🤖 Embracing Tech to Navigate Bitcoin’s Regulatory Waves

Navigating through the ever-shifting sea of Bitcoin regulations can seem daunting, but think of technology as your lighthouse, guiding you safely to shore. Imagine using advanced tools like blockchain analysis software, which acts like a high-tech map, showing you where the regulatory waters are rough and where they’re calm. This isn’t just about avoiding storms; it’s about finding the best routes that keep you compliant with laws, no matter where you are in the world. By keeping a digital ear to the ground, through smart use of tech, you stay ahead of the curve, ensuring your Bitcoin journey is smooth sailing. Tech not only helps you navigate but also protect your investments from regulatory whirlpools. With the right gadgets in your toolkit, you’re more than prepared for whatever 2024 throws your way.

| Technology Tool | Use Case |

|---|---|

| Blockchain Analysis Software | Track regulatory changes and ensure compliance |

| Crypto Market Trackers | Stay updated with real-time information on market trends |

| Secure Wallets & Storage | Protect your Bitcoin investments from regulatory impacts |

📚 Educate Yourself on Global Bitcoin Policy Changes

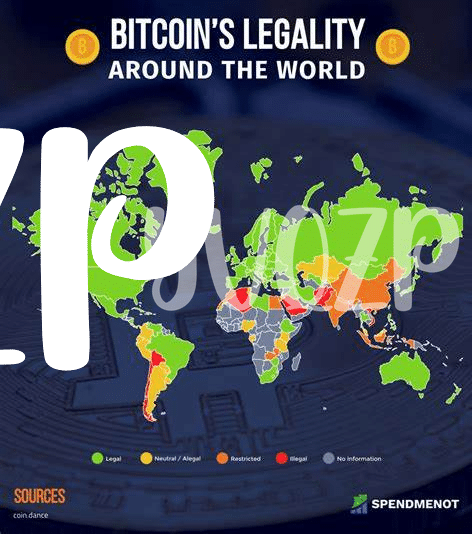

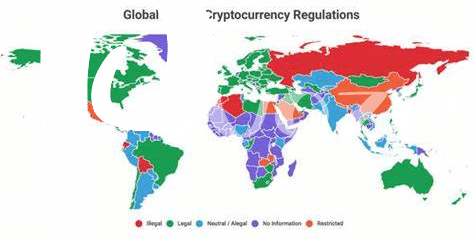

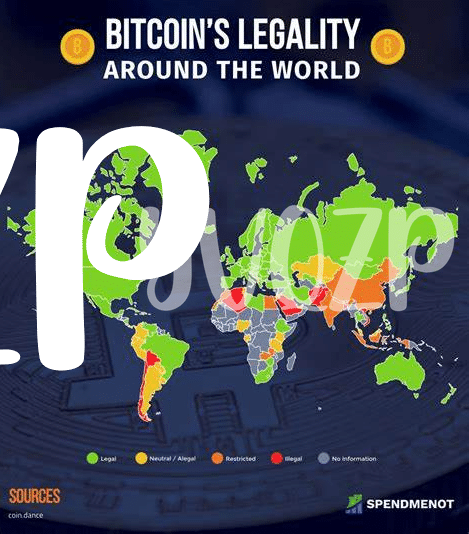

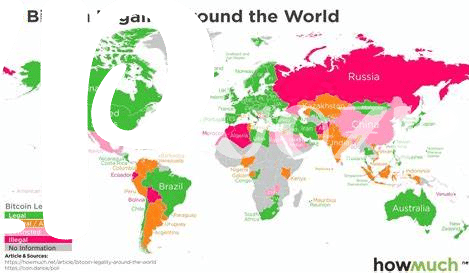

In the ever-evolving world of Bitcoin and cryptocurrencies, staying informed about global policy changes is crucial. It’s like riding a giant wave; if you’re not prepared, you might get swept away. Governments around the world are starting to pay more attention to Bitcoin, figuring out how to fit this digital currency into their financial rules. This means regulations can change quickly, and what’s allowed in one country might be forbidden in another. It’s all about keeping your ear to the ground. Websites like https://wikicrypto.news/decoding-bitcoin-payments-e-commerce-checkout-process-in-2024 offer a treasure trove of information, helping you stay ahead of the curve. By diving into the details of global Bitcoin policies, you’re not just protecting your investments; you’re also spotting new opportunities that others might miss. Remember, knowledge is power, especially in the fast-paced world of cryptocurrency. So, don your learning cap, and let’s ride the wave of Bitcoin regulations together, armed with information and ready for what comes next.

🌐 Diversifying Outside the Bitcoin Bubble

Venturing beyond Bitcoin can be like stepping into a kaleidoscope of opportunities. Think of the crypto world as a vast ocean, and Bitcoin as just one island. There are countless other islands (or digital currencies) with their own unique features and potential for growth. By exploring these, you’re not putting all your eggs in one basket, and you give your portfolio the chance to dance with the diverse rhythms of the market. It’s about being smart, not just safe.

🚀 Diving into altcoins or even looking at non-crypto investments like stocks or bonds might seem a stretch, but it’s akin to learning different languages to feel at home anywhere in the world. This diverse investment approach can help cushion against Bitcoin’s price sways triggered by new regulations. And remember, in a world that’s constantly changing, having a bit of everything might just be your best strategy. 🎨✨

💼 Leveraging Expert Advice for Crypto Investments

When diving into the world of cryptocurrency, it’s like charting the unknown waters of a vast ocean. 🌊 Surrounding yourself with seasoned sailors – or in this case, financial experts knowledgeable about Bitcoin – can make all the difference. These pros keep their ears to the ground, staying updated on shifts in the market and regulatory changes. They’re like your personal navigators, guiding you through the choppy waters of crypto investments with ease. For anyone venturing into Bitcoin, taking a moment to learn more about the financial side of things can be incredibly beneficial. This includes understanding how Bitcoin fees work and the impact of global regulations on your investments. To get a head start, I recommend checking out navigating bitcoin taxation: a global perspective in 2024. It’s a handy resource that sheds light on the intricacies of Bitcoin fees and taxation, ensuring you’re well-informed. Remember, in the ever-evolving world of cryptocurrency, staying informed and adaptable is key. 🗝️📈

🛡️ Safeguarding Your Assets with Smart Contracts

In the world of Bitcoin and cryptocurrencies, keeping your investments safe is a bit like guarding a treasure chest under the sea. With all the waves and currents – or market ups and downs – it’s easy to feel a bit lost. This is where smart contracts come into play, acting like an underwater map guiding us to safety. Imagine a treasure chest that only opens with a special song known just by you. That’s kind of what smart contracts are. They’re like secret agreements, stored on the blockchain, that say, “Hey, I’ll only open if certain things happen.” This means if you lend some Bitcoin or invest in a project, everything that’s supposed to happen, like you getting returns on your investment, is automatically taken care of according to the rules everyone agreed on from the start. No need to worry about someone forgetting their part of the deal or the rules changing midway. It’s like having a super smart guard dolphin watching over your treasure!

| Tool | Use Case | Description |

|---|---|---|

| Smart Contracts | Safeguard Investments | A code agreement that executes automatically when its conditions are met, ensuring the security of crypto transactions without the need for a middleman. |

🔄 Staying Flexible in Your Investment Strategy

Imagine a world where your crypto investments dance gracefully with the tides of the market. In this constantly changing landscape, your ability to adapt is your strongest asset. Think of it like planting a garden; you wouldn’t just plant one type of flower and hope for the best. Instead, you diversify, planting a variety of seeds to ensure that, no matter the weather, something blooms. Similarly, in the world of crypto, putting all your digital coins in one basket isn’t the wisest strategy. Keep your eyes open, and be ready to pivot your approach, exploring new coins or technologies as they emerge. This adaptability not only protects you but could also reveal unexpected opportunities for growth. And speaking of staying informed, a smart move is to understand bitcoin transaction fees and how to minimize them in 2024, which is crucial for anyone looking to utilize bitcoin for e-commerce transactions. This knowledge ensures you’re not just following the trends but leading the charge with informed decisions, keeping your portfolio resilient in the face of change.