🤔 Understanding the Basics of Fibonacci Retracement

Imagine diving into a pool without knowing how deep it is. That’s a bit like trading Bitcoin without understanding Fibonacci Retracement – it’s a tool that helps you gauge the depth of the market waters. It sounds fancy, but at its heart, Fibonacci Retracement is based on a series of numbers that ancient mathematicians found occur naturally in the world around us. These numbers help traders figure out potential turning points in the bitcoin market, essentially giving them a map to navigate price fluctuations.

For beginners, think of it as a lighthouse guiding ships through foggy conditions; it shines a light on where prices might head next, enabling traders to make decisions with more confidence. Here’s a simplified breakdown:

| Step | Description |

|---|---|

| 1. Identify Peak & Trough | Locate the recent biggest move up or down in the price of Bitcoin. |

| 2. Apply Fibonacci Levels | Overlay the Fibonacci Retracement tool from the peak to the trough (or vice versa). |

| 3. Watch the Magic Numbers | Observe how prices interact with these levels, which might act as support or resistance. |

This framework doesn’t promise sure wins but offers insights into market psychology and potential future movements. As traders become familiar with using this tool, they can blend it with other strategies to enhance their trading approach, especially during uncertain times.

💡 Why It’s a Must-know for Bitcoin Traders

In the buzzing world of Bitcoin trading, knowing your way around the Fibonacci Retracement tool is like having a secret map in a treasure hunt. For starters, it’s not just another fancy technique; it’s a beacon of light in the unpredictable sea of digital currency. This tool, borrowed from a mathematical sequence discovered centuries ago, helps traders make sense of price movements. By identifying key levels where the price of Bitcoin is likely to pause or reverse, traders can make decisions with greater confidence. Whether you’re navigating through a stormy market or riding a bullish wave, understanding how to use Fibonacci Retracement can give you an edge.

Moreover, amid the evolving landscape of cryptocurrencies, staying informed is crucial. For insights into how regulatory changes in 2023 could affect your trading strategies, consider reading more at https://wikicrypto.news/bitcoin-and-the-regulatory-landscape-a-2023-overview. This knowledge, combined with tools like Fibonacci Retracement, equips traders to adjust their strategies not only to maximize gains but also to minimize losses. Whether you’re a seasoned trader or just starting, embracing this tool can tremendously impact your trading journey, helping you to navigate through market uncertainties with more assurance.

📈 Integrating Fibonacci into Your Trading Strategy

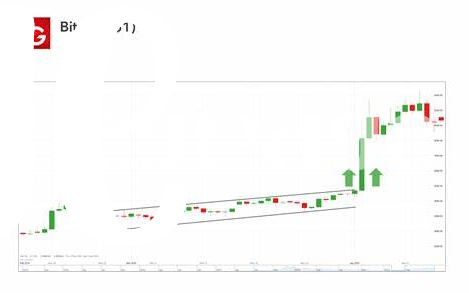

Imagine you’re a chef. In your kitchen, you have a special set of knives, each designed for a specific task. Just like those knives, Fibonacci retracement is a tool for your trading toolkit, tailored to help you slice through the Bitcoin market’s noise and find meaningful trends. This tool uses maths to identify potential turning points by connecting a high and a low point. The magic lies in the numbers it reveals, hinting at where prices might head next, making your trading decisions clearer and more strategic.

By weaving Fibonacci retracement into your daily trading, you embark on a journey of recognizing the rhythms of Bitcoin’s price movements. It’s about listening to the market’s melody and knowing when it’s likely to change its tune. Those numbers become your notes, guiding you on when to enter or step back, turning chaotic market movements into a harmonized symphony. As you get comfortable with this tool, it becomes easier to dance to the market’s beat, ensuring you’re always in step with Bitcoin’s ever-changing tempo.

🚀 Boosting Confidence in Volatile Market Conditions

Trading Bitcoin, especially in unpredictable market conditions, sometimes feels like trying to sail a ship in stormy seas. Knowing when to hold on and when to let your assets go is crucial. This is where the wisdom of using tools like Fibonacci retracement comes into play. It’s like having a lighthouse guiding you through the dark, providing a beacon of confidence when the waters get rough. Learning to interpret these signals can turn the tides in your favor, easing the journey through the volatile waves of the cryptocurrency market.

In such conditions, having a reliable strategy to fall back on not just helps in navigating through the ups and downs, but it also injects a sense of confidence in your trading decisions. With making micropayments feasible with bitcoin regulatory outlook, traders can adapt and adjust their strategies, ensuring they are not left adrift. Embracing these methods helps in identifying the calm during the storm, ensuring that you are equipped to ride out the volatility or even use it to your advantage. This adaptability can be key to not just surviving but thriving in the ever-changing crypto landscape.

🎯 Identifying Entry and Exit Points with Precision

When diving into the world of Bitcoin trading, the key to maximizing your success lies in making smart moves at the right time. That’s where the magic of using Fibonacci retracement comes into play. Imagine you’re a surfer trying to catch the perfect wave; you need to know when to jump in and when to ride back to shore. Similarly, Fibonacci retracement helps traders pinpoint the golden spots on the price chart where they can enter or exit a trade with precision—a bit like having a high-tech compass in the vast ocean of digital currency markets. It isn’t just about guessing; it’s about making informed decisions based on historical data and patterns, which often repeat themselves. With this tool, you’re looking at the past to predict future turning points, making your trading journey less about luck and more about strategy. By identifying these strategic points, traders can adjust their sails according to the market’s winds—knowing exactly when to hold on for the ride and when to cash in on their gains.

Here is a simple breakdown of how these entry and exit points can be charted:

| Phase | Description |

|---|---|

| Identifying Peaks and Troughs | Find significant high and low price points on your chart. |

| Applying Fibonacci Levels | Draw the Fibonacci retracement levels between the high and low points. |

| Spotting Entry Points | Look for price actions reacting to these levels as potential buy-in points. |

| Identifying Exit Points | Observe resistance at these levels to determine when to sell. |

This method offers a clear advantage in fine-tuning your strategy and making the most out of each trade by reducing guesswork and enhancing precision.

🛠 Adjusting Strategies for Maximum Gain

In the fast-paced world of Bitcoin trading, fine-tuning your approach can really make a difference in maximizing gains. It’s like being a surfer who knows exactly when to ride the big waves and when to sit out; it requires a keen eye and flexibility. Imagine riding the wave of market trends, where adjustments in your trading plan are informed by real-time data and patterns. This dynamic approach involves keeping an eye on the bigger picture while making small, strategic moves. It’s not just about picking the right entry and exit points but also knowing how to shift your tactics based on market conditions. Imagine this being your trading compass, guiding you through the stormy seas of Bitcoin volatility. For those looking to stay ahead of the curve, staying updated with the latest in the crypto world is crucial. So, diving into best practices for securing your bitcoin against theft market trends can provide you with valuable insights and strategies. It’s like having a treasure map in a land of digital gold; you just need to know how to read it. Remember, the goal is not just to survive in the world of Bitcoin trading but to thrive, making informed decisions that lead to maximum gain. Through this adaptive strategy, you become not just a trader, but a savvy navigator of the digital finance landscape.