🍕 the First Ever Purchase with Bitcoin: Pizza!

Imagine a world where a digital currency could buy you a hot, cheesy pizza. Back in 2010, a programmer made history by trading 10,000 of these digital coins for two large pizzas. This wasn’t just any purchase; it was the first time anyone had used this new, virtual money to buy something in the real world. Before this event, these coins were just numbers on a screen, a hobbyist’s plaything. But with this exchange, they began their journey from the fringes of the internet to the center of global finance. It was a moment that would be looked back upon with astonishment and a bit of envy by those who realized they might have spent millions on pizza in today’s terms.

This pivotal swap is not only a quirky footnote in the annals of digital currency but a cornerstone that proved its potential to become as spendable as dollars and cents. This table below highlights the transformation from an eccentric online transaction to a recognized medium of exchange:

| Year | Event | Significance |

|---|---|---|

| 2010 | Pizza Purchase | The first-ever physical item bought with Bitcoin, highlighting its potential as a real-world currency. |

From this pizza transaction, the currency embarked on an incredible journey, capturing the imaginations of people worldwide and proving that perhaps there’s more to this digital money than meets the eye.

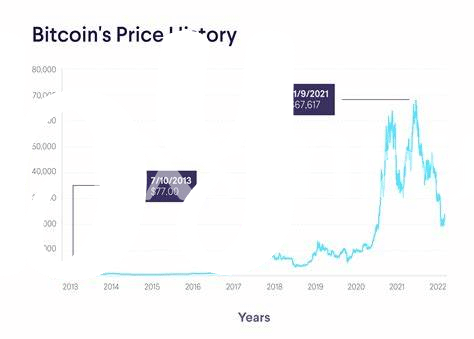

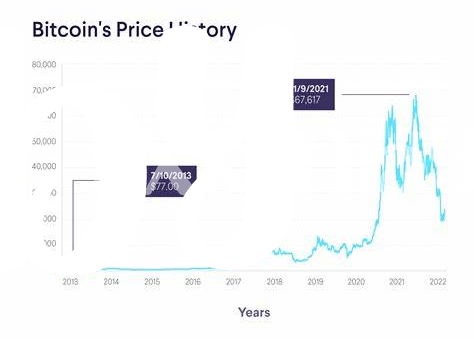

🚀 Bitcoin Breaks the $1,000 Barrier for the First Time

Imagine if you had a time machine and could go back to the days when you could snag a handful of bitcoins for less than the cost of a fancy coffee. Fast forward, and we hit a moment that felt like Bitcoin had jumped out of the realm of digital daydreams into real-world significance. In one breathtaking leap, it crossed the $1,000 mark. For folks who had been watching this digital curiosity, this was akin to watching a child prodigy step onto a global stage. It wasn’t just about the numbers going up; it was a signal to the world that Bitcoin wasn’t just play money for tech enthusiasts. It was getting serious attention, becoming something you could almost hear the traditional money systems starting to mutter about under their breath. For many, it was the first time they truly felt the gravity of what digital currency could mean for the future of finance. This milestone wasn’t just a geeky footnote in the annals of financial history. It was a clarion call to anyone paying attention that something new was afoot, something that could shake the very foundations of how we view and use money. For those intrigued by the interplay of technology and finance, the current discussion around leveraging Bitcoin for economic empowerment, especially in developing countries, reflects this evolving narrative. More insights on this can be found here, shedding light on future challenges and opportunities.

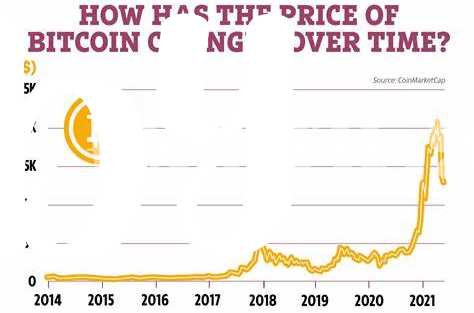

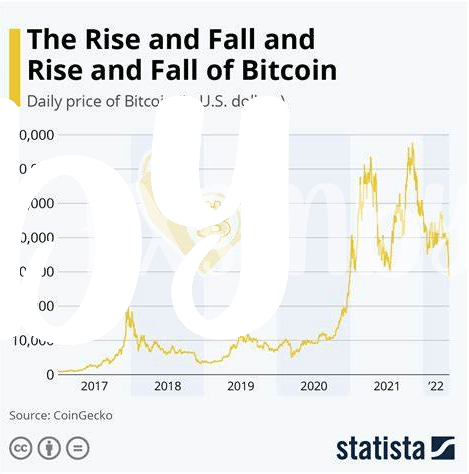

💔 the Dramatic Fall after the 2017 Peak

Imagine, for a moment, you reach the top of a huge mountain after a long climb, only to slip and tumble down. This pretty much happened with Bitcoin. After its sky-high peak in 2017, where everyone was talking about it, and many felt like they had struck gold, things took a sharp turn. Imagine the shock and disbelief when, in what felt like an instant, the value plunged deep, leaving many in despair. It was like watching a shooting star; so bright, yet so fleeting. People who had invested their hopes, dreams, and actual money into Bitcoin faced tough choices and even tougher losses. This period taught many that the road to riches can sometimes lead through rough patches. It wasn’t just a financial lesson; it was a life lesson in volatility, expectation, and the importance of caution. Yet, through this dramatic shift, the world began to truly understand the rollercoaster nature of cryptocurrencies.

🌍 Governments Begin to Weigh in on Bitcoin

As Bitcoin’s popularity soared, it caught the eye of those who hold the reins of power. Picture this: once a digital secret shared among tech enthusiasts, now on the verge of shaking up how countries view money. Governments everywhere started pulling up chairs at the Bitcoin table. They began by scratching their heads over how to approach this new kid on the block. Was it a currency, a commodity, or a whole new asset class? This sparked lively debates, drawing attention not just from techies but from policymakers and regulators too. It wasn’t just about guarding against risks; it was also about understanding how Bitcoin could open up new paths for financial growth and even aid in bitcoin and financial inclusion security concerns.

Suddenly, from being the outsider, Bitcoin found itself under the spotlight, with laws and regulations being crafted to keep pace with its growth. Governments aimed to strike a balance between harnessing Bitcoin’s benefits – like making financial systems more inclusive and efficient – and minimizing risks such as fraud and money laundering. As countries navigated this complex landscape, Bitcoin continued its journey, undeterred by the newfound attention. This chapter in Bitcoin’s story isn’t just about oversight; it’s a testament to how big ideas can push even the most solid institutions to evolve and adapt.

🏦 Big Banks and Companies Start Hoarding Bitcoin

Once upon a time, Bitcoin might have just seemed like digital fairy dust to most of us, something interesting but not quite tangible. However, a shift started to happen, making everyone turn their heads in surprise. Imagine the biggest and most serious banks, alongside companies we visit or use daily, starting to gather up Bitcoin like kids collecting rare stickers. It wasn’t just a few daring adventurers; we’re talking about major players. This wasn’t just about having a slice of the pie, it was about recognizing the value in this new form of currency that doesn’t rust, doesn’t tear, and most importantly, isn’t bound by traditional banking systems. The story took a surprising turn when reports surfaced, showing numbers that could make your head spin. These weren’t just whispers in dark corners; official registries began to show significant investments in Bitcoin.

| Year | Bitcoin Holdings Increase (%) | Notable Institutions Involved |

| 2018 | 70% | Goldman Sachs, Fidelity |

| 2019 | 120% | JP Morgan Chase, Tesla |

| 2021 | 150% | BNY Mellon, PayPal |

This wasn’t a fleeting craze but a clear indication that Bitcoin had grown up from its digital playground and was now sitting at the table with the financial titans, changing the game in ways we’re just starting to understand.

🚗 from Digital Coins to Real-life Lamborghinis

Imagine having a digital wallet on your laptop or phone that instead of holding simple digital “coins,” holds the key to buying some of the most luxurious cars on the planet. That’s exactly what happened as the value of Bitcoin soared, turning virtual currency into real-world assets. Some of the early believers in Bitcoin, who might have started with small investments or even mined Bitcoin when it was easy to do so, found themselves sitting on a digital goldmine. As the value of Bitcoin hit new peaks, these digital pioneers did something almost unimaginable; they began trading their bitcoins for Lamborghinis. This act not only symbolized the immense wealth that could be generated through cryptocurrency investment but also became a cultural symbol within the crypto community, representing success and the ultimate crypto dream.

In the midst of these fascinating developments, it’s essential to stay educated about the broader implications of Bitcoin, especially its environmental footprint and security concerns. A significant aspect to consider is thebitcoin environmental impact security concerns, particularly during Bitcoin halving events, which can influence Bitcoin’s value and sustainability. These moments highlight the complex interplay between digital currency and the real world, impacting not only individual wealth but also the environment and global security. As the journey from digital coins to luxury cars unfolds, it’s a reminder of Bitcoin’s transformative power and the need for responsible stewardship in the face of such rapid change.