Introduction to Bitcoin Regulations 🌍

As the digital landscape continues to evolve, the sphere of cryptocurrency has garnered significant attention worldwide. The emergence of Bitcoin, in particular, has sparked interest and debate on a global scale. With the increasing adoption of this decentralized digital currency, regulatory frameworks have become a crucial focal point. Understanding the landscape of Bitcoin regulations is essential for navigating the complexities of this innovative financial ecosystem. By delving into the foundations of these regulations, one can grasp the implications they have on various aspects of transactions and financial activities. The dynamic interplay between regulation and the decentralized nature of Bitcoin presents a unique paradigm that shapes the landscape for users and businesses alike. By exploring the intricacies and implications of Bitcoin regulations, stakeholders can gain insights into the evolving landscape of digital finance and the broader implications for global economic systems.

Importance of Regulations for Financial Stability 💰

Regulations are the backbone of a stable financial system, providing a framework within which businesses and individuals can operate with confidence. By establishing rules and guidelines, regulations help to promote transparency, accountability, and fairness in the financial sector. They serve as a safeguard against potential risks and uncertainties, creating a secure environment that fosters trust and encourages investment. In the realm of cryptocurrency and digital assets, regulations play a crucial role in ensuring the integrity of transactions and protecting users from fraud and exploitation. By setting standards and enforcing compliance, regulatory frameworks help to mitigate risks associated with money laundering, terrorist financing, and other illicit activities. Ultimately, regulations form the foundation upon which financial stability is built, shaping the future trajectory of the global economy.

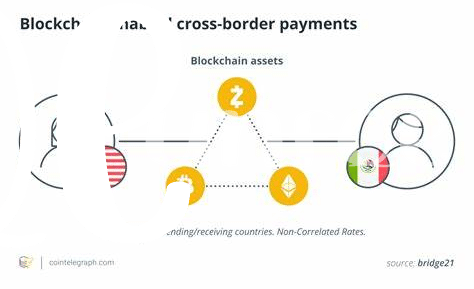

Impact on Cross-border Transfers 🌐

Cryptocurrencies, like Bitcoin, have revolutionized the way cross-border transfers are conducted. The impact of regulations on these transactions in St. Kitts and Nevis is significant. With clear guidelines in place, individuals and businesses engaging in cross-border transfers can experience enhanced security and transparency throughout the process. These regulations not only help mitigate risks associated with money laundering and fraud but also promote trust and confidence in the digital asset landscape. By fostering a regulatory environment that supports cross-border transfers, St. Kitts and Nevis can attract more investment and foster economic growth within its borders. Additionally, adopting a proactive approach to regulation can position the country as a leader in the evolving fintech space, paving the way for innovative solutions and partnerships in the sector.

Challenges Faced by Individuals and Businesses 💼

When navigating the realm of Bitcoin regulations, individuals and businesses in St. Kitts and Nevis encounter a myriad of challenges. From the complexities of complying with ever-evolving laws to the uncertainties surrounding the enforcement of regulations, stakeholders face a constant struggle to stay abreast of the shifting landscape. Moreover, the ambiguity in regulatory frameworks can hinder innovation and investment in the sector, posing obstacles for those seeking to harness the full potential of cryptocurrencies. As businesses strive to adapt to the changing regulatory environment, the need for clarity and streamlined processes becomes increasingly apparent. To overcome these hurdles, stakeholders must actively engage with regulatory bodies and industry peers to advocate for clearer guidelines and more conducive environments for growth. By addressing these challenges head-on, individuals and businesses can better position themselves to thrive in the evolving cryptocurrency ecosystem. [bitcoin cross-border money transfer laws in Samoa](https://wikicrypto.news/bitcoin-as-a-solution-to-compliance-challenges-in-international-money-transfers-from-peru).

Opportunities for Innovation in the Sector 🚀

In the rapidly evolving landscape of Bitcoin regulations, the sector is ripe with opportunities for innovation. With a shifting regulatory framework, there is space for creative solutions to emerge, offering new avenues for payment systems, financial services, and technological advancements. These innovations can lead to improved efficiency, increased transparency, and enhanced security in the sector. Collaborations between industry players, regulators, and innovators can pave the way for disruptive technologies that revolutionize how transfers are conducted, setting the stage for a more dynamic and inclusive financial ecosystem. As the sector adapts to regulatory changes, forward-thinking individuals and businesses have the opportunity to pioneer groundbreaking solutions that not only meet compliance requirements but also push the boundaries of what is possible in the realm of cross-border transfers. This environment of innovation fosters a spirit of exploration and experimentation, driving the sector forward into uncharted territories of possibility and progress.

Future Outlook and Potential Developments 🔮

In considering the future outlook and potential developments of Bitcoin regulations in St. Kitts and Nevis, it is evident that ongoing advancements in this space hold significant promise. Embracing innovative approaches to regulation can pave the way for enhanced transparency and security in financial transactions, fostering trust and confidence in the cryptocurrency ecosystem. Furthermore, as international standards continue to evolve, there is a growing opportunity for St. Kitts and Nevis to position itself as a forward-thinking jurisdiction for digital asset management. By staying abreast of emerging trends and leveraging regulatory frameworks effectively, the region can attract investment, spur economic growth, and ensure compliance with global best practices. This proactive approach not only sets the stage for a resilient financial landscape but also opens doors for greater collaboration and synergy among stakeholders in the digital currency sector. 🚀

Please refer to the bitcoin cross-border money transfer laws in Saint Vincent and the Grenadines for insights into regulatory approaches that can potentially shape the landscape in St. Kitts and Nevis.