Introduction to Aml and Bitcoin 🌐

The world of cryptocurrencies, particularly Bitcoin, has sparked a wave of innovation and transformation in the realm of Anti-Money Laundering (AML). As digital transactions gain momentum, the need for robust AML protocols within the realm of cryptocurrencies like Bitcoin has become more critical than ever. Understanding how AML processes intersect with the decentralized nature of Bitcoin is key to navigating the evolving landscape of financial compliance and regulation in the digital age. Amidst these complexities, technological advancements have emerged as a driving force in enhancing AML efforts in the realm of cryptocurrencies, reshaping the way financial institutions and authorities approach regulatory compliance in a rapidly digitizing world.

Evolution of Aml Regulations 🔍

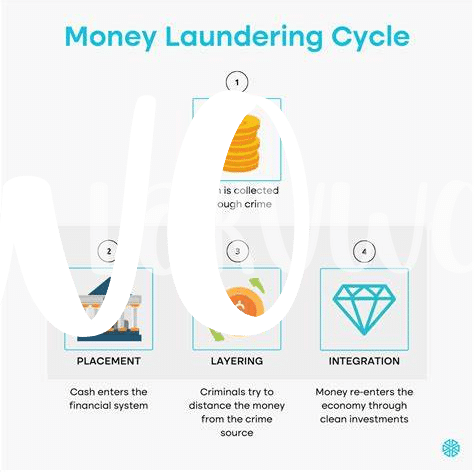

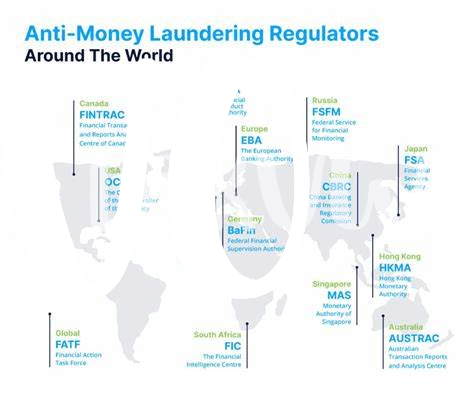

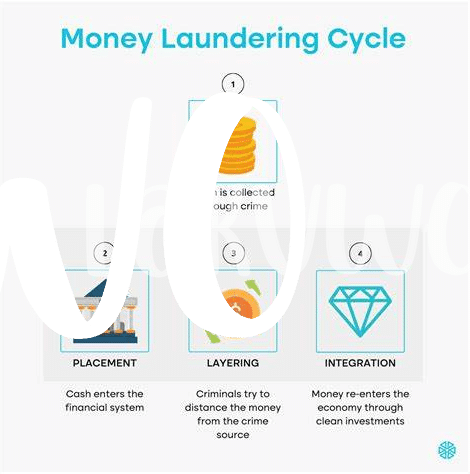

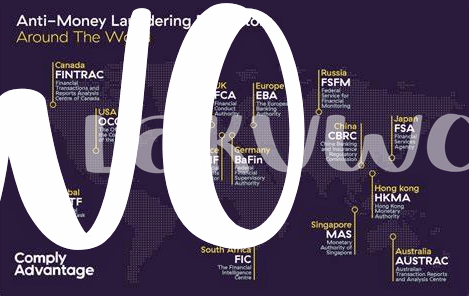

The evolution of Anti-Money Laundering (AML) regulations has been a dynamic process, shaped by the changing landscape of financial transactions and the increasing sophistication of illicit activities. As traditional banking systems faced mounting challenges in combating money laundering, authorities began to recognize the need for more robust regulatory frameworks. The initial steps towards AML regulations focused on establishing reporting requirements for suspicious transactions, but as criminal methods evolved, so did the regulations. This led to the implementation of more advanced monitoring techniques and greater international cooperation to address the global nature of money laundering activities. The evolution of AML regulations reflects a continuous effort to stay ahead of financial crimes and adapt to emerging threats in the digital age.

Integration of Technology for Aml Compliance 🤖

The rapid advancement of technology is revolutionizing Anti-Money Laundering (AML) processes in the realm of Bitcoin. Automation tools, artificial intelligence, and blockchain analytics are being harnessed to enhance AML compliance measures. These innovative solutions streamline the identification of suspicious transactions, improve risk assessment procedures, and bolster overall security in the cryptocurrency space. By integrating cutting-edge technology, businesses are better equipped to detect and prevent illicit activities, ensuring a more transparent and secure environment for Bitcoin transactions.

Challenges in Implementing Aml Tech Solutions 🚧

Implementing technology for Anti-Money Laundering (AML) in the realm of Bitcoin comes with its fair share of challenges. One significant hurdle is ensuring seamless integration of complex software systems with existing AML processes. Another challenge lies in keeping pace with the rapidly evolving nature of digital currencies, which often require constant upgrades and adaptations to meet regulatory requirements. Additionally, there may be resistance from traditional financial institutions towards embracing innovative AML technologies due to concerns about security and compliance. These obstacles highlight the need for careful planning and collaboration between industry stakeholders to overcome implementation challenges in AML technology solutions.

Benefits of Technology in Aml for Bitcoin 💡

-Technology plays a pivotal role in enhancing Anti-Money Laundering (AML) processes for Bitcoin, offering a streamlined approach to compliance. By leveraging advanced tools, such as blockchain analysis and artificial intelligence, AML technology can effectively identify and track illicit activities within the cryptocurrency space. These innovative solutions not only improve the detection of suspicious transactions but also enhance the overall transparency and security of Bitcoin transactions. Ultimately, the integration of technology in AML for Bitcoin brings about increased efficiency and confidence for stakeholders in the digital currency ecosystem.

Future Trends in Aml Technology for Cryptocurrency 🚀

The future of AML technology in the realm of cryptocurrency is poised for dynamic evolution. As the landscape continues to morph and adapt, advancements in artificial intelligence and machine learning algorithms are set to play a pivotal role in enhancing detection capabilities for suspicious transactions. Moreover, blockchain technology integration is expected to streamline compliance processes, offering increased transparency and traceability within the cryptocurrency ecosystem.

Link to bitcoin anti-money laundering (aml) regulations in Liberia: bitcoin anti-money laundering (aml) regulations in Malawi