are drawn to the stability and forward-thinking regulatory environment that the country offers, making it an attractive hub for Bitcoin investments. The market dynamics in Luxembourg reflect a mix of traditional finance practices and innovative approaches, generating a unique landscape for those venturing into the realm of digital currencies. This strategic convergence has set the stage for a dynamic evolution in the investment landscape, shaping the future of Bitcoin ventures in the grand duchy.

| Category | Description |

|---|---|

| Investment Landscape | Diverse mix of traditional finance practices and innovative approaches |

| Regulatory Environment | Stable and forward-thinking framework for digital assets |

| Market Dynamics | Reflects the global rise in crypto adoption |

💼 Impact of Regulatory Clarity on Investments

The transparent regulatory framework plays a pivotal role in shaping the investment landscape in Luxembourg. With clear guidelines and rules in place, investors gain confidence and a sense of security when considering Bitcoin as an investment avenue. Regulatory clarity not only fosters a conducive environment for investment growth but also attracts institutional investors who prioritize compliance and legal certainty. This shift towards a more regulated space can enhance the credibility of Bitcoin investments in the eyes of skeptics and traditional finance players, potentially leading to increased capital inflows and broader adoption within the Luxembourg market.

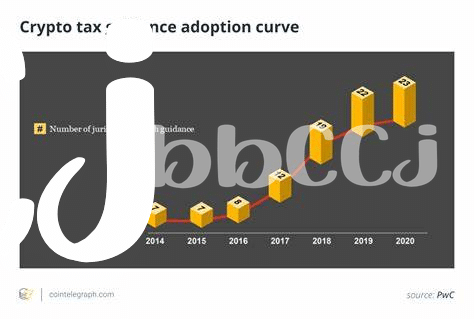

📈 Trends in Bitcoin Market Post-regulatory Decisions

Following regulatory decisions, the Bitcoin market in Luxembourg witnessed a significant shift in trends. Investors eagerly awaited the outcome, and the subsequent clarity provided a boost in confidence. This newfound stability led to increased participation from both retail and institutional players, resulting in a surge in trading volumes. The market also saw a diversification in investment strategies, with a growing interest in long-term holdings and innovative financial products. Overall, the post-regulatory period marked a period of adaptability and growth for Bitcoin investments in Luxembourg, setting the stage for sustained momentum in the evolving landscape of digital assets.

💰 Investment Opportunities and Risks

The cryptocurrency landscape in Luxembourg offers a range of investment opportunities and risks for individuals and businesses looking to capitalize on the growing popularity of Bitcoin. With the increasing regulatory clarity in the country, investors can now navigate the market with more confidence, knowing that their investments are backed by a clearer legal framework. However, it is essential for investors to stay informed about the potential risks associated with Bitcoin investments, such as market volatility and regulatory changes. By understanding these risks and opportunities, stakeholders in Luxembourg’s Bitcoin market can make more informed decisions to optimize their investment strategies and mitigate potential losses. For further insights on regulatory guidance on Bitcoin investments, check out this article on regulatory guidance on Bitcoin investments in Latvia.

🌍 Luxembourg’s Position in Global Crypto Market

Luxembourg’s position in the global crypto market is a fascinating blend of innovation and regulatory clarity. As one of the leading financial hubs in Europe, the country has taken a proactive approach to embracing blockchain technology and cryptocurrencies. This has not only attracted a growing number of crypto companies to establish their presence in Luxembourg but has also positioned the country as a key player in shaping the future of the global crypto market.

Below is a table showcasing the key strengths and potential areas of growth for Luxembourg in the global crypto market:

| Strengths | Potential Growth Areas |

|————————-|————————|

| Proactive Regulatory Environment | Increased Investment Opportunities |

| Strong Financial Infrastructure | Crypto Innovation and Research |

| Strategic Geographical Location | Collaboration with Global Players |

Luxembourg’s strategic location, combined with its supportive regulatory framework, places it in a prime position to continue gaining prominence in the global crypto market.

🤔 Future Outlook for Bitcoin Investments in Luxembourg

The future outlook for Bitcoin investments in Luxembourg appears promising, with regulatory clarity paving the way for increased investor confidence and participation in the market. As the landscape continues to evolve, opportunities for growth and diversification are expected to emerge, attracting both local and international interest. Luxembourg’s proactive approach to digital assets positions it as a key player in the global crypto market, further solidifying its reputation as a forward-thinking financial hub. With ongoing advancements in regulatory frameworks and technological innovation, the future holds exciting possibilities for Bitcoin investments in Luxembourg. [regulatory guidance on bitcoin investments in Lesotho](#)