Overview of Bitcoin Banking Regulations 🌍

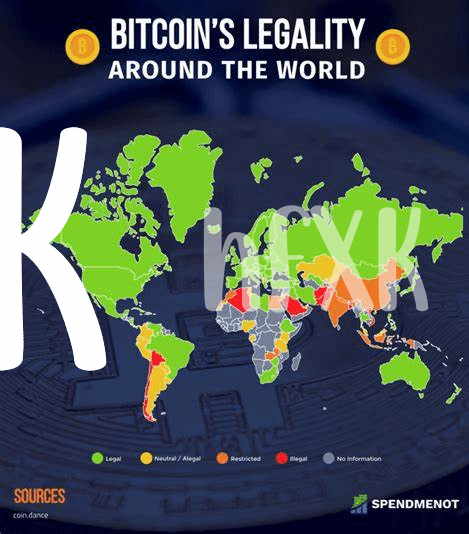

Bitcoin banking regulations play a pivotal role in shaping the financial landscape, impacting both users and industry stakeholders. These guidelines not only govern the use of virtual currencies but also oversee the operation of Bitcoin-related services in Guinea. Understanding these regulations is crucial for navigating the evolving cryptocurrency ecosystem and ensuring compliance with the legal framework.

Current Challenges Faced by Bitcoin Users 💳

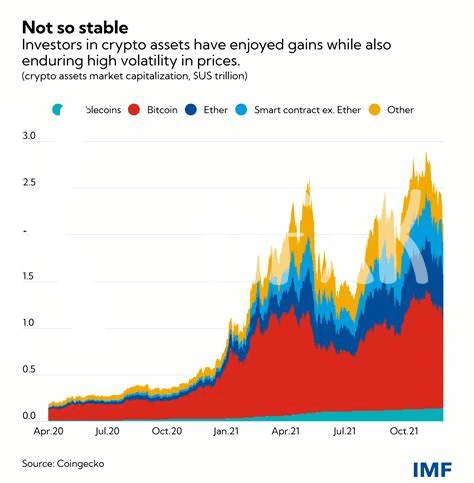

Bitcoin users in Guinea encounter various hurdles in their digital currency transactions. Limited awareness and understanding within the population often lead to skepticism towards Bitcoin. Additionally, the lack of clear regulatory frameworks poses a significant obstacle, creating uncertainty and risk for users. Moreover, the fluctuating nature of Bitcoin prices presents challenges for individuals relying on the cryptocurrency for daily transactions. These combined factors make it a challenging environment for Bitcoin users to navigate effectively and securely.

The Role of Government in Regulating Bitcoin 💼

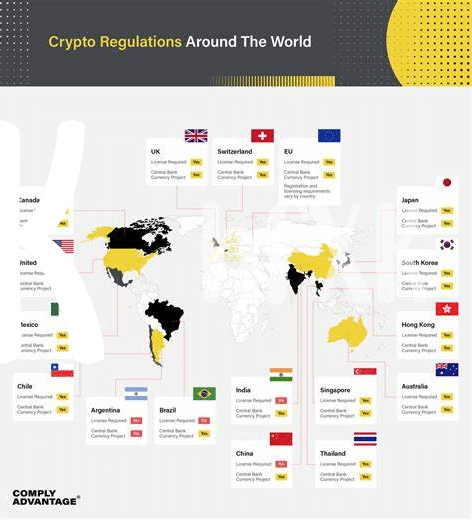

– In the realm of Bitcoin banking, governments play a pivotal role in establishing regulatory frameworks that aim to safeguard the interests of both users and the broader financial system. By enacting clear guidelines and oversight mechanisms, authorities can foster trust and legitimacy within the evolving landscape of digital currencies. Striking a delicate balance between innovation and risk mitigation, government interventions can shape the trajectory of Bitcoin adoption and its integration into traditional banking systems.

– Through proactive engagement and collaboration with stakeholders, regulatory bodies can facilitate a climate conducive to responsible Bitcoin usage while mitigating potential illicit activities. By staying abreast of technological advancements and market dynamics, governments can adapt their regulatory approaches to ensure a well-functioning and secure environment for Bitcoin banking activities. In doing so, they aim to harness the transformative potential of cryptocurrencies while safeguarding against systemic risks and ensuring compliance with established legal standards.

Impacts of Regulations on Financial Inclusion 📈

Bitcoin regulations in Guinea have had a significant impact on financial inclusion, shaping the accessibility of banking services for the unbanked population. By establishing clear guidelines and oversight, these regulations have fostered trust in Bitcoin banking, encouraging more individuals to participate in the financial system. However, the challenge lies in striking a balance between innovation and security to ensure that the benefits of Bitcoin banking are extended to all members of society. Policymakers in Guinea have a critical role to play in creating a regulatory environment that promotes financial inclusion while safeguarding against potential risks. For further insights on regulatory considerations in the Bitcoin banking sector, refer to the article on bitcoin banking services regulations in Finland.

Future Outlook for Bitcoin Banking in Guinea 🔮

With the rapid growth of digital currencies globally, Guinea is poised to embrace the potential of Bitcoin banking. As regulations evolve, there is an optimistic outlook for the future of Bitcoin banking in Guinea, offering increased financial accessibility and opportunities for economic empowerment. The integration of digital currencies into the country’s financial landscape could pave the way for innovative financial services and inclusive banking solutions, catering to a tech-savvy population eager to participate in the digital economy.

Recommendations for a Balanced Regulatory Approach 📜

When considering a balanced regulatory approach for Bitcoin banking in Guinea, it is essential to focus on fostering innovation while ensuring consumer protection. Regulators should strive to create a framework that promotes financial inclusion and transparency, encourages compliance with anti-money laundering laws, and minimizes the risks associated with digital currencies. Collaborating with industry stakeholders and international best practices can help develop regulations that support the growth of Bitcoin banking in Guinea sustainably.

Bitcoin banking services regulations in Germany