Bitcoin: the Future of Personal Finance? 💰

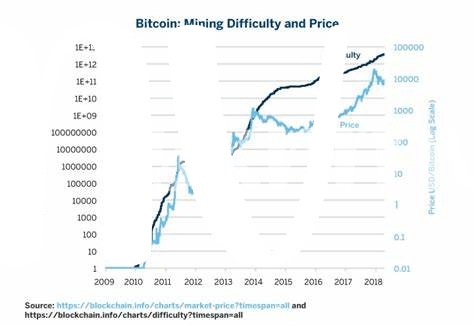

Imagine being able to manage your money directly from a digital wallet on your phone or computer, bypassing traditional banks entirely. This is where the magic of digital currencies, like Bitcoin, comes into play. It proposes a future where managing personal finances might not just be easier but also more directly under our control. The key to Bitcoin’s charm lies in its ability to perform transactions anywhere in the world, at any time, without the need for a middleman. This not only speeds things up but could also mean fewer fees. Yet, while it promises a revolution in how we handle money, it’s not all smooth sailing. The value of Bitcoin can be as unpredictable as a rollercoaster, which might make you think twice before putting all your eggs in this digital basket.

Here’s a quick glance at some pros and cons:

| Pros | Cons |

|---|---|

| 🌍 Global access | 🎢 Value can be unpredictable |

| ⏰ 24/7 transactions | 💾 Technical barriers for some |

| 🚫 No middlemen | ❓ Regulatory uncertainty |

As we navigate this new digital financial landscape, the potential for Bitcoin to redefine our relationship with money is immense, yet the path is lined with both opportunities and challenges.

Shaking up the Banking World, One Block at a Time 🔗

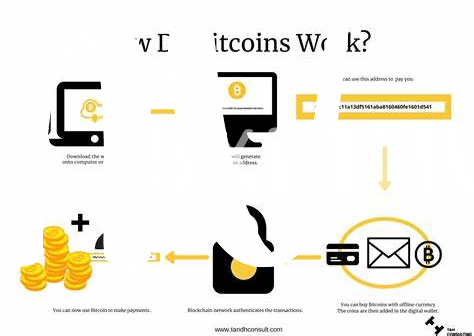

Imagine a world where you could be your own bank, free from waiting in line or filling out endless paperwork. This isn’t a fantasy; it’s becoming reality thanks to Bitcoin. Picture Bitcoin as digital gold that lives online, where each “block” in a “chain” represents a ledger of transactions. Unlike traditional banking, which relies on a central authority, Bitcoin operates on a public network managed by its users around the globe. It’s like a giant group project where everyone contributes to ensure everything runs smoothly.

However, while the idea of managing your own money might sound empowering, it challenges the very foundation of how banks have operated for centuries. With Bitcoin, transactions are direct, from person to person, without needing a middleman, making it a game-changer. Banks are noticing, too, as they begin to explore how blockchain, the technology behind Bitcoin, could be used in traditional banking. For a closer look at Bitcoin’s role in this shift, consider checking out https://wikicrypto.news/bollinger-bands-and-bitcoin-navigating-volatility-for-profit, which dives into the intricacies of Bitcoin and its potential impact on the financial world. Whether Bitcoin will replace banks outright or simply inspire a new way of thinking about money remains to be seen, but its influence is undeniable.

No More Middlemen? How Bitcoin Cuts Out Banks 🏦

When we chat about our money and how we move it around, usually banks pop up in that picture. They’re like the friends who always want to be in between when you’re sending or receiving cash. But imagine if we could send money directly to each other, no friends needed in the middle. That’s what Bitcoin offers. It uses technology to let anyone send and receive money directly, skipping the bank line. This can mean faster transactions and sometimes even saving on fees that banks would usually charge for their role.

Now, take this idea to a bigger scale. Imagine this happening all over the world, every day. People and businesses could manage their money in a way that feels like sending a text message – quick and simple. 🌐💼 This approach challenges how banks have traditionally operated and could change our relationship with money. As more people start to use Bitcoin, it raises big questions about what the future of banking looks like. Could we be moving towards a world where banks play a very different role, or maybe no role at all in our day-to-day finances? 🤷♂️💡

The Global Impact: Bitcoin Vs. Traditional Currencies 🌍

In the dance of digital versus traditional, Bitcoin is stepping on some pretty big toes across the globe 🌍. Picture this: you’re in one country, and with just a few clicks, you can send money to someone halfway across the world without waiting days or paying hefty fees to banks. That’s Bitcoin changing the game. It’s not just individual people feeling the effects; entire countries are noticing the shift. In places where the local currency might be losing value quickly due to inflation, Bitcoin offers a stable alternative, protecting people’s purchasing power. But it’s not all smooth sailing. The widespread adoption of Bitcoin challenges the way countries control their own currencies and manage their economies. This raises big questions about how nations can keep up with such a fast-moving technology. For those looking to understand the technical side of things, including keeping their digital money safe, bitcoin software wallets explained offers a deep dive into how to protect your digital coins in a world where traditional banking rules don’t always apply. As Bitcoin continues to carve its path, it’s clear that its impact on the global stage is only just beginning 🔗🌐.

Regulatory Headaches: Governments Grapple with Bitcoin ⚖

As Bitcoin continues to make headlines, governments around the world are faced with a unique challenge: how to deal with this new form of money. Unlike traditional currencies controlled by central banks, Bitcoin operates on a decentralized system, which means no single entity has control over it. This has left regulators scratching their heads, trying to figure out how to implement laws that protect consumers without stifling innovation. The dance between regulation and freedom is a delicate one, with each step closely watched by the global community.

The impact of Bitcoin’s rise has been felt far beyond the trading screens. With its increasing popularity, governments fear the loss of control over the financial system and are concerned about potential illegal activities that could be facilitated through its anonymous nature. This has led to a variety of responses, from outright bans in some countries to cautious acceptance and regulation in others. As this digital currency continues to evolve, the question remains: how will traditional laws apply to this revolutionary technology? The table below outlines some of the approaches taken by different governments around the world:

| Country | Approach to Bitcoin |

|---|---|

| USA | Regulation and taxation as property |

| China | Bans on cryptocurrency exchanges and ICOs |

| Germany | Legal and treated as currency |

| South Korea | Regulation, but with a focus on innovation |

Bitcoin: a Threat or Opportunity for Economic Policies? 🤔

When it comes to understanding how Bitcoin might change the world of money and rules, folks have a lot to think about. Is it a big scary monster that’ll throw a wrench in how countries manage their money, or is it a golden opportunity for making everything fairer and more open? Imagine a world where sending money is as easy as sending a text message, and where you don’t have to go through a bunch of hoops just to get your own money. That’s the promise of Bitcoin. But governments and big money folks aren’t so sure. They worry about losing control and not being able to keep things stable. On the flip side, some see Bitcoin as a way to shake things up for the better, making financial systems more honest and giving folks more power over their own dough. For a deeper dive into how Bitcoin affects things like money value and why governments are scratching their heads, check out bitcoin and inflation explained. It’s a wild ride, and whether Bitcoin is seen as a troublemaker or a game-changer, it’s clear that the conversation is just getting started. 🤯💼🚀