Tax Laws 📊

Tax laws concerning Bitcoin mining in the Netherlands play a crucial role in shaping the financial landscape for miners. Understanding the nuances of these regulations is essential to navigate the tax implications effectively. cryptocurrency mining, like any other business or investment activity, is subject to tax laws that dictate how profits and expenses are treated. It is important for miners to comply with these laws to avoid any potential legal issues or penalties. The tax laws aim to ensure fair and transparent operations within the cryptocurrency market while also safeguarding the interests of both miners and the government.

Mining Process ⛏️

Bitcoin mining involves utilizing powerful computers to solve complex mathematical algorithms, verifying transactions, and adding them to the blockchain. Miners compete to be the first to solve these puzzles, earning rewards in the form of newly minted bitcoins. The process requires substantial computational power and energy, as miners work tirelessly to secure the network and maintain its integrity. With each successful verification, a new block is added to the chain, perpetuating the decentralized nature of the cryptocurrency system. As the mining process continues to evolve, efficiency and sustainability remain key considerations.

Reporting Obligations 📝

Bitcoin mining in the Netherlands comes with specific reporting obligations that miners need to adhere to. Understanding and fulfilling these requirements is crucial to ensure compliance with tax laws and regulations. From documenting mining income to keeping track of expenses, accurate reporting plays a key role in the successful and legal operation of bitcoin mining activities in the country. Failure to meet reporting obligations can lead to penalties and scrutiny from tax authorities.

As cryptocurrency regulations evolve, staying informed about reporting obligations remains essential for miners. Changes in legislation or guidelines may impact how mining activities are taxed and reported. It is advisable for miners to stay proactive in understanding and fulfilling their reporting obligations to navigate the evolving landscape of cryptocurrency taxation effectively.

Electric Costs 🔌

Electric costs can significantly impact the profitability of Bitcoin mining operations. Understanding the expenses involved in powering the mining equipment is crucial for miners to accurately assess their financial viability. As the energy consumption of mining rigs can be substantial, keeping a close eye on electricity costs is essential for maximizing returns on investment and maintaining a sustainable mining operation. Balancing the electricity expenses with the potential earnings from mining is a key consideration for miners in optimizing their profitability.

To delve deeper into the relationship between electric costs and Bitcoin mining profitability, it’s essential to examine how mining activities interact with the energy pricing structures in different regions. By analyzing the cost of electricity in the Netherlands and its implications for mining operations, miners can make informed decisions to manage their expenses effectively and enhance their overall financial performance. Factoring in electric costs alongside other operational expenses is a critical aspect of running a successful and sustainable Bitcoin mining operation.

Capital Gains 💰

Capital gains in Bitcoin mining refer to the profits made when you sell or exchange your mined Bitcoins for a value higher than what you initially paid for them. In the Netherlands, capital gains resulting from Bitcoin mining are subject to taxation. It’s crucial to keep detailed records of your transactions to accurately calculate and report your capital gains. Understanding the tax implications of these gains is essential for compliant and smooth Bitcoin mining operations in the Netherlands.

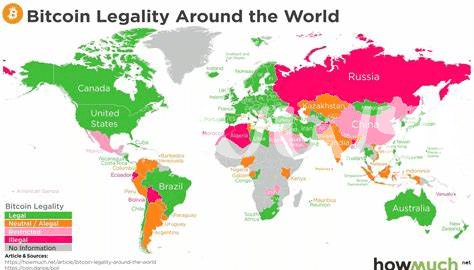

Future Regulations 🌐

It is evident that as the cryptocurrency landscape continues to evolve, the regulatory framework surrounding Bitcoin mining in the Netherlands will likely see significant adjustments. Future regulations are expected to focus on enhancing transparency and streamlining compliance procedures for mining operations. Authorities may aim to strike a balance between fostering innovation in the sector and safeguarding against potential risks associated with unregulated mining activities.

For further insight into the legality of Bitcoin mining across different regions, explore the link is mining of bitcoin legal in New Zealand?.