Origin of Ponzi Schemes in Bitcoin Market 🕵️♂️

The emergence of Ponzi schemes in the Bitcoin market traces back to the early days of cryptocurrency adoption. Initially, as Bitcoin gained popularity, opportunistic individuals sought to capitalize on the excitement surrounding this new digital asset. Operating under the guise of investment platforms, these schemes promised unrealistic returns to unsuspecting investors. The allure of quick profits and the decentralized nature of Bitcoin created the perfect environment for such fraudulent activities to flourish. As more people entered the market without fully understanding the technology or investment principles, Ponzi schemes found fertile ground to thrive. Despite efforts to expose and shut down these schemes, new iterations continue to surface, preying on those hopeful for financial gain in the volatile world of cryptocurrencies.

“`html

| Year | Event |

|---|---|

| 2009 | Introduction of Bitcoin |

| 2013 | First Bitcoin Ponzi Scheme Exposed |

| 2017 | Heightened Regulatory Scrutiny |

“`

Common Characteristics of Bitcoin Ponzi Schemes 💸

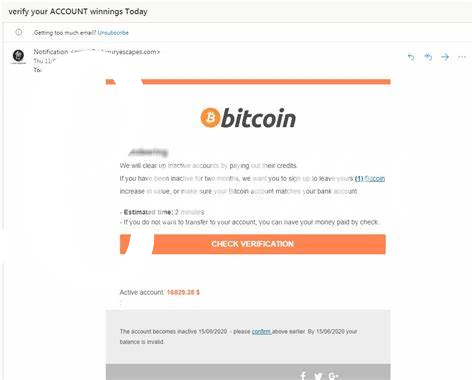

Bitcoin Ponzi schemes share common characteristics that make them distinguishable from legitimate investment opportunities. These schemes often promise high returns with little to no risk, luring in unsuspecting investors with the allure of quick profits. One common characteristic is the reliance on new investor funds to pay existing investors, creating a cycle of unsustainable growth that eventually collapses.

Additionally, Bitcoin Ponzi schemes typically lack transparency and operate under a shroud of secrecy, making it difficult for investors to verify the legitimacy of their operations. They may also use aggressive marketing tactics to attract more participants, further perpetuating the facade of legitimacy. As investors become more aware of these red flags, they can better protect themselves from falling victim to such fraudulent schemes.

Impact on Investors and the Market 📉

Investors lured into Bitcoin Ponzi schemes often find themselves facing devastating consequences, both financially and emotionally. As these schemes crumble, investors are left empty-handed, with their hard-earned money vanished into thin air. Beyond individual losses, the market as a whole can suffer from decreased trust and credibility, as news of Ponzi schemes taint the reputation of cryptocurrencies. This not only impacts current investors but also deters potential newcomers from entering the market, hindering its overall growth and stability. The aftermath of these scams serves as a sobering reminder of the need for vigilant oversight and due diligence when navigating the volatile landscape of digital currencies.

Warning Signs to Identify Bitcoin Ponzi Schemes 👀

When venturing into the Bitcoin market, it’s crucial to be vigilant and aware of the warning signs that could indicate a Ponzi scheme. These schemes often promise high, guaranteed returns with little to no risk, using new investors’ funds to pay off earlier investors. Look out for overly consistent returns, complex investment structures, a lack of transparency, and pressure to recruit new investors as red flags. Additionally, be wary of schemes that discourage you from cashing out or accessing your funds easily. Educating yourself on these warning signs and conducting thorough research before investing can help you steer clear of potential scams. Remember, if something seems too good to be true, it probably is. Stay informed and stay safe in the rapidly evolving landscape of cryptocurrency investments.

Regulatory Efforts to Combat Ponzi Schemes 🛡️

Regulatory efforts play a crucial role in protecting investors from falling victim to Ponzi schemes in the Bitcoin market. Authorities are increasingly focused on implementing measures to combat fraudulent schemes and ensure a safer environment for investors. By enforcing stringent regulations and conducting thorough investigations, regulatory bodies aim to detect and shut down Ponzi schemes before they cause significant harm. These efforts include monitoring suspicious activities, issuing warnings to the public, and collaborating with international agencies to track down perpetrators. Through proactive measures and strong enforcement actions, regulators are working towards safeguarding the integrity of the Bitcoin market and preventing unsuspecting individuals from being exploited.

Staying Safe in the Bitcoin Market 🚨

When diving into the Bitcoin market, it’s crucial to prioritize safety above all else. Awareness and education play pivotal roles in safeguarding oneself against potential risks. Research thoroughly before making any investments and remain vigilant for any red flags that may signal fraudulent activity. Keep in mind that if something seems too good to be true, it probably is. Stay updated on the latest scams and schemes circulating in the market, and be cautious of any offers promising unrealistic returns. Utilize reputable sources and platforms to stay informed and seek guidance if ever in doubt. By staying informed and cautious, individuals can navigate the Bitcoin market with greater confidence. Remember, protecting your investments is key to long-term financial well-being. To report any suspicious activity in Armenia, visit the bitcoin fraud and scam reporting in Andorra.