Bitcoin Basics 🌟

Bitcoin operates on a decentralized system known as a blockchain, which is essentially a digital ledger that records all transactions. Unlike traditional currencies issued by governments, Bitcoin is digital and not controlled by any central authority. Transactions are verified by network nodes through cryptography and recorded on the blockchain. Users store their Bitcoins in digital wallets, which are secured by private keys. The total supply of Bitcoin is capped at 21 million coins, ensuring scarcity and potentially increasing its value over time. Bitcoin transactions are pseudonymous, meaning they are not tied to real-world identities but rather to digital addresses.

Bitcoin provides a way to transact globally without the need for intermediaries like banks. It has gained popularity as a store of value and a medium of exchange in various industries. Its decentralized nature and limited supply make it an attractive option for investors looking for an alternative to traditional assets. Understanding the basics of Bitcoin is essential for anyone looking to explore its potential impact on financial systems and various sectors.

Aml Regulations 📜

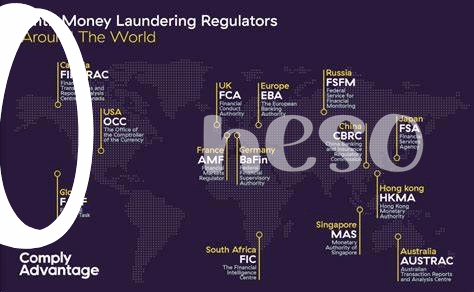

A shortcoming of current AML regulations is their static nature, which often struggles to keep pace with the rapidly evolving landscape of digital currencies like Bitcoin. Regulators are faced with the challenge of reconciling established financial laws with the decentralized and pseudonymous features of cryptocurrencies, leading to ambiguities in compliance procedures. This gap highlights the need for a more adaptive and nuanced regulatory framework that can effectively address the unique characteristics of Bitcoin transactions. Collaborative efforts between government bodies, financial institutions, and technology experts are essential to foster a proactive approach to AML compliance in the ever-changing realm of cryptocurrency.

Challenges in Compliance 🔒

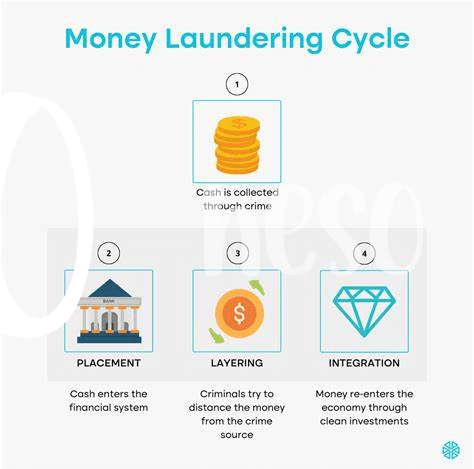

Navigating the realm of regulatory compliance in the world of cryptocurrency poses a significant hurdle for both businesses and authorities. The decentralized nature of Bitcoin, while praised for its innovation, also presents a challenge when it comes to implementing traditional anti-money laundering measures. Identifying the parties involved in transactions and ensuring compliance with AML regulations becomes increasingly complex in this digital landscape, where anonymity and pseudonymity are inherent features of the technology. Overcoming these challenges demands a delicate balance between preserving the privacy of users and safeguarding against illicit activities, requiring a nuanced approach to compliance procedures.

Innovations in Tracking 💡

Bitcoin’s rise has brought about significant challenges in tracking transactions to ensure compliance with AML regulations. Recent advancements in technology have paved the way for innovative approaches to monitoring and tracing Bitcoin transactions in a more efficient and secure manner. Through the integration of advanced analytical tools and blockchain analysis techniques, financial institutions and regulatory bodies are gaining better insights into the flow of funds, helping to detect and prevent illicit activities within the cryptocurrency space. For a deeper dive into these cutting-edge solutions, check out this article on Bitcoin anti-money laundering (AML) regulations in Samoa.

—

For the full picture on how fintech solutions are revolutionizing Bitcoin AML compliance, visit the article on innovative approaches here: https://wikicrypto.news/innovative-approaches-fintech-solutions-for-bitcoin-aml-compliance.

Emerging Trends 📈

The current landscape of Bitcoin and AML practices is witnessing dynamic shifts as technology advances and regulatory frameworks evolve. One notable emerging trend is the increased adoption of blockchain analytics tools by compliance teams to enhance monitoring capabilities. These tools enable more efficient tracking of transactions, allowing for better identification of potential risks and illicit activities. Moreover, the rise of decentralized finance (DeFi) platforms has presented new challenges for AML compliance, requiring innovative solutions to address the unique risks associated with these platforms. Understanding and adapting to these emerging trends will be crucial for ensuring the effectiveness of AML practices in the rapidly changing cryptocurrency ecosystem.

Future Implications 🚀

As the realm of Bitcoin continues to evolve, the future implications are poised to shape global financial landscapes. With ongoing advancements in AML practices and regulatory frameworks, the integration of Bitcoin into mainstream financial systems holds immense potential. Enhanced transparency and security protocols are expected to revolutionize the traditional understanding of financial transactions. Furthermore, as digital currencies gain wider acceptance, the impact on cross-border transactions and regulatory harmonization will be pivotal in defining the future of financial governance.

insert a link to bitcoin anti-money laundering (aml) regulations in saint lucia with anchor bitcoin anti-money laundering (aml) regulations in romania using the