Regulatory Clarity 🛡️

Regulatory clarity plays a vital role in shaping the framework for crypto exchange licensing in various jurisdictions. Clarity in regulations provides a sense of direction and security for both the industry players and investors, fostering a conducive environment for growth and compliance. It sets the tone for how exchanges operate within the legal boundaries, ensuring transparency and accountability. Furthermore, clear regulations can help mitigate risks associated with money laundering and illicit activities, enhancing the overall credibility of the crypto market within a specific region.

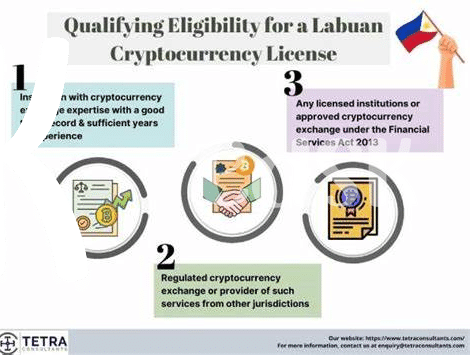

Licensing Requirements 📝

Navigating the hoops for acquiring a cryptocurrency exchange license can be a labyrinthine journey. From demonstrating strong financial backing to rigorous KYC and AML compliance procedures, the licensing requirements demand unwavering attention to detail and a proactive approach. The regulator’s scrutiny leaves no stone unturned, emphasizing the need for stringent cybersecurity measures to safeguard users’ funds. Obtaining a license isn’t just a checkbox exercise but a testament to the exchange’s commitment to operating transparently and ethically within the Maldivian financial ecosystem. The complex web of requirements underscores the evolving nature of the cryptocurrency landscape and signals a maturing market hungry for legitimacy.

Compliance Challenges 💼

Navigating the regulatory landscape of crypto exchange licensing in Maldives presents a myriad of challenges, particularly in terms of compliance. The evolving nature of digital assets and the lack of standardized regulations pose significant hurdles for companies looking to operate within the legal framework. Ensuring adherence to anti-money laundering (AML) and know your customer (KYC) regulations, as well as keeping up with evolving cybersecurity measures, requires a delicate balance of resources and expertise. The dynamic nature of the crypto market further complicates compliance efforts, as regulatory requirements continue to shift in response to emerging threats and opportunities.

Impact on Innovation 💡

Cryptocurrency exchange licensing requirements are instrumental in shaping innovation within the financial landscape. By establishing clear guidelines and regulations, authorities can foster an environment conducive to exploring new technologies and business models. The impact of these licensing frameworks on innovation is multifaceted, influencing not only the entry of new players into the market but also the development of novel solutions to compliance and security challenges. As countries worldwide navigate the complexities of regulating crypto exchanges, the approach taken can either catalyze or stifle innovation in this rapidly evolving sector. Understanding the interplay between regulatory frameworks and innovation is crucial for stakeholders seeking to harness the full potential of blockchain technology and digital assets. For insights into the detailed licensing fees and procedures for crypto exchanges in Malta, refer to the information provided by cryptocurrency exchange licensing requirements in Malta.

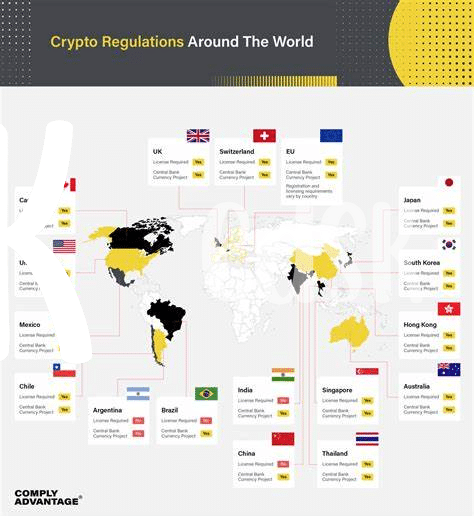

Global Market Comparison 🌍

The growth of crypto exchanges has been phenomenal, with various countries around the world embracing this emerging industry. Each jurisdiction brings its unique set of regulations and requirements, shaping the way these platforms operate globally. For instance, while some countries have stringent licensing conditions in place, others have more lenient frameworks, creating a varied landscape for crypto exchange activities. This diversity in regulatory approaches highlights the need for a deeper understanding of how different markets function, allowing businesses to navigate complexities and make informed decisions when expanding internationally.

Future Prospects and Trends 🔮

The future of crypto exchange licensing in Maldives offers a promising landscape for innovation and growth. With evolving regulatory frameworks and increasing market demand, the industry is poised for expansion. One of the key trends to watch out for is the integration of advanced technology like blockchain to enhance security and transparency in transactions, making the crypto space more accessible and trustworthy. As the market matures, collaborations between regulators and industry players will be crucial in shaping a sustainable ecosystem for digital asset exchange.

Cryptocurrency exchange licensing requirements in Mali