The Birth of Bitcoin: Transforming Money 🌍

Once upon a time, in 2008, a mysterious figure named Satoshi Nakamoto introduced the world to Bitcoin, a brand new type of money that lives on the internet. Unlike traditional money, which is made and controlled by governments, Bitcoin is digital and operates on a system that allows people to send or receive money directly to each other, no banks needed. This was a game-changer because, for the first time in history, there was a form of money that wasn’t tied to any country or institution, and it promised to make transactions faster, cheaper, and more private.

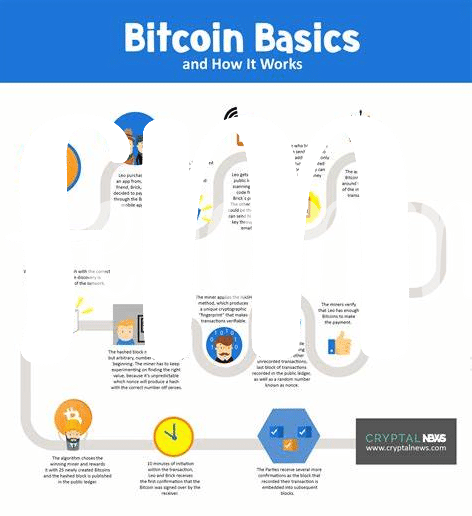

What’s fascinating about Bitcoin is how it keeps track of all these transactions. Each Bitcoin transaction is recorded in a public list called the blockchain. Imagine this as a giant, global ledger that is open for anyone to see, but secured by complex puzzles that make it incredibly hard for anyone to cheat. This feature not only made Bitcoin transactions trustworthy but also sparked a revolution in how we think about and use money across the globe. Let’s explore this transformation through a simple table:

| Feature | Description |

|---|---|

| Digital Nature | Operates entirely online, making it accessible to anyone with an internet connection. |

| Decentralized System | No single institution controls Bitcoin, empowering users with full control of their money. |

| Transparent Transactions | Each transaction is recorded on the blockchain, ensuring transparency and security. |

Through its innovative design, Bitcoin has not just offered a new way of thinking about money but has laid the foundation for a future where digital currency is a key player in the global economy.

What Makes a Bitcoin Transaction Special? 💡

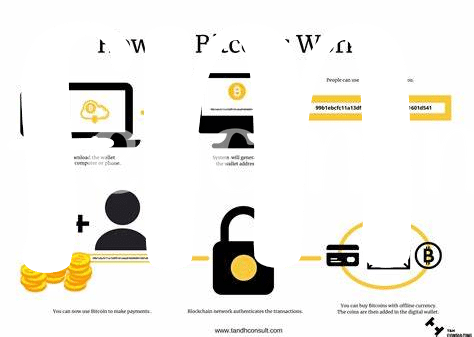

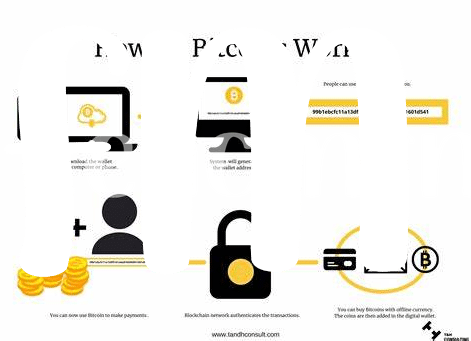

Bitcoin transactions sparkle with a unique kind of magic, and it’s not just because they’re digital. Imagine sending money across the globe without having to wait days for the transaction to clear or paying hefty fees. This is the reality of Bitcoin. Unlike traditional banking, where transactions are processed and verified by a central authority, Bitcoin transactions occur directly between two parties, cutting out the middleman. This means you can send and receive money quicker and often at a lower cost. But there’s more; every transaction is securely recorded on a public ledger called the blockchain, ensuring transparency and trust in the process.

As we navigate through the digital age, understanding the intricacies of Bitcoin transactions becomes essential. They’re not only transforming how we think about money but also how we use it. For those keen on exploring further, a comprehensive guide on the global economy and Bitcoin’s significant impact and influence can be found here: https://wikicrypto.news/bitcoin-exchange-demystified-a-beginners-ultimate-guide. This digital evolution brings money into the modern era, making transactions faster, safer, and, surprisingly, more public. With Bitcoin leading the charge, the future of money looks nothing like its past.

The Blockchain: a Digital Ledger for Everyone 📖

Imagine having a special book where every time someone decides to exchange digital coins like Bitcoin, the details of this transaction get noted down for everyone to see. This isn’t just any book, but a super secure one that cannot be easily tampered with, ensuring that each record is accurate and trustable. This is the magic of what we call the blockchain technology. It’s like a digital diary 📖, open for all to verify transactions, ensuring everything is above board. This not only makes every bitcoin exchange 💡 feel like a transparent deal between parties but also sets a new standard for how money moves around the globe 🌍. It’s a revolutionary step that puts power back in the hands of the people, giving everyone a chance to be a part of a secure, efficient, and transparent financial system. This openness is what helps build trust in digital money, making the blockchain not just a technology, but a cornerstone of modern finance.

Speed and Safety: Bitcoin’s Double Edge Sword 🚀

Picture this: you’re sending money across the globe in just minutes, without hefty fees or waiting for bank approvals. That’s the magic of Bitcoin transactions. They zip across the internet, making the movement of money speedy like never before. It’s a game-changer, allowing people to send financial aid to family overseas swiftly or pay for an online purchase without the drag of traditional banking delays. This speed is one of the crowning achievements of digital currencies, revolutionizing how we think about money transfers. But with great speed comes great responsibility. The digital nature of Bitcoin means that transactions are secured by complex cryptographic techniques, making them incredibly tough to tamper with. Yet, this also means that once a transaction is made, it’s nearly impossible to reverse if something goes wrong. If you’re curious about how this technology compares to other digital currencies, btc online offers insightful analysis.

Now, let’s talk safety, the other side of the coin. The secure backbone of Bitcoin transactions is something called blockchain. Think of it as a public notebook that keeps a record of every transaction ever made, visible for all to see. This transparency adds a layer of security, as every transaction is verified and recorded by a network of computers. However, because personal responsibility plays a big role in managing digital wallets, losing access to your digital wallet means your bitcoins might be gone for good. It’s a blend of unmatched speed and a robust security model, pushing the boundaries of traditional financial systems and ushering in a new era of digital economy. 🚀🌍💡

Global Impact: How Bitcoin Is Changing Economies 🌐

Imagine a world where sending money is as easy as sending an email. This is no longer a dream, thanks to Bitcoin. Across the globe, from bustling city markets to remote villages, Bitcoin is transforming the way we think about and use money. Unlike traditional currencies, it doesn’t rely on a central authority, like a bank or government, to work. This means that people everywhere have the power to send and receive money, quickly and without hefty fees. Especially in places where banking is difficult or not possible, Bitcoin is stepping in to fill the gap, making it a game-changer for many.

Now, let’s delve into some numbers to see this impact more clearly:

| Region | Bitcoin Adoption Rate | Impact on Local Economy |

|---|---|---|

| Latin America | High | Greater financial inclusion, remittance cost reduction |

| Sub-Saharan Africa | Moderate to High | Increased business opportunities, enhanced trade across borders |

| Asia-Pacific | Varies | Financial innovation, investment in blockchain technology |

The table highlights how Bitcoin is not just a digital currency; it’s a worldwide movement towards financial freedom and innovation. For millions, it has opened up new opportunities, democratizing access to global markets and providing a lifeline where traditional financial systems have failed. As we continue on this journey, Bitcoin’s influence on economies around the planet only promises to grow, reshaping our understanding of money in the digital age.

The Future Is Now: Bitcoin’s Growing Influence 💫

As Bitcoin continues to weave its digital threads into the fabric of global finance, its influence is undeniable. Imagine a world where sending money across the globe is as easy as sending a text message, where financial systems operate on transparency rather than closed doors, and where the everyday person can bypass traditional banking systems altogether. This is not a distant dream but the reality shaping up right before our eyes, thanks to Bitcoin. Its unique approach to transactions, grounded in the innovative blockchain technology, is prompting a rethink of how money moves around the world. More than just a digital currency, Bitcoin is a catalyst for change, offering new opportunities for financial inclusion and economic empowerment, especially in parts of the world where traditional banking services are out of reach. With each transaction, Bitcoin chips away at the old edifice of centralized finance, laying the groundwork for a more open and accessible financial system. For those curious about the current state of digital currency, checking the ethereum price today can provide insights into the broader market trends influenced by Bitcoin’s ascendancy. Its growing influence speaks volumes about the potential of decentralized currencies not just as speculative assets but as tools for building a more equitable financial future. 🌍💡🚀