The Big Picture: Why Crypto Taxes Matter 🌍

Just like when you go to a store and pay tax on what you buy, people who trade digital money like Bitcoin and Ethereum also need to think about taxes. It might seem strange to talk about taxes with something as futuristic as digital currencies, but it’s becoming a big deal. Governments around the world are paying more attention to how these online coins are used and making sure people pay taxes on them. This is important because when people trade these digital coins, they might make some money, and just like any other kind of earning, the government wants its share.

By understanding and paying these taxes, investors can avoid trouble and contribute to the public good, like schools and roads, funded by taxes. However, the world of digital money taxes can be tricky, as rules vary wildly from one country to another. This makes it super important for crypto fans to keep up. Here’s a simple look at why these taxes matter:

| Reason | Explanation |

|---|---|

| Legal Compliance | Following the law to avoid fines or legal issues. |

| Financial Responsibility | Ensuring you’re paying your fair share for public services. |

| Market Stability | Contributing to a more predictable and stable digital currency market. |

Tracing Bitcoin’s Tax Journey Around the World 🛤️

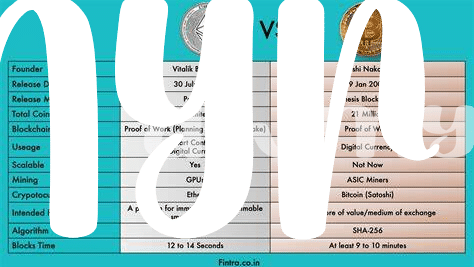

Bitcoin, the trailblazer of cryptocurrencies, has set off on a global tax adventure that has both lawmakers and investors keeping a keen eye on its developments. As it zigzags through various countries, the tax treatment of Bitcoin varies widely, painting a complex quilt of regulations. Some countries embrace it with open tax laws inviting innovation, while others guard their financial borders with strict taxation, viewing Bitcoin more as a asset to be controlled rather than a currency to be utilized freely. This worldwide journey is not just about following the rules; it’s about understanding how each jurisdiction views Bitcoin, from a digital gold mine to a taxable asset, creating a labyrinth of tax implications for investors. Navigating this maze requires staying informed about the ever-evolving tax landscape, which can significantly impact investment strategies and outcomes. For those diving deeper into how different countries view not just Bitcoin but also other cryptocurrencies like Ethereum, a thorough comparison can be found at https://wikicrypto.news/leveraging-ethereums-lower-volatility-for-consistent-gains, shedding light on regulatory stances and how they influence market dynamics.

Ethereum’s Unique Tax Challenges and Opportunities 💰

Ethereum, like a bustling market square in the digital age, brings its own set of rules when it comes to taxes. 🌐 Imagine this: every transaction, every smart contract, and the very act of “mining” these digital coins can catch the eye of tax authorities, each looking for their slice of the pie. However, it’s not all about navigating through stormy waters. 🚣 For the savvy investor or developer, Ethereum offers a playground of possibilities. With its unique technology, some find themselves in a position to leverage these digital transactions in ways that could be more tax-efficient than traditional investments. But beware, the road is fraught with potential pitfalls. From not keeping accurate records to misunderstanding how rewards from staking are taxed, the journey with Ethereum requires a map and a sharp mind to steer clear of unnecessary troubles while making the most of the opportunities that lie within the crypto landscape. 🗺️

Common Missteps in Reporting Crypto Taxes 🚫

Diving into the world of crypto taxes can feel like navigating a complex maze with unseen hurdles at every turn. Many folks find themselves tripping over the same stumbling blocks. One of the biggest slip-ups? Not realizing that every trade—yes, swapping Bitcoin for Ethereum counts—needs to be reported. Imagine buying a piece of artwork with vintage coins; you wouldn’t just walk away without giving it a second thought. The same goes for crypto. There’s also a common myth that you only need to report your activities if you’re cashing out into traditional money, but that’s far from the truth. Every transaction is a potential reportable event, something many learn the hard way.

Keeping up with the evolving landscape is another hurdle. With regulations changing faster than a high-speed blockchain, staying informed is crucial. For the latest scoop, latest updates on bitcoin regulations worldwide versus ethereum can be your go-to guide. It’s not just about dodging penalties; it’s about embracing opportunities. Innovations in tax law could mean new ways to optimize your investments, making it all the more important to stay on the ball 🌐📊.

Innovations in Tax Law for Digital Currencies 🔍

In the ever-evolving world of digital money, like Bitcoin and Ethereum, countries are stepping up their game to keep pace. Imagine a world where paying taxes on your virtual coins is as straightforward as online shopping. That’s where we’re headed! Governments are crafting new rules to make this a reality. From the use of super-smart computer programs that can automatically track your digital coin transactions, to offering guidelines that are as easy to follow as a recipe in your favorite cookbook, the changes are all about making life easier. Some countries are even thinking outside the box, introducing methods for paying taxes with cryptocurrencies themselves. It’s like using your gaming tokens to get real-world goodies. What’s more, there’s a push towards global cooperation, aiming to iron out the wrinkles so that everyone’s playing by the same rules, making it fairer for all of us no matter where we live or how we earn our digital dollars.

| Country | Innovation Type | Description |

|---|---|---|

| Japan | Regulatory Sandbox | Testing ground for new crypto tax laws before full-scale implementation. |

| Portugal | Tax Exemptions | Crypto transactions not taxed under certain conditions, boosting crypto investments. |

| Switzerland | Tax Payment in Crypto | Allows citizens to pay taxes with Bitcoin and Ethereum, integrating crypto into daily life. |

Preparing for Future Tax Trends in Crypto 🚀

Navigating the waters of digital currency taxes feels a bit like exploring uncharted territory, with twists and turns at every corner. Imagine you’re gearing up for an adventure into the unknown; that’s how we should approach future tax trends in the world of Bitcoin and Ethereum. Governments and financial authorities around the globe are starting to get a clearer picture of how cryptocurrencies fit into the existing financial ecosystem. With this awareness, there’s a push to introduce clearer guidelines and rules that could impact how we deal with our digital assets. It’s a bit like learning the rules of a new game, where staying informed and proactive can make all the difference.

As we move forward, it’s crucial to keep an eye on developments and adapt our strategies accordingly. For those looking to refine their approach, understanding the intricacies of bitcoin versus traditional fiat currencies: a comprehensive comparison versus ethereum can provide a competitive edge. This insight is not just about staying compliant but also about optimizing your investments in a landscape that’s evolving rapidly. Imagine it as being akin to navigating a ship through a storm; the more prepared you are, the smoother the journey. Whether you’re a seasoned investor or new to the crypto scene, staying educated on these changes will be key to securing your asset’s future. 🚢💼🌊