Legal Landscape 🏛️

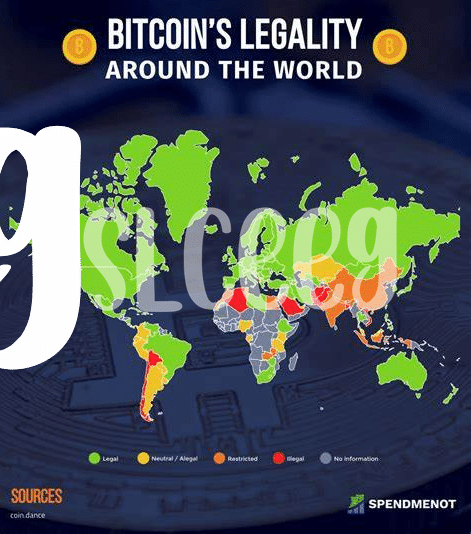

Denmark’s legal framework for Bitcoin is a maze of regulations, unclear guidelines, and evolving policies. Navigating this complex landscape requires a thorough understanding of both traditional financial laws and emerging digital currency regulations. The Danish government has shown a cautious approach to Bitcoin, seeking to balance innovation with risk mitigation in a rapidly changing financial environment. Understanding and complying with these legal requirements are crucial for businesses looking to integrate Bitcoin into their operations in Denmark.

Tax Implications 💰

Tax Implications in Denmark can present a nuanced landscape for businesses utilizing Bitcoin. Understanding the tax considerations in this digital currency realm is pivotal to maintaining compliance with Danish tax laws. From capital gains to VAT implications, businesses must navigate these aspects carefully. With the evolving nature of cryptocurrency taxation globally, seeking professional advice tailored to the Danish market is essential for managing tax liabilities effectively. Additionally, staying abreast of regulatory updates and interpretations related to Bitcoin can aid businesses in making informed decisions regarding their financial obligations. Consequently, businesses operating with Bitcoin in Denmark must proactively address tax implications to ensure legal compliance and financial sustainability.

Compliance Challenges 🛡️

Navigating the regulatory framework when incorporating Bitcoin into business operations in Denmark poses several challenges. Ensuring compliance with anti-money laundering laws and regulations is a primary concern for companies utilizing cryptocurrency. Implementing robust know-your-customer procedures can be complex, requiring thorough due diligence measures to verify the legitimacy of transactions. Additionally, staying updated on evolving legislative requirements and regulatory guidelines is essential to mitigate legal risks associated with using Bitcoin for business. The ambiguity surrounding the classification and treatment of digital assets adds another layer of complexity to compliance efforts. Engaging with regulatory authorities and seeking legal counsel can help businesses address these compliance challenges effectively.

Consumer Protection 🛡️

When considering the implications of using Bitcoin for business in Denmark, it is crucial to address consumer protection measures. Ensuring that consumers are safeguarded against potential risks such as fraud and scams is of utmost importance in the adoption of this digital currency. By implementing robust consumer protection policies and guidelines, businesses can create a safer environment for their customers to engage in Bitcoin transactions. To learn more about the legal consequences of Bitcoin transactions in Djibouti, visit legal consequences of bitcoin transactions in Djibouti.

Data Privacy Concerns 🔒

Businesses utilizing Bitcoin in Denmark must navigate potential data privacy concerns. The decentralized nature of blockchain technology, which underpins Bitcoin transactions, may raise issues related to the protection of personal information. Ensuring compliance with data privacy regulations, such as the General Data Protection Regulation (GDPR), is crucial in safeguarding customer data. Additionally, the traceability of Bitcoin transactions poses challenges in maintaining confidentiality, requiring businesses to implement robust measures to protect sensitive information.

Future Outlook 🔮

The future outlook for utilizing Bitcoin in business in Denmark shows promising potential for increased adoption and integration. As more businesses explore the benefits of leveraging cryptocurrencies, regulatory frameworks are likely to evolve to provide clearer guidelines and safeguards. This shift could further enhance trust and confidence in using Bitcoin for commercial transactions. Additionally, advancements in blockchain technology may lead to improved security measures and increased efficiency in processing transactions, opening up new opportunities for businesses to optimize their operations and streamline financial processes.

For more information on the legal consequences of Bitcoin transactions in Colombia, and how they compare to the legal implications in the Democratic Republic of the Congo, please refer to this resource: Legal Consequences of Bitcoin Transactions in Democratic Republic of the Congo.