Rise of Bitcoin 💰

The digital currency known as Bitcoin has been making waves globally with its decentralized and borderless nature. It has disrupted traditional financial systems by offering a new way for individuals to transact securely and efficiently. As its popularity grows, more people are venturing into the world of cryptocurrencies, drawn by the potential for financial independence and innovation that Bitcoin brings. Its rise signifies a shift towards a more digital and interconnected financial landscape, challenging the status quo and prompting discussions on the future of money.

Financial Inclusion Opportunities 🌐

In a world increasingly dominated by digital technologies, embracing the concept of financial inclusion presents a crucial opportunity for Guyana. By leveraging the power of Bitcoin and blockchain technology, the country can uplift marginalized communities, provide access to banking services for the unbanked population, and promote economic empowerment. The borderless nature of cryptocurrencies can pave the way for seamless transactions, reducing the reliance on traditional banking systems and fostering a more inclusive financial ecosystem.

Moreover, the decentralized nature of Bitcoin eliminates the need for intermediaries, lowering transaction costs and enhancing accessibility for individuals who are often excluded from the formal financial sector. This democratization of financial services has the potential to revolutionize how individuals engage with money, enabling them to participate more actively in the economy and improve their overall financial well-being. By capitalizing on these Financial Inclusion Opportunities 🌐, Guyana can drive sustainable development and foster greater economic equality within its borders.

Regulatory Challenges and Concerns 🚫

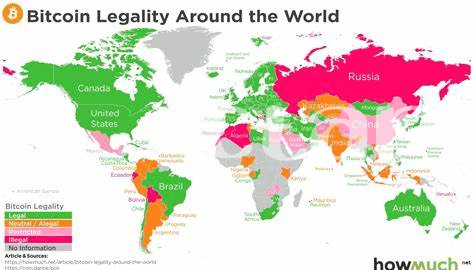

Bitcoin’s rapid growth in Guyana’s financial landscape has brought about a wave of regulatory challenges and concerns. Authorities are grappling with how to monitor and regulate this decentralized digital currency effectively. The lack of a centralized authority overseeing Bitcoin raises questions about consumer protection, money laundering, and tax evasion, leading to growing concerns among policymakers about the potential risks associated with its use. The evolving nature of cryptocurrency technologies further complicates the regulatory landscape, requiring agile and forward-thinking approaches to address these challenges.

Investment Potential and Risks 💸

Bitcoin presents an array of possibilities for investors in Guyana, offering a unique avenue for potential returns and diversification. The decentralized nature of Bitcoin means that traditional investment models may not apply, introducing both opportunities and risks for those looking to capitalize on its growth. As individuals weigh the potential rewards against the volatility of the cryptocurrency market, thorough research and strategic decision-making become pivotal in navigating the complexities of investing in Bitcoin. Understanding the market dynamics, regulatory landscape, and technological advancements can empower investors to make informed choices that align with their risk tolerance and financial goals.

For a deeper dive into the legal aspects of Bitcoin in different countries, including Gabon, you can explore the legality of buying, selling, and using Bitcoin in Germany on Wikicrypto.news. This resource sheds light on the current status of Bitcoin regulations and can serve as a valuable reference point for individuals seeking clarity on the legal framework surrounding cryptocurrencies in various jurisdictions.

Changing Consumer Behavior Patterns 🔄

With the increasing acceptance of Bitcoin as a digital currency, consumers in Guyana are gradually shifting their behavior towards embracing this new financial landscape. This change is evident in how people are becoming more open to conducting transactions, making investments, and managing their finances through cryptocurrency platforms. The convenience, security, and potential for growth that Bitcoin offers have led to a noticeable shift in the way consumers perceive and interact with traditional financial institutions. As more individuals and businesses in Guyana adopt Bitcoin as a means of financial exchange, the consumer behavior patterns are evolving to align with the opportunities presented by this digital currency revolution.

Future Outlook and Adaptation Strategies 🚀

In adapting to the evolving landscape shaped by Bitcoin, businesses in Guyana must proactively embrace digital currencies and blockchain technology. This proactive stance entails integrating secure payment platforms that facilitate Bitcoin transactions, promoting financial literacy on cryptocurrencies, and collaborating with regulatory authorities to establish clear guidelines for the use of digital assets. Implementing robust cybersecurity measures and fostering partnerships with fintech companies will be vital in enhancing the country’s competitiveness and resilience in the digital economy. By embracing innovation and adopting agile strategies, Guyana can position itself as a forward-thinking player in the global financial arena.

is bitcoin legal in germany?