What Is Bitcoin Halving? 🎓

Imagine a world where every four years, something magical happens to our favorite digital gold, Bitcoin. This event is a bit like a financial fairy tale, where miners—the people solving complex puzzles to keep the transaction ledger updated—suddenly find their rewards cut in half. This might sound a little sad at first, but it’s actually a thrilling chapter in Bitcoin’s story. The reason? It’s designed to keep Bitcoin scarce and, by extension, valuable, much like precious metals.

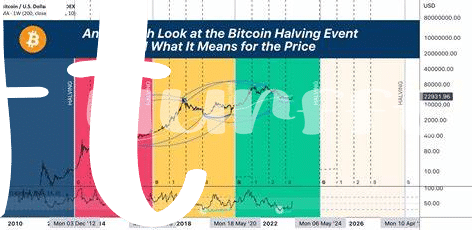

This clever mechanism is baked right into Bitcoin’s code, ensuring that no more than 21 million Bitcoins can ever exist. To date, we’ve witnessed this phenomenon three times since the cryptocurrency’s creation in 2009. Each halving event is a milestone that not only tests the resilience and commitment of miners but also sparks widespread interest and speculation around Bitcoin’s future value. Popularity surges, debates ignite across forums and news sites, and everyone tries to guess what will happen next. Will the price soar, or will it dip? The suspense is part of what makes Bitcoin so fascinating.

| Halving Event | Date | New BTC per Block Before | New BTC per Block After |

|---|---|---|---|

| 1st Halving | 2012 | 50 | 25 |

| 2nd Halving | 2016 | 25 | 12.5 |

| 3rd Halving | 2020 | 12.5 | 6.25 |

Past Halving Events and Price Patterns 📉📈

In the world of Bitcoin, halving events are a bit like a financial New Year’s Eve. They come around every four years and stir up quite the excitement, yet not everyone fully understands the impact. These events cut the reward for mining new bitcoins in half, which might not sound like good news at first. However, they’ve historically led to an interesting pattern where the price of Bitcoin tends to shoot up afterwards. Imagine you have a pie, and suddenly, there are fewer slices to go around; each slice naturally becomes more valuable if people still want it just as much. Looking back, after each halving, prices didn’t soar overnight. It was more of a slow burn, with values gradually increasing as demand continued to outpace the slowed supply. This historical dance of supply and demand has turned halving events into milestones worth watching, offering clues to those keen on predicting Bitcoin’s next big price wave. For those eager to dive deeper into Bitcoin’s journey and its future prospects, consider https://wikicrypto.news/innovative-technologies-shaping-bitcoin-transactions-in-2024 for a richer perspective on how innovative technologies are shaping its transactions in 2024.

How Halving Influences Bitcoin’s Value? 💰

Imagine a world where gold mines suddenly decided to cut the amount of gold they pulled out of the earth by half. You’d expect the price of gold to jump, right? This is pretty much the nutshell of what happens during a Bitcoin halving event. Every four years or so, the reward for mining Bitcoin is cut in half. This isn’t about penalizing the miners but is a built-in feature of Bitcoin to control its supply. Since there are fewer new coins being created, if demand stays the same or increases, the scarcity of Bitcoin increases. This scarcity can lead to an increase in Bitcoin’s price, as people find it more valuable.

🌐💡 The event sparks a chain reaction. Initially, miners might find their rewards diminished, but if the value of Bitcoin increases as expected, their smaller rewards could potentially be worth more in the long run. This potential for increased value captures the attention of investors and the general public alike, fostering discussions, speculation, and even more interest in Bitcoin. As this cycle continues, the anticipation of the halving event can itself become a catalyst for pushing the value of Bitcoin upwards. It’s a fascinating dance between supply, demand, and human psychology, wrapped up in the digital world of cryptocurrency. 🚀📊

Public Perception and Media Buzz 📰👀

When Bitcoin enters a halving event, it’s like the whole internet starts buzzing like a busy market. Imagine a bunch of people talking all at once about whether it’s going to rain or shine – that’s how it gets when we talk about Bitcoin’s value. Everyone has an opinion, from the person who only heard about Bitcoin yesterday to the ones who’ve been watching it since day one. News outlets start competing on who can predict the future better, social media turns into a battleground of predictions, and forums light up with debates 📰👀. This chatter isn’t just noise, though; it plays a massive part in shaping what everyone thinks Bitcoin will do next. It’s like a wave that lifts the boat of Bitcoin’s value higher on the seas of the financial market. For those curious about how Bitcoin stacks up against traditional investments, the insights in how does bitcoin compare to gold market trends in 2024 are eye-opening. The power of public perception and media coverage in influencing Bitcoin’s future is undeniable, making it a thrilling spectacle to watch and be part of 📅🔍.

Expert Predictions Vs. Reality 🧙♂️🔮

When it comes to Bitcoin, everyone seems to have a crystal ball. Before each halving event, experts dust off their predictive tools 🧙♂️🔮, forecasting how this mysterious event will send Bitcoin’s value to the moon. These predictions often paint a picture of skyrocketing prices, making it hard not to get caught up in the excitement. It’s like predicting the next big lottery numbers, with everyone hoping their guess hits the jackpot.

However, if we look back, reality often has its own script. The table below compares some notable predictions with what actually happened. Despite the buzz, the aftermath of halving events can be more of a slow burn 🔥🐢 rather than an immediate boom. It teaches an important lesson: in the world of Bitcoin, expecting the unexpected might just be the best strategy.

| Event | Prediction | Reality |

|---|---|---|

| 2012 Halving | Immediate price jump | Gradual increase over year |

| 2016 Halving | Price to double | Slow growth, then 2017 boom |

| 2020 Halving | New all-time highs | Steady climb, then 2021 peak |

Preparing for the Next Halving Event 📅🔍

As the clock ticks down to the next big event in the Bitcoin world, getting ready feels a bit like gearing up for a journey into the unknown. Imagine marking your calendar, not just for any day, but for an event that could twirl the whole digital currency scene on its head – that’s what the next Bitcoin halving promises. With history as our guide, we’ve seen this mysterious event play roles in setting the stage for price climbs. But how does one even begin to prepare? 📅🔍 First off, knowledge is key. Diving into how Bitcoin works offers a solid base. Think of it as gathering your gear before a hike. This means not only understanding the tech behind Bitcoin but also getting a grasp on market trends. For those looking to brush up or dive deeper, checking out “when was bitcoin created market trends in 2024” offers a treasure trove of insights. Besides tech-savviness, becoming part of the community discussions, keeping an eye on past patterns without assuming history will always repeat, and, yes, embracing a bit of caution in the face of expert predictions versus reality becomes part of your prep work. Remember, while the halving is predictable, how the world reacts is anything but. So, as we edge closer to this anticipated date, wrapping our heads around the complexity and excitement of it all, becomes not just about financial preparedness, but about staying curious, cautious, and above all, informed. 🧠💡