Understanding Tax Obligations When Mining Bitcoin in Poland 🇵🇱

When it comes to Bitcoin mining in Poland, navigating the tax obligations is crucial. Understanding the tax landscape is essential for miners to ensure compliance with Polish regulations. From income tax implications to corporate tax liabilities, miners need to be aware of how their activities are taxed. Exploring potential tax deductions and incentives can also help miners optimize their tax situation. Being knowledgeable about VAT regulations on mining operations is equally important to avoid any unexpected tax liabilities. Stay informed to make sound financial decisions in this evolving tax environment.

Implications of Cryptocurrency Mining on Personal Income Tax 💰

When it comes to cryptocurrency mining and personal income tax, miners in Poland need to navigate through a set of implications that can impact their financial obligations. The taxable nature of mining rewards and the classification of income derived from such activities play a significant role in determining the tax liability of individuals involved in cryptocurrency mining. Understanding how these factors intersect with the existing tax framework is essential for miners to ensure compliance and proper reporting of their earnings to the tax authorities.

Cryptocurrency mining not only presents opportunities for financial gain but also introduces complexities in the realm of personal income tax. Miners must stay abreast of the evolving tax landscape and guidelines to accurately assess and fulfill their tax obligations while engaging in this innovative and potentially lucrative industry.

Impact of Bitcoin Mining on Corporate Tax Liabilities 🏢

Bitcoin mining activities in Poland can have a significant impact on the corporate tax liabilities of companies engaged in this sector. The profits generated from mining operations are typically subject to corporate income tax, requiring careful consideration and planning to optimize tax obligations. Companies need to navigate the complex tax landscape to ensure compliance with regulations while maximizing their tax efficiency. Understanding the nuances of corporate tax liabilities in the context of Bitcoin mining is crucial for businesses looking to thrive in this evolving industry.

Exploring Tax Deductions and Incentives for Miners 🧾

Tax deductions and incentives play a vital role for Bitcoin miners in Poland, offering potential savings and advantages. By strategically leveraging available deductions, miners can optimize their tax liabilities and enhance profitability. Understanding the intricacies of tax codes and incentives tailored for miners can empower individuals and companies in the cryptocurrency mining sector to navigate the taxation landscape effectively. Moreover, staying informed about the latest updates and potential incentives can position miners for sustainable growth and financial efficiency in their operations.

For further insight into the legal framework surrounding Bitcoin mining, explore the conditions in Portugal through the comprehensive resource provided at is mining of bitcoin legal in Portugal?.

Regulations Governing Vat on Bitcoin Mining Operations 📑

Regulations governing VAT on Bitcoin mining operations in Poland require miners to carefully navigate the tax implications of their activities. Understanding how VAT applies to the mining process is crucial to ensure compliance and avoid potential penalties. It is essential for miners to keep detailed records of their transactions and be aware of any changes in VAT regulations to accurately report their earnings and expenses. The complexity of VAT laws in relation to cryptocurrency mining underscores the importance of seeking professional advice to navigate this evolving regulatory landscape effectively.

Future Prospects and Potential Changes in Polish Tax Laws 🌱

The evolving landscape of Polish tax laws presents both challenges and opportunities for Bitcoin miners in the country. As regulations continue to adapt to the dynamic nature of cryptocurrency mining, miners must stay informed and proactive in understanding and complying with tax obligations. Potential changes in tax laws could impact the profitability and feasibility of mining operations, necessitating a strategic approach to financial planning and compliance. Keeping abreast of future prospects in Polish tax laws is essential for miners to navigate this evolving regulatory environment effectively.

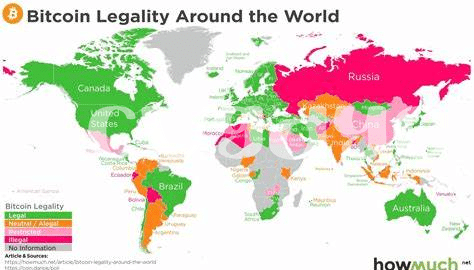

Is mining of Bitcoin legal in Paraguay?