Overview of Cryptocurrency Trading Platforms 🌐

Cryptocurrency trading platforms serve as digital marketplaces where users can buy, sell, and exchange various cryptocurrencies. These platforms enable individuals to participate in the rapidly evolving world of digital assets, offering access to a diverse range of coins and tokens. With user-friendly interfaces and features like real-time pricing charts, trading platforms cater to both novice and experienced cryptocurrency enthusiasts, fostering a dynamic ecosystem of digital asset trading. The increasing popularity of these platforms highlights the growing interest in cryptocurrencies as viable investment instruments, driving innovation and reshaping the financial landscape.

Regulatory Challenges Faced by Trading Platforms 🚫

Cryptocurrency trading platforms operate in a fast-paced and ever-evolving regulatory landscape, facing a host of challenges brought about by varying legal frameworks globally. One significant hurdle is the lack of uniformity in regulations pertaining to cryptocurrencies, leading to uncertainty and ambiguity for platform operators. Additionally, issues such as anti-money laundering (AML) and know your customer (KYC) compliance requirements present ongoing challenges that platforms must navigate to ensure regulatory adherence and maintain trust with users.

Ensuring compliance with existing regulations while anticipating and adapting to forthcoming regulatory changes is crucial for trading platforms to remain viable and secure in the long term. Proactively addressing regulatory challenges not only fosters a safer trading environment but also demonstrates a commitment to transparency and accountability in the burgeoning cryptocurrency space.

Security Measures and Investor Protection 🔒

When it comes to ensuring the safety and trustworthiness of cryptocurrency trading platforms, implementing robust security measures and mechanisms is paramount. These platforms need to prioritize safeguarding users’ funds and personal information against potential cyber threats and hacking attempts. In addition to technological safeguards like encryption and multi-factor authentication, regular security audits and proactive monitoring can help mitigate risks and enhance investor protection. By instilling a secure environment, trading platforms can foster confidence among users and promote long-term sustainability in the crypto market.

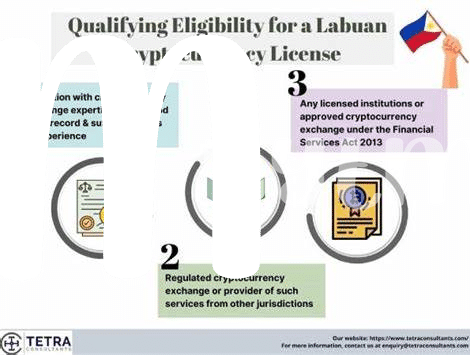

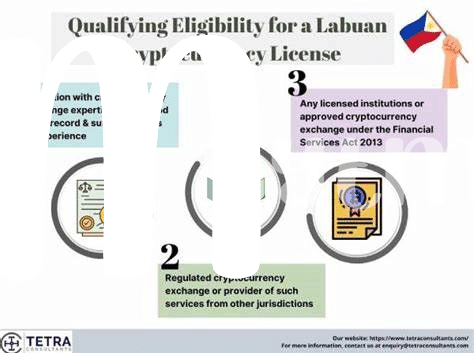

Compliance Requirements for Platform Operators 📝

Platform operators in the cryptocurrency trading space face a myriad of compliance requirements that are crucial for ensuring a secure and transparent trading environment. These obligations encompass regulatory guidelines, anti-money laundering (AML) procedures, customer due diligence (CDD), as well as cybersecurity protocols to safeguard user data and assets. By adhering to these standards, platform operators not only demonstrate their commitment to regulatory compliance but also build trust among users and potential investors. Staying updated with the evolving regulatory landscape is imperative in this fast-paced industry to mitigate risks and enhance the overall integrity of the platform.

For a detailed exploration of specific licensing obligations for cryptocurrency exchanges in different regions, such as Singapore, consider referring to this comprehensive guide on cryptocurrency exchange licensing requirements in Singapore. This resource offers valuable insights into the legal frameworks and licensing procedures that platform operators need to navigate to operate legally within the jurisdiction. By obtaining a clear understanding of these requirements, operators can proactively address compliance challenges and establish a strong foundation for their trading platforms.

Importance of Legal Clarity in Cryptocurrency Trading 💡

Legal clarity is the cornerstone of a stable and secure environment for cryptocurrency trading. By establishing clear regulations and guidelines, both traders and platforms can operate with confidence and transparency. This clarity not only protects investors from potential risks but also fosters trust within the industry. Additionally, defined legal frameworks can help prevent fraudulent activities and ensure fair practices are upheld. As the cryptocurrency market continues to evolve, the importance of legal clarity cannot be overstated, serving as a fundamental pillar for the future growth and sustainability of trading platforms.

Future Trends and Developments in the Industry 🚀

In the ever-evolving landscape of cryptocurrency trading, the industry is witnessing a shift towards more advanced technologies and decentralized platforms. As blockchain technology continues to mature, we can expect to see increased scalability, improved security measures, and enhanced user experience. Moreover, the integration of artificial intelligence and machine learning algorithms is set to revolutionize trading strategies and risk management practices. With the emergence of regulatory frameworks in various jurisdictions, such as Slovenia and Sierra Leone, cryptocurrency exchanges are likely to become more transparent and compliant with legal requirements. These developments signal a promising future for the industry, paving the way for widespread adoption and mainstream acceptance of digital assets.