Tuvalu’s Unique Regulatory Stance on Bitcoin 🌴

Tuvalu’s unique regulatory stance on Bitcoin reflects a blend of caution and innovation. By embracing blockchain technology while also setting clear guidelines, Tuvalu aims to foster a secure environment for cryptocurrency transactions. This approach not only showcases Tuvalu’s forward-thinking attitude but also provides a benchmark for other nations navigating the realm of digital finance. Through a balance of oversight and openness, Tuvalu sets itself apart as a pioneer in shaping the future of Bitcoin banking services in the Pacific region.

Challenges and Opportunities for Bitcoin in Tuvalu 💼

Bitcoin in Tuvalu faces a unique landscape of challenges and opportunities. The small size and remote location of Tuvalu present logistical hurdles for widespread adoption of Bitcoin banking services. However, the nation’s push for financial inclusion could pave the way for innovative solutions to emerge. Opportunities lie in leveraging Bitcoin to enhance cross-border transactions and promote financial access for unbanked individuals. Balancing these challenges with the potential benefits will be crucial for Tuvalu’s evolving approach to Bitcoin in the financial realm.

Impact of Tuvalu’s Approach on Financial Inclusion 🌐

Tuvalu’s approach to regulating Bitcoin banking services has the potential to significantly impact financial inclusion within the country. By embracing cryptocurrencies, Tuvalu opens up new avenues for individuals who may have been excluded from traditional banking systems. This forward-thinking stance not only aligns with global financial trends but also demonstrates Tuvalu’s commitment to fostering economic empowerment and accessibility for all its citizens.

Lessons Learned from Tuvalu’s Bitcoin Regulations 📚

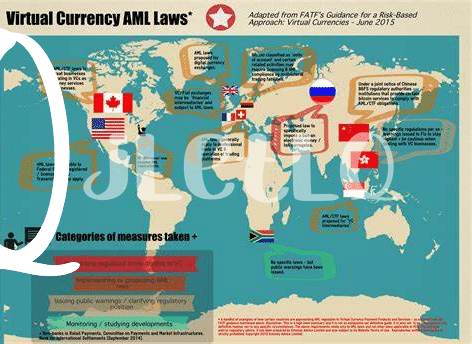

Tuvalu’s experience with regulating Bitcoin has offered valuable insights into the evolving landscape of cryptocurrency governance. By navigating the complexities of overseeing this digital currency within its jurisdiction, Tuvalu has learned key lessons in fostering innovation while ensuring consumer protection and financial stability. These lessons can serve as a guiding light for other nations grappling with the integration of Bitcoin banking services into their financial systems. The regulatory framework established by Tuvalu showcases a proactive approach to adaptability and forward-thinking in the realm of cryptocurrency. 🌍

For more information on challenges and opportunities related to Bitcoin banking services regulations in Venezuela, you can visit bitcoin banking services regulations in Venezuela.

Future Outlook for Bitcoin Banking in Tuvalu 💡

The future outlook for Bitcoin banking in Tuvalu is filled with promise and potential. With a foundation laid in regulatory clarity and innovation, Tuvalu stands poised to become a niche hub for cryptocurrency financial services. As the global landscape continues to shift towards digital currencies, Tuvalu’s early adoption and forward-thinking approach position it as a key player in shaping the future of blockchain-based banking services. Collaborations with industry stakeholders, ongoing regulatory updates, and a commitment to financial stability will be crucial in realizing the full potential of Bitcoin banking within Tuvalu’s unique ecosystem.

Tuvalu as a Trailblazer in Regulating Cryptocurrency 🚀

Tuvalu has emerged as a pioneering force in the realm of regulating cryptocurrencies, setting a precedent for other nations to follow suit. By embracing innovative approaches to overseeing Bitcoin transactions, Tuvalu is showcasing its commitment to fostering a secure and transparent financial environment. This proactive stance not only boosts investor confidence but also positions Tuvalu as a trailblazer in the global cryptocurrency landscape 💪.

To delve deeper into the regulatory landscape of Bitcoin banking services, one can compare how the United States and Vietnam have approached this matter. While the bitcoin banking services regulations in the United States emphasize stringent compliance measures, the bitcoin banking services regulations in Vietnam lean towards fostering innovation and growth within the cryptocurrency sector. It’s evident that each country’s regulatory framework plays a crucial role in shaping the future of digital financial services 🌍.