Regulatory Landscape 🌐

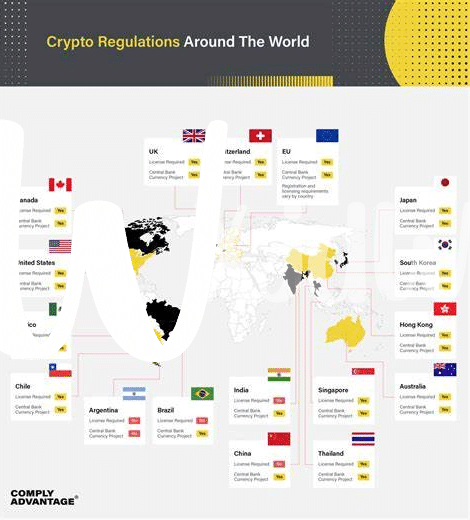

In navigating the regulatory landscape of cryptocurrency banking in Maldives, it is essential to understand the evolving framework that governs these digital assets. The authorities are progressively shaping policies to ensure transparency, prevent financial crimes, and promote innovation within the sector. By examining the current regulations and anticipated changes, stakeholders can assess the opportunities and challenges that come with integrating cryptocurrencies into the banking system. Stay informed about the legal requirements and potential market shifts to make informed decisions within this dynamic environment.

Banking Integration 🏦

In the realm of digital currencies, bridging the gap between traditional banking systems and cryptocurrency platforms is paramount for establishing a seamless financial landscape. This convergence not only enhances accessibility for users but also paves the way for innovative financial solutions. By fostering a symbiotic relationship between banks and cryptocurrencies, a new era of financial integration emerges, promising greater flexibility and efficiency in transactions.

Consumer Protections 🛡️

Cryptocurrency banking in Maldives holds immense potential for financial innovation, yet safeguards to protect consumers must be prioritized. In navigating the evolving landscape, robust mechanisms for consumer protections are essential to instill confidence and mitigate risks associated with digital assets. By establishing clear guidelines and protocols, the Maldivian regulatory framework can ensure that individuals engaging in cryptocurrency transactions are shielded from potential vulnerabilities, thereby fostering a secure environment for financial activities in the digital realm.

Cryptocurrency Adoption 📈

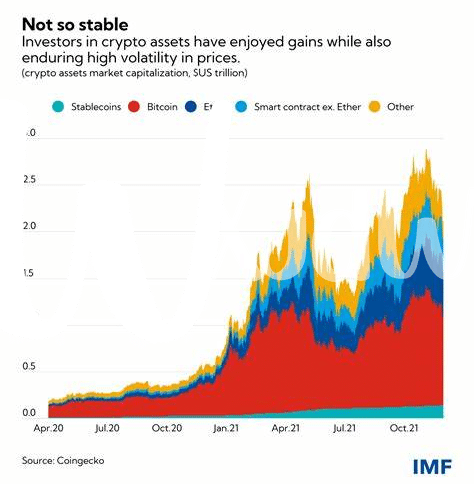

Cryptocurrency adoption in Maldives has been steadily increasing, with more individuals and businesses recognizing the benefits of digital currencies. From online retailers accepting crypto payments to financial institutions exploring blockchain technology, the landscape is evolving rapidly. This shift towards embracing cryptocurrencies signals a new era of financial transactions in the Maldives, with potential for greater efficiency and accessibility in the digital economy. To learn more about the role of government in regulating Bitcoin services, check out this insightful article on Bitcoin banking services regulations in Malawi.

Compliance Challenges ⚖️

Navigating the regulatory landscape in the Maldives poses significant challenges for cryptocurrency banking entities. Adhering to existing financial regulations while accommodating the unique characteristics of digital assets requires a delicate balance. One of the primary hurdles faced is ensuring compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) standards, which can be complex and time-consuming in the context of decentralized finance. Additionally, the lack of specific guidelines tailored to cryptocurrencies can lead to ambiguity and interpretation discrepancies, further complicating compliance efforts and potentially exposing banks to legal risks.

Future Outlook 🔮

The future outlook for cryptocurrency banking in Maldives is poised for significant growth and development. As regulatory frameworks continue to evolve and adapt to the digital landscape, the integration of cryptocurrency into traditional banking systems is expected to deepen, offering more accessible and efficient financial services to consumers. With a focus on enhancing consumer protections and addressing compliance challenges, the overall trajectory points towards a more robust ecosystem for cryptocurrency adoption in the country. Looking ahead, the potential for innovative solutions and advancements in technology signals a promising future for cryptocurrency banking in Maldives.

To stay updated on the latest regulations and developments in cryptocurrency banking services, you can refer to the official Bitcoin banking services regulations in Malta [here](Bitcoin banking services regulations in Mali).