Introduction to Aml Laws in the Bahamas 🌴

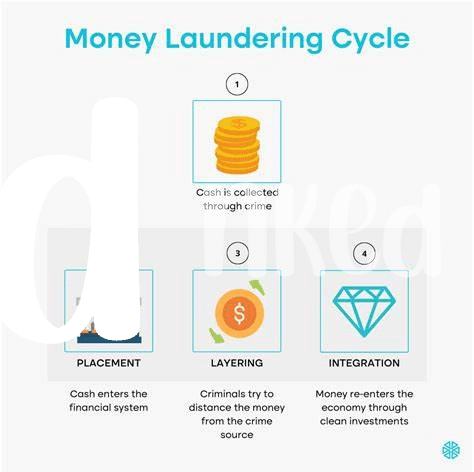

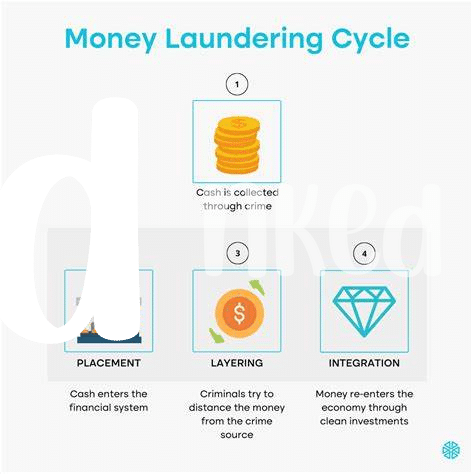

The Bahamas, known for its picturesque beaches and vibrant culture, has implemented Anti-Money Laundering (AML) laws to combat financial crimes. These laws require financial institutions and businesses to verify the identities of their customers, monitor transactions, and report any suspicious activities. In the Bahamas, AML regulations aim to uphold the integrity of the financial system, protect against money laundering and terrorist financing, and maintain the country’s reputation as a reputable financial hub. Understanding these laws is crucial for individuals and entities engaging in financial transactions within the jurisdiction.

Impact of Aml Laws on Bitcoin Transactions 💰

The implementation of AML laws in the Bahamas has significantly impacted Bitcoin transactions, leading to increased regulatory scrutiny and compliance requirements for users. This has resulted in a more transparent and accountable environment for cryptocurrency activities, as authorities aim to prevent unlawful financial activities such as money laundering through digital assets. The integration of AML regulations has also encouraged the adoption of blockchain analytics tools to monitor and trace the movement of funds, promoting greater accountability within the Bitcoin ecosystem. As a result, users are faced with the challenge of balancing privacy concerns with regulatory compliance, requiring them to adopt robust KYC and transaction monitoring practices to navigate the evolving landscape of AML laws in the Bahamas.

Challenges Faced by Bitcoin Users in Compliance 🕵️♂️

Bitcoin users in the Bahamas face a myriad of challenges when it comes to compliance with AML laws. One significant obstacle is the anonymity that Bitcoin offers, which can make it difficult to trace and verify transactions effectively. Additionally, the evolving nature of cryptocurrency regulations poses a challenge for users, as the landscape continues to shift and new requirements are introduced. Moreover, the lack of clarity on how AML laws specifically apply to Bitcoin transactions adds another layer of complexity for users seeking to remain compliant.

Navigating these challenges requires a deep understanding of AML regulations and proactive measures to ensure compliance. Bitcoin users must stay updated on the latest developments in AML laws and implement robust compliance strategies to mitigate risks. Engaging with regulatory authorities and seeking guidance from legal experts can also help users navigate the complex compliance landscape effectively. By staying informed and proactive, Bitcoin users can adapt to regulatory changes and continue to engage in transactions securely within the bounds of AML laws.

Strategies to Navigate Aml Regulations Effectively 🧭

Navigating Anti-Money Laundering (AML) regulations while engaging in Bitcoin transactions can be a complex endeavor for users. A key strategy involves staying informed about the evolving AML landscape and understanding the specific requirements set forth by regulatory authorities. Additionally, implementing strict due diligence procedures and utilizing reputable compliance tools can streamline the compliance process and enhance the overall security of transactions.

To further delve into effective strategies for navigating AML regulations in the Bahamas concerning Bitcoin transactions, check out this insightful article on bitcoin anti-money laundering (AML) regulations in Bahrain. This resource offers a deep dive into the intricacies of AML compliance within the cryptocurrency industry, providing valuable insights for individuals seeking to ensure regulatory adherence while maximizing the potential of their Bitcoin transactions.

Future Outlook for Bitcoin Transactions in the Bahamas 🔮

In the ever-evolving landscape of cryptocurrency, the future outlook for Bitcoin transactions in the Bahamas is poised for growth and adaptation. With the increasing importance of Anti-Money Laundering (AML) laws, the regulatory environment is expected to shape the way Bitcoin transactions are conducted in the region. As stakeholders continue to find innovative solutions to comply with AML regulations while fostering Bitcoin innovation, the future holds promise for a more secure and transparent ecosystem. Through collaboration and vigilance, the Bahamas can potentially position itself as a hub for compliant and thriving Bitcoin transactions, offering new opportunities for both users and regulators alike.

Conclusion: Balancing Aml Compliance and Bitcoin Innovation ✨

Strategies that harmonize Anti-Money Laundering (AML) compliance with the innovative potential of Bitcoin transactions are pivotal for the evolution of financial frameworks in the Bahamas. This delicate balance requires a nuanced approach that fosters transparency and legitimacy in cryptocurrency dealings while also nurturing the potential for financial inclusivity and technological advancement in the digital economy. Achieving this synergy demands collaborative efforts from regulatory bodies, financial institutions, and cryptocurrency users to ensure the integrity of transactions without stifling the transformative capabilities inherent in blockchain technologies.

In navigating the complex landscape of AML regulations and digital currencies, stakeholders must remain agile and proactive in adapting to evolving compliance standards while also fostering an environment that encourages innovation and growth in the emerging field of cryptocurrency transactions within the Bahamian financial ecosystem.