Introduction to Aml Regulations in Bitcoin Transactions 🌐

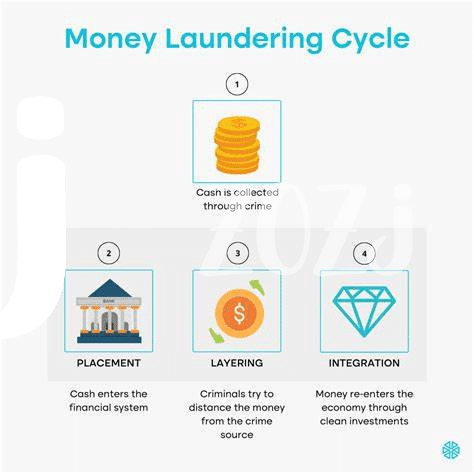

Aml regulations play a crucial role in shaping the landscape of Bitcoin transactions. These regulations are designed to combat money laundering activities and promote transparency within the cryptocurrency sector. By requiring certain verification processes and identifying suspicious activities, Aml regulations aim to enhance the security and credibility of transactions conducted using Bitcoin. Understanding how these regulations impact the cryptocurrency market is essential for both users and service providers alike. As the regulatory environment continues to evolve, staying informed about Aml compliance requirements is key to navigating the complex world of digital currencies.

Impact of Aml Regulations on Transaction Privacy 🔒

The enforcement of AML regulations on Bitcoin transactions has significant implications for transaction privacy. These regulations aim to enhance transparency in financial transactions, but they also raise concerns about the exposure of personal information and financial data. The increased scrutiny on cryptocurrency transactions can compromise the anonymity that many users value in the decentralized nature of digital currencies. As regulatory requirements tighten, individuals engaging in Bitcoin transactions may find their privacy at risk, leading to a need for innovative solutions to balance compliance with preserving privacy in the evolving landscape of digital finance.

Challenges Faced by Cryptocurrency Exchanges 🤔

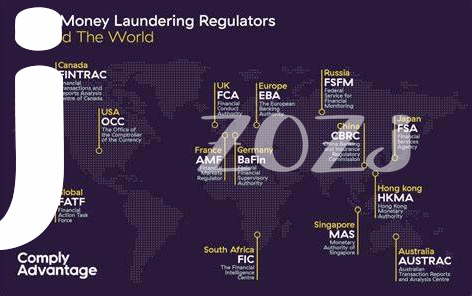

Cryptocurrency exchanges encounter a myriad of challenges in navigating the intricate landscape of regulatory compliance. One key hurdle is the lack of standardized AML procedures across jurisdictions, leading to confusion and complexity in ensuring adherence to regulations. Moreover, the evolving nature of AML requirements poses a continuous challenge for exchanges, requiring them to remain vigilant and proactive in updating their protocols to meet the latest regulatory standards. Adapting to the varying levels of scrutiny and oversight demanded by different regulatory authorities further adds to the operational burden faced by cryptocurrency exchanges.

The need to strike a delicate balance between maintaining user privacy and complying with stringent AML regulations presents a persistent conundrum for exchanges. Ensuring the security of user data and transactions while fulfilling regulatory obligations demands a sophisticated technological infrastructure and robust compliance framework. Moreover, the increasing sophistication of money laundering techniques necessitates constant vigilance and investment in advanced monitoring and detection tools to safeguard against illicit activities. Amidst these challenges, exchanges must continuously innovate and collaborate with regulatory bodies to uphold the integrity of the cryptocurrency ecosystem.

Role of Regulatory Bodies in Enforcing Compliance 🕵️♂️

Regulatory bodies play a crucial role in ensuring compliance within the cryptocurrency industry. By establishing and enforcing guidelines, these bodies aim to safeguard against illicit activities such as money laundering and fraud. Through proactive measures and oversight, regulatory bodies work to maintain transparency and integrity in transactions. Individuals and businesses operating in the digital asset space are expected to adhere to these regulations to promote a safe and secure environment for all participants. For further insights on compliance strategies related to bitcoin anti-money laundering (AML) regulations in Sweden, visit [bitcoin anti-money laundering (AML) regulations in Sweden](https://wikicrypto.news/compliance-strategies-for-individuals-using-bitcoin-under-aml-regulations-in-south-sudan).

Innovations in Blockchain Technology to Address Aml Concerns 🚀

Blockchain technology continues to evolve to meet the challenges posed by AML regulations. One notable innovation is the development of advanced tracking and monitoring tools that enhance transparency in Bitcoin transactions. These tools allow for the identification of suspicious activities, aiding compliance efforts and reducing the risk of illicit financial activities. Additionally, the integration of smart contracts in blockchain technology automates certain AML processes, streamlining compliance procedures for cryptocurrency exchanges and enhancing overall efficiency in monitoring transactions. Coupled with ongoing advancements in data analytics and machine learning, these innovations are reshaping the landscape of AML compliance within the realm of Bitcoin transactions.

Future Outlook and Implications for the Crypto Industry 🔮

In the ever-evolving landscape of the crypto industry, the future outlook is filled with both excitement and uncertainty. As regulatory bodies around the world tighten their grip on AML compliance, the implications for the crypto industry are profound. While some may see this as a challenge, others view it as an opportunity for growth and legitimacy. Innovations in blockchain technology continue to emerge, offering solutions to address AML concerns and enhance transparency. The industry is poised for further advancements, with stakeholders navigating a complex regulatory environment to shape the future of cryptocurrencies. Bitcoin anti-money laundering (AML) regulations in Sri Lanka and South Sudan offer unique insights into the global efforts to combat financial crimes within the cryptocurrency space.