Introduction to Aml Regulations 🌍

Introduction to AML Regulations 🌍

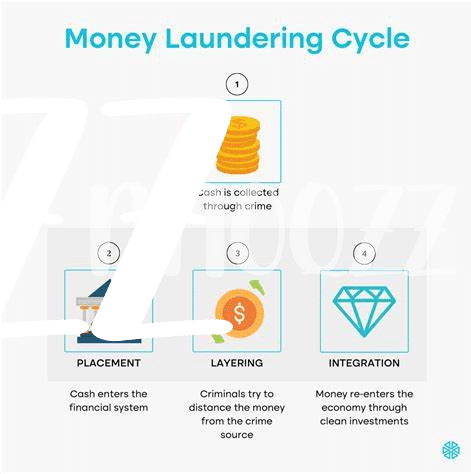

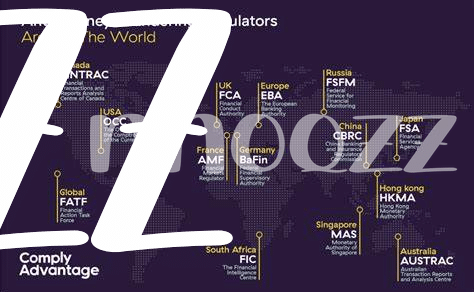

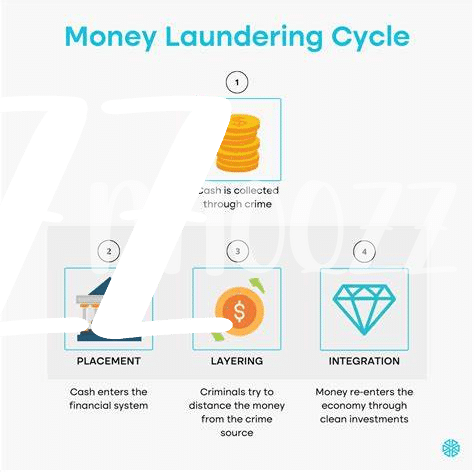

In today’s global financial landscape, Anti-Money Laundering (AML) regulations play a crucial role in combating illicit activities and ensuring financial transparency. These regulations set out guidelines and procedures that financial institutions, including Bitcoin exchanges, must adhere to in order to prevent money laundering and terrorist financing.

AML regulations are designed to monitor and track financial transactions, identify suspicious activities, and report them to the relevant authorities. By enforcing AML regulations, countries aim to maintain the integrity of their financial systems and protect them from being used as a means for illegal activities. As the digital economy continues to evolve, understanding and complying with AML regulations becomes paramount for Bitcoin exchanges operating in Saudi Arabia.

Impact on Bitcoin Exchanges 💱

The regulations in Saudi Arabia have significantly impacted the operations of Bitcoin exchanges in the country. These regulations have introduced new requirements and compliance measures for exchanges, leading to changes in how they conduct their business and interact with their customers. The increased focus on Anti-Money Laundering (AML) initiatives has forced exchanges to implement stricter KYC (Know Your Customer) procedures and enhance their monitoring of transactions. This has not only affected the operational costs of exchanges but also influenced the overall user experience for customers. As exchanges navigate through the implications of these regulations, they are continually adapting their strategies to remain compliant while ensuring a seamless trading experience for their users.

Compliance Challenges Faced 📝

Facing compliance challenges in the realm of Bitcoin exchanges in Saudi Arabia can be a complex dance between regulatory requirements and the agility needed to adapt to evolving standards. One of the key hurdles encountered is the need for strict adherence to Anti-Money Laundering (AML) guidelines while navigating the decentralized nature of cryptocurrencies. Ensuring robust KYC (Know Your Customer) protocols, transaction monitoring, and reporting mechanisms are in place can pose a significant operational challenge for exchanges striving to uphold compliance standards in this digital landscape.

Moreover, the dynamic nature of the crypto market adds an extra layer of complexity, with the need to stay abreast of changing regulations and best practices to mitigate risks effectively. Implementing effective compliance measures requires a fine balance between innovation and adherence to regulatory frameworks, presenting a continuous challenge for Bitcoin exchanges operating in Saudi Arabia. Staying proactive in addressing these challenges is crucial to fostering trust with stakeholders and ensuring the integrity of the financial system in the digital age.

Changes in Customer Behavior 🧑🏽💼

Changes in customer behavior have been notably observed in response to the AML regulations impacting Bitcoin exchanges in Saudi Arabia. Customers are displaying increased caution and adherence to compliance measures, leading to a noticeable shift towards transparency and verification processes. This change signifies a growing awareness among users regarding the importance of adhering to regulatory requirements and ensuring the legitimacy of their cryptocurrency transactions. To delve deeper into the compliance challenges faced by exchanges in this changing landscape, you can explore the impact of bitcoin anti-money laundering (AML) regulations in Sierra Leone on startups in the sector via the following link: bitcoin anti-money laundering (AML) regulations in Sierra Leone.

Regulatory Strategies for Exchanges 📊

When it comes to navigating the landscape of AML regulations in Saudi Arabia, Bitcoin exchanges must adopt proactive regulatory strategies to ensure compliance while sustaining business growth. Embracing technology for robust identity verification, transaction monitoring, and suspicious activity reporting is vital. Additionally, fostering partnerships with financial institutions and regulatory bodies can help exchanges stay ahead of evolving compliance requirements. Striking a balance between regulatory adherence and user experience will be key for exchanges aiming to thrive in the changing regulatory environment.

Future Outlook for Crypto Trading 🚀

The evolution of crypto trading is set to be positively influenced by various factors, including technological advancements, regulatory developments, and shifting investor preferences. As more countries establish clear frameworks for digital asset transactions, the industry is poised to attract a broader range of participants, bolstering market liquidity and overall stability. The continuous improvement in security measures and compliance standards will further enhance trust and confidence among traders, paving the way for sustained growth and innovation in the crypto market.

For more information on how Bitcoin exchanges are adapting to anti-money laundering regulations in different countries, you can explore the bitcoin anti-money laundering (aml) regulations in Singapore and the challenges faced in compliance with the bitcoin anti-money laundering (aml) regulations in South Africa.